Stock market V21, Huge Stimulus Age

|

|

Feb 25 2009, 05:13 PM Feb 25 2009, 05:13 PM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

means it has found its supporting line lor.

|

|

|

|

|

|

Feb 25 2009, 05:14 PM Feb 25 2009, 05:14 PM

|

Senior Member

7,176 posts Joined: Dec 2006 From: Kuching |

|

|

|

Feb 25 2009, 05:33 PM Feb 25 2009, 05:33 PM

|

Senior Member

1,345 posts Joined: Dec 2007 |

QUOTE(chyaw @ Feb 25 2009, 05:14 PM) seems unlikely for today jor (since RESORTS is yet to release their report too, but ASIATIC is doing OK)... so it'll be either tomolo or Fri kua..This post has been edited by fergie1100: Feb 25 2009, 05:46 PM |

|

|

Feb 25 2009, 05:56 PM Feb 25 2009, 05:56 PM

|

All Stars

18,672 posts Joined: Jan 2003 From: Penang |

|

|

|

Feb 25 2009, 06:33 PM Feb 25 2009, 06:33 PM

|

Senior Member

3,413 posts Joined: Dec 2006 From: Damansara |

|

|

|

Feb 25 2009, 07:20 PM Feb 25 2009, 07:20 PM

|

Senior Member

1,217 posts Joined: Aug 2005 From: d' Kay El |

But Resorts was down today with huge selling volume. Hmm.. wonder why..

|

|

|

|

|

|

Feb 25 2009, 07:31 PM Feb 25 2009, 07:31 PM

|

Senior Member

1,256 posts Joined: Nov 2004 |

|

|

|

Feb 25 2009, 07:45 PM Feb 25 2009, 07:45 PM

|

Senior Member

803 posts Joined: Feb 2009 |

anyone know when LCL will announce it's financial report?

|

|

|

Feb 25 2009, 08:03 PM Feb 25 2009, 08:03 PM

|

All Stars

17,875 posts Joined: Jan 2005 |

|

|

|

Feb 25 2009, 08:28 PM Feb 25 2009, 08:28 PM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

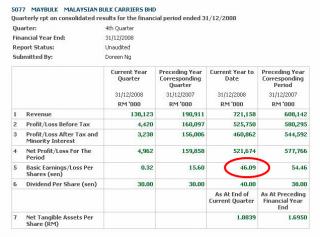

QUOTE(Junior83 @ Feb 25 2009, 07:31 PM) - revenue grew, but recorded a nett loss of 388 million in 4Q 08.according to its report, "...The loss is due to the impairment of its investment in Star Cruises Limited (“SCL”) of RM781.5 million." - basic earnings per share for FY2008 is 11.1 sen - final dividend of 4.0 sen per ordinary share Source |

|

|

Feb 25 2009, 08:38 PM Feb 25 2009, 08:38 PM

|

Senior Member

1,345 posts Joined: Dec 2007 |

MAYBULK div "tiga puluh sen" !!

|

|

|

Feb 25 2009, 08:41 PM Feb 25 2009, 08:41 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

|

|

|

Feb 25 2009, 08:43 PM Feb 25 2009, 08:43 PM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

|

|

|

|

|

|

Feb 25 2009, 08:44 PM Feb 25 2009, 08:44 PM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

|

|

|

Feb 25 2009, 08:45 PM Feb 25 2009, 08:45 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

|

|

|

Feb 25 2009, 08:48 PM Feb 25 2009, 08:48 PM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

|

|

|

Feb 25 2009, 08:57 PM Feb 25 2009, 08:57 PM

|

Senior Member

1,345 posts Joined: Dec 2007 |

QUOTE(panasonic88 @ Feb 25 2009, 08:48 PM) they must have known bout the 30 cents b4 us so they better giv us more than 5% interest 4 our EPF Added on February 25, 2009, 8:58 pm QUOTE(cherroy @ Feb 25 2009, 08:45 PM) Share ur view here ya after reading? This post has been edited by fergie1100: Feb 25 2009, 08:58 PM |

|

|

Feb 25 2009, 08:59 PM Feb 25 2009, 08:59 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

Maybulk

EPS is pretty ugly. Cash level is healthy with 790 million which is substantial enough to weather through the bad time. Future generous dividend is not sustainable as it just draining out cash if EPS continue to be as bad and operational profit remain at distress level. After all, the significant cash generated is from vessel disposal, not from operation activities. So the dividend is given from the past year accumulated profit plus vessel disposal. Conclusion, if not the 30 cents dividend, with this kind of result, share price would plunge, so company management decided to give generious dividend as sweeties. My opinoin only. |

|

|

Feb 25 2009, 09:04 PM Feb 25 2009, 09:04 PM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

|

|

|

Feb 25 2009, 09:06 PM Feb 25 2009, 09:06 PM

|

Senior Member

1,345 posts Joined: Dec 2007 |

QUOTE(cherroy @ Feb 25 2009, 08:59 PM) Maybulk their Q4 profit is really EPS is pretty ugly. Cash level is healthy with 790 million which is substantial enough to weather through the bad time. Future generous dividend is not sustainable as it just draining out cash if EPS continue to be as bad and operational profit remain at distress level. After all, the significant cash generated is from vessel disposal, not from operation activities. So the dividend is given from the past year accumulated profit plus vessel disposal. Conclusion, if not the 30 cents dividend, with this kind of result, share price would plunge, so company management decided to give generious dividend as sweeties. My opinoin only. but i'm more surprise with the uglier RESORTS result perhaps we'll get another round of surprise frm GENTING 2molo? |

|

Topic ClosedOptions

|

| Change to: |  0.0276sec 0.0276sec

0.81 0.81

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 18th December 2025 - 07:23 PM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote