QUOTE(mynewuser @ Oct 22 2009, 07:56 PM)

so how do we play dji then?

Added on October 22, 2009, 11:21 pm

QUOTE(redken @ Oct 22 2009, 06:10 PM)

If falling below long term MA its time to buy already. U should sell before it breach long term MA threshold coz from there onwards, its gonna freefall. If its approaching long term MA from below, then its time to sell, the reverse is true.

hmm... that means 95% of my ramblings could not be understood ok, in future more pictures, less talking

if can, u got to try the theory & see how it fits to ur study plan

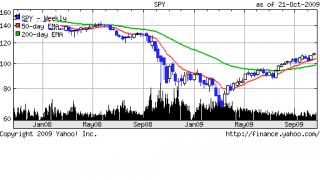

basically 50>200 means its in uptrend

u can note some charts, the price just above 50 & ride up along the trend

so 50<200 means downtrend

u can note some charts, the price just below 200 & ride down along the trend

see how is 50 trying to move, notis it tries to move up, while still under 200

refer dia, qqqq & spy chart. the candlesticks charts & volume is giving u some kind of a clue, where the support & resistance r located

dia = dow jones, qqqq = nasdaq & spy = s&p500

the key point to watch is when 50 intersect with 200 & vice versa, who will win the fight? bulls or bear. u can either wait for confirmation or gamble on its next path

This post has been edited by sulifeisgreat: Oct 22 2009, 11:48 PM

Oct 22 2009, 11:12 PM

Oct 22 2009, 11:12 PM

Quote

Quote

0.0264sec

0.0264sec

0.79

0.79

6 queries

6 queries

GZIP Disabled

GZIP Disabled