QUOTE(yhtan @ Dec 9 2021, 01:48 AM)

Last year crash he didn't buy much, after few months after the crash he bought a lot of stock like SAM, bioalpha and Airasia.

Sold MSC around RM0.80 and now trading at RM3.50

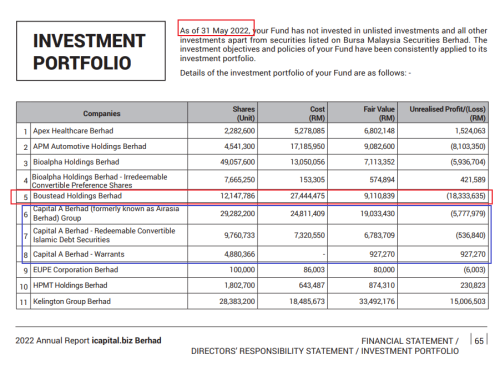

His boustead sitting at huge losses among all portfolio, macam sudah 70%+ loss on paper

The airasia cost macam RM0.84, the loan stock subscription would cost them about RM9mil

Ah Boo still getting 6mil for year 2021 and 6.6mil for year 2020

Now AA is only 0.785...... Sold MSC around RM0.80 and now trading at RM3.50

His boustead sitting at huge losses among all portfolio, macam sudah 70%+ loss on paper

The airasia cost macam RM0.84, the loan stock subscription would cost them about RM9mil

Ah Boo still getting 6mil for year 2021 and 6.6mil for year 2020

The bulk of icap money is in money market fund. 180+ million. Don't see him touching that. Which leaves the 22+ million in bank balances. Will he use it for AA rights? ( not much money left for...) Or has he dump the stocks like previously in Axiata...

Dec 9 2021, 07:26 AM

Dec 9 2021, 07:26 AM

Quote

Quote

0.0215sec

0.0215sec

0.59

0.59

6 queries

6 queries

GZIP Disabled

GZIP Disabled