syong:

the reason bac

poor dividend with highest value 60-70 usd

no doubt bac is a dividend counter but inview of current TARP bac need some time to digest what he had eaten..

please remember bac do not have permanent capital loss like citigroup or aig.

it have better potential than anyone.

march i am looking at bcs barclays, bought 1000share.. i think this is a good counter as well for 1/2 speculative and 1/2 investment purpose.

i bought bac at 3.7usd 1000share and another 1000share at 5usd., 500 share at 11.5usd

i am holding them thru thick and thin. i believe my effort will be paid off by the time i pass on to my son or daughter.

good luck with all the investment.

50 counter are just nice;

5 counter =reit

5counter=energy

10 counter = banking+finance + insurance

10 counter= consumer staples eg pep,ko,bkc,mcd,yum,kft,

10 counter=industrial product ge gd,lmt,ford,dd, dow

5counter=gaming industry lvs,mgm,dis

5counter= raw material bhp, riotinto, alcoa,

only new investor will own one to two counter, believe me i been like that before..trust me you will understand at some point of time.

not everyone can manage huge portfolio like 50 .. try 10 then 25 or 35 ..

this come with experience.

Added on June 20, 2009, 9:31 pmactually i am adding another 5 more portfolio

health product: merk,gsk, pfe,azn, abbott

You got a big portfolio there. It is very true you know, "The rich gets Richer"

By looking at your holdings which are mainly Blue Chips I am very sure there are plenty of money to come in the future.

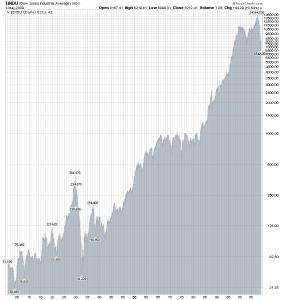

The current downturn represents a great opportunity to invest. We don't know for sure if the market has reach it's bottom but in the long run.....

Just look at the Dow's Graph.

Jun 18 2009, 08:26 PM

Jun 18 2009, 08:26 PM

Quote

Quote

0.0299sec

0.0299sec

0.59

0.59

6 queries

6 queries

GZIP Disabled

GZIP Disabled