Before close, Fail like 911.

Investing in US stocks, Does anyone know how?

Investing in US stocks, Does anyone know how?

|

|

Oct 22 2009, 06:42 AM Oct 22 2009, 06:42 AM

|

Senior Member

2,549 posts Joined: Dec 2004 From: Sungai Petani, Kedah |

Before close, Fail like 911.

|

|

|

|

|

|

Oct 22 2009, 06:53 AM Oct 22 2009, 06:53 AM

|

Senior Member

2,211 posts Joined: Sep 2009 From: Kuala Lumpur |

DJ changing colors

Open Dark Green Midday turning yellow Close on dark red CI... open red? Midday... Yellow? Close....green? Is this just a fat hope? |

|

|

Oct 22 2009, 07:37 AM Oct 22 2009, 07:37 AM

|

Senior Member

534 posts Joined: Dec 2006 |

Wtf? Woke up this morning to see everything in the red. Damn that d*** Bove.

Wall Street sees late sell-off as bank optimism fades |

|

|

Oct 22 2009, 08:24 AM Oct 22 2009, 08:24 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

QUOTE(mH3nG @ Oct 22 2009, 07:37 AM) Wtf? Woke up this morning to see everything in the red. Damn that d*** Bove. yes, what the FARK, one simple farker downgrade WFC - all the market reversed. Wall Street sees late sell-off as bank optimism fades |

|

|

Oct 22 2009, 09:28 AM Oct 22 2009, 09:28 AM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(mrPOTATO @ Oct 21 2009, 11:18 PM) Sulifeisgreat, thanks for your experiences condensed for our reading, though its not that short though, and i'm still digesting ahha.. Looking at the chart u inserted, the blue line in the middle of the diagram intersecting the share price line, whats that ? Seems to be accurately predicting bullish price movement. I bought google already, just keep it aside. Danmooncake, ppl saying AAPL can go $300. Dare (crazy enuf) to buy at $205 not ? Duno got possibility it'll dip or not. i dun advertise, agree nor disagree with them, i jus see whther they conveying a topic that can be understood or not if can't be understood, then u need google & do further r&d pelajaran hari ini untuk investing & trading101 would be on candlestick & 50-200 moving day average http://optionstradingbeginner.blogspot.com...hart-basic.html http://education.wallstreetsurvivor.com/node/400 "wat works for me, may not even work for me, so can it work for u"

|

|

|

Oct 22 2009, 09:37 AM Oct 22 2009, 09:37 AM

|

Senior Member

2,113 posts Joined: Dec 2008 |

|

|

|

|

|

|

Oct 22 2009, 09:44 AM Oct 22 2009, 09:44 AM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(epalbee3 @ Oct 22 2009, 12:39 AM) I din get my MBL IPO voting.. They returned my money to me. gee... i have never found many good tip that sure winSo I will wire my money to Sogotrade tomorrow. I won't use firstrade anymore. Sifus, any good tip to sure win? Buy swing at dip? normally for me but if u really do come across, pls share izit ok if u help to do a homework for our trading & investing101 class? can u try google & find out more about industry sectors? or anyone out there willing to volunteer?

Added on October 22, 2009, 9:47 am QUOTE(mrPOTATO @ Oct 22 2009, 09:37 AM) Its all the fed's fault ! why can't they be more positive with their words like obama ? learning to trade is tough, trading is even tougher, so this thread needs to lighten up Sulifei, whats that ? A rifle scoping on your doll ? btw, thats no doll, thats the famous barney This post has been edited by sulifeisgreat: Oct 22 2009, 09:52 AM |

|

|

Oct 22 2009, 10:10 AM Oct 22 2009, 10:10 AM

|

Senior Member

2,113 posts Joined: Dec 2008 |

QUOTE(sulifeisgreat @ Oct 22 2009, 09:44 AM) learning to trade is tough, trading is even tougher, so this thread needs to lighten up Ahaha.. i had a deprived childhood. btw, thats no doll, thats the famous barney Hey, those analysts over in usa keep talking abt asia leading recovery. Pessimistic lot. Is china/hk ah a better place to trade i wonder. Or how about investing in nyse chinese stocks like unicom, china mobile etc ? |

|

|

Oct 22 2009, 10:37 AM Oct 22 2009, 10:37 AM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(mrPOTATO @ Oct 22 2009, 10:10 AM) Ahaha.. i had a deprived childhood. refer post #1487 stock market moves in anticipation of the future, most news u wil read is old & stale Hey, those analysts over in usa keep talking abt asia leading recovery. Pessimistic lot. Is china/hk ah a better place to trade i wonder. Or how about investing in nyse chinese stocks like unicom, china mobile etc ? imo, whereever can make $$$, its alwiz a good place izit ok if we do a surprise test on u for trading & investing101 classs? wat is ur opinion on unicom & china mobile? come on dun be shy... we all wanna see is tis thread working?

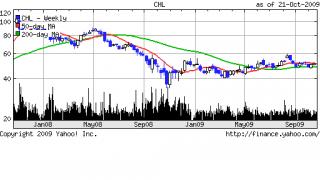

in same sector,here is a sample of uptrend, breakout after $5 & supported by volume, but y can it do tat? can u find out?

in same sector,here is a sample of gap up with high volume, but y can it do tat? can u/ any volunteer find out?

come come... anyone out there can participate in this class to make thread active. there is no right or wrong answer. if u r right, ur bank ac got lots of zero & vice versa if u r wrong. i'm not a fan of buffet, but for those buffet lovers : In the business world, the rearview mirror is always clearer than the windshield. Warren Buffett US financier & investment businessman (1930 - ) This post has been edited by sulifeisgreat: Oct 22 2009, 10:59 AM |

|

|

Oct 22 2009, 11:25 AM Oct 22 2009, 11:25 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

Umm, AAPL looks delicious below 200$.

May want to enter at 200$ x20 |

|

|

Oct 22 2009, 11:56 AM Oct 22 2009, 11:56 AM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

|

|

|

Oct 22 2009, 12:11 PM Oct 22 2009, 12:11 PM

|

Senior Member

1,523 posts Joined: Apr 2005 From: too far to see |

KONG looks like all time high. can we apply the all time high in it? wat is the hourly moving average for this stock?

CHL is experiencing 1 st day low. need to wait for the 1st hour on today trading day to justify entry point. do u have 20 DMA for these 2 stocks? |

|

|

Oct 22 2009, 01:06 PM Oct 22 2009, 01:06 PM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(taitianhin @ Oct 22 2009, 12:11 PM) KONG looks like all time high. can we apply the all time high in it? wat is the hourly moving average for this stock? i dun hav hourly ma nor 20ma for them? we need to ask those day traders for assistanceCHL is experiencing 1 st day low. need to wait for the 1st hour on today trading day to justify entry point. do u have 20 DMA for these 2 stocks? any idea wat drives kong up? try check up google or yahoo finance message boards to see stil got roket fuel or not? wonder when wil be the pullback? 11? imo, there r other better quality stocks in this group maybe need to check any momo bought or adding or selling position or not? also need to check (if got time) those momo got quality boh? http://finance.yahoo.com/q/mh?s=KONG in comparison to lvs http://finance.yahoo.com/q/mh?s=lvs can u see the difference? so if this stock can generate earnings quarter after quarter & more momo add position then u r early bird (but maybe it can even do a pullback to shakeout weak holders) but if co no make money, then could be speculative or goreng stock notis speculative stock quality difference between us & our beloved m'sia This post has been edited by sulifeisgreat: Oct 22 2009, 01:12 PM |

|

|

|

|

|

Oct 22 2009, 05:25 PM Oct 22 2009, 05:25 PM

|

Senior Member

2,113 posts Joined: Dec 2008 |

QUOTE(sulifeisgreat @ Oct 22 2009, 10:37 AM) izit ok if we do a surprise test on u for trading & investing101 classs? I didn't even know the importance of technical analysis until lately. After reading yr link about MA and looking at the charts, i learnt that it is useful to compare the short term MA against long term MA and once the short term MA goes lower than the long term one, its time to run ? wat is ur opinion on unicom & china mobile? come on dun be shy... we all wanna see is tis thread working? Other parts of the technical analysis i haven't touched yet. Only use common sense to judge that the bottom blue bars are for volume, if they are on top its a good sign. Once it turns upside down, its not such a good sign anymore. Sifu, right or not ? What other things to read in conjunction with the above ? This post has been edited by mrPOTATO: Oct 22 2009, 05:49 PM |

|

|

Oct 22 2009, 06:10 PM Oct 22 2009, 06:10 PM

|

Senior Member

2,352 posts Joined: Jan 2003 From: Pixelgasm |

QUOTE(mrPOTATO @ Oct 22 2009, 05:25 PM) I didn't even know the importance of technical analysis until lately. After reading yr link about MA and looking at the charts, i learnt that it is useful to compare the short term MA against long term MA and once the short term MA goes lower than the long term one, its time to run ? If falling below long term MA its time to buy already. U should sell before it breach long term MA threshold coz from there onwards, its gonna freefall. If its approaching long term MA from below, then its time to sell, the reverse is true.Other parts of the technical analysis i haven't touched yet. Only use common sense to judge that the bottom blue bars are for volume, if they are on top its a good sign. Once it turns upside down, its not such a good sign anymore. Sifu, right or not ? What other things to read in conjunction with the above ? |

|

|

Oct 22 2009, 07:44 PM Oct 22 2009, 07:44 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

BIG news mounting today : Unemployment Claims @ 830pm local time.

It will have big impact .. L&G - hold on to your ride. my C already -540$ right now @ 4.43 |

|

|

Oct 22 2009, 07:56 PM Oct 22 2009, 07:56 PM

|

Senior Member

2,549 posts Joined: Dec 2004 From: Sungai Petani, Kedah |

TA cannot use in DJI.

|

|

|

Oct 22 2009, 08:30 PM Oct 22 2009, 08:30 PM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

Shiat. Unemployment number getting shittier every month.

|

|

|

Oct 22 2009, 09:19 PM Oct 22 2009, 09:19 PM

|

All Stars

10,125 posts Joined: Aug 2007 |

QUOTE(zamans98 @ Oct 22 2009, 08:30 PM) Yes, that's is what's expected to happen. The US market has been ignoring the unemployment numbers... what they care is "lesser" claim. If we have this kind of unemployment numbers in Malaysia (closing to double digit), I think our market may crash big time. Ok, just buy the dip for now to play the swing trade. In TNA during dip: 43.80 This post has been edited by danmooncake: Oct 22 2009, 10:55 PM |

|

|

Oct 22 2009, 11:06 PM Oct 22 2009, 11:06 PM

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(sulifeisgreat @ Oct 20 2009, 09:52 AM) right click on the image. save to ur pc, from there, u can open or enlarge for viewing here is the post mortem for spar imo but beware, here is a stock for swing trading, as earnings due 22/10/09. alwiz set ur target profit & loss in advance, as if stock dun move rite, we dun wan to hold the bag & be an involuntary long term investor, also move ur trailing stop if it goes up. coz we either win some or we lose most eg. a quick case study in options vs stock % movement. taking strike price of $5 & expiry on 19/3/10. of coz, we can take other expiry date & price too. whichever suit ur style [attachmentid=1259941] if we think its going up buy stock 100*5.44=544 or buy call option QQPCA.X 100*1.4=140 but if we think its going down sell stock 100*5.44=544 or buy put option QQPOA.X 100*1=100 http://finance.yahoo.com/q/os?s=SPAR&m=2010-03-19 well if u own 100 of the stock, u can write a cover call, collect premium & the money wil be in ur ac, provided u gamble & stock move in ur direction. otherwise ur 100 stock would be sold & u collect balance of the proceeds. if u gamble rite, then u get to keep ur 100 stock & the premium collected from cover call... dream on if we think its going down sell call option QQPCA.X 100*.85=85 coz if we sell a put option & it really moves down, our stock wil be sold if we think its going up sell put option QQPOA.X 100*.7=70 coz if we sell a call option & it really moves up, our stock wil be sold taking a gamble, i think spar may move up, so i use scenario buy stock/ buy call options/ sell put options as it has been beating earnings estimates, otherwise its arang batu time - jmo http://www.reuters.com/finance/stocks/esti...s?symbol=SPAR.O if u had did earnings play, ie sold before earnings, would gain 6-5.44=.56 (careful as got some stock never move after earnings)

refer above purchase example on arang batu case study, below is the results for 20/3/10 options expiry bought call option & now close position QQPCA 1.4-.85=.55 lost bought put option & now close position QQPOA 1-.05=.95 gain before comm sold call option QQPCA & collected 85 in advance, if want to close position, need to buy back at 130, lost 45 (but normally we do nothing as we had already collected 85. now we waiting to see would open interest person exercise this option or not?) unless we want to keep the stock in hand now sold put option QQPOA & collected 70 in advance, if want to close position, need to buy back at 175, lost 105 (but normally we do nothing as we had already collected 70. now we waiting to see would open interest person exercise this option or not?) unless we want to keep the stock in hand now |

|

Topic ClosedOptions

|

| Change to: |  0.0329sec 0.0329sec

1.00 1.00

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 06:28 AM |