QUOTE(Boon3 @ Dec 4 2013, 08:39 AM)

Hehe.... you used what search parameter? ( I remembered the losses were more.

)

this is mine. 'icapital', 'axiata'; 'losses'.

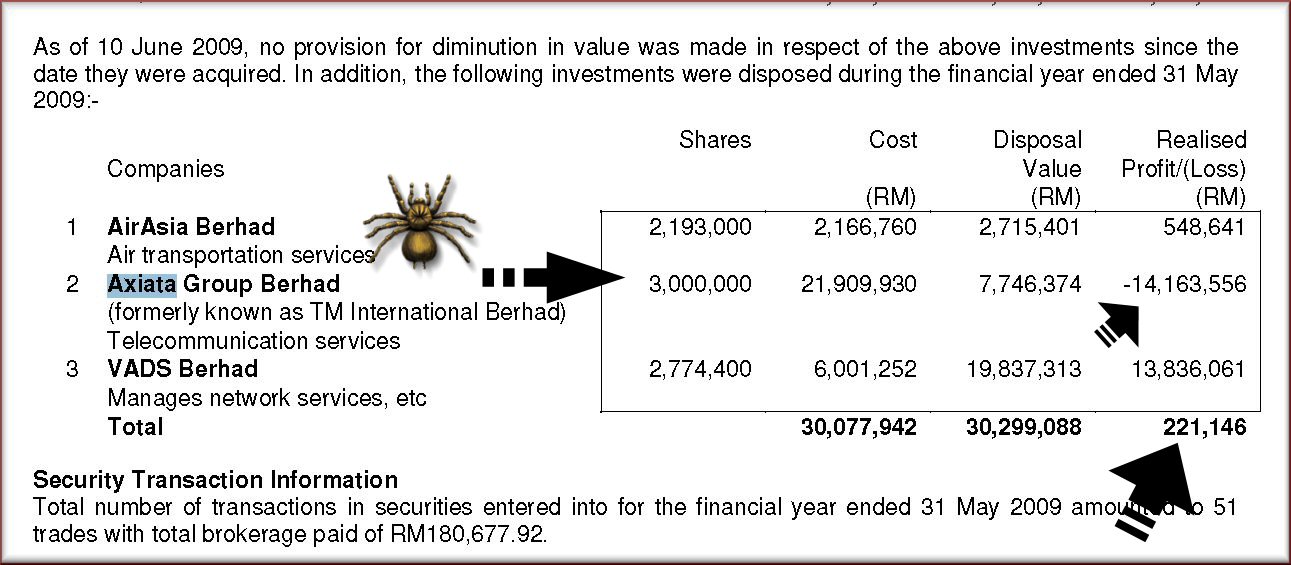

google search linkhttp://whereiszemoola.blogspot.com/2009/06...-in-axiata.htmlThe Edge mentioned 14.16 million.

This other posting was lagi best.

http://whereiszemoola.blogspot.com/2009/08...nnual-2009.htmlThat one screenshot:

3,000,000 shares of Axiata sold at 7.764,374.

That is about a price of 2.58.

Imagine if iCapital went ahead and paid for the rights issue....

The Axiata rights issue was 1.12.

5 for 4 share.

If iCapital sapu the rights issue...

They would have gotten 750,000 rights shares...

And they would have to top up 840,000.

Which means total investment in Axiata = 22,749,930.

Total shares now = 3,750,000.

New cost per share =6.06

Axiata today is 6.72.

So because iCapital did not want to top up rm 840,000, they lost over 14 milllion.

And if they had paid that rm 840,000, they would have recovered all losses and would now be sitting on a gain.

Whatever happened to long term investing?

Your calculation wrong liao

3,000,000 shares at 5:4 rights issue at RM1.12, if they subscribe it all, would be total 6,750,000 shares

3,750,000 shares from right issue would cost additional RM4.2mil

previous purchase cost at RM21.9mil

Total cost = RM26.1mil @ RM3.87 per share

If count in dividend received the past few years, within 4 years time he would have rake in 100% gain, roughly 18% CAGR

I remember he invested Digi back in early years, KLK he sold off too early, TM also dispose the same reason as Axiata if i'm not mistaken

Nov 26 2013, 03:44 PM

Nov 26 2013, 03:44 PM

Quote

Quote 0.0337sec

0.0337sec

1.02

1.02

6 queries

6 queries

GZIP Disabled

GZIP Disabled