Outline ·

[ Standard ] ·

Linear+

Priority Banking, Everything about Priority Banking

|

henrytanck

|

Jan 25 2017, 08:37 PM Jan 25 2017, 08:37 PM

|

New Member

|

QUOTE(bbgoat @ Jan 25 2017, 08:33 PM) UOB AUM is 500k. But their team seems solid, my RM has been trying to get me to buy some investment products. PBB do not have PB facility in Penang. MBB wise, I am tagged as their PB but actually nothing in there.  Awesome!!! Your sharing and experience is priceless. Can you share how you find UOB team is solid? |

|

|

|

|

|

drbone

|

Jan 25 2017, 08:49 PM Jan 25 2017, 08:49 PM

|

|

QUOTE(bbgoat @ Jan 25 2017, 08:33 PM) UOB AUM is 500k. But their team seems solid, my RM has been trying to get me to buy some investment products. PBB do not have PB facility in Penang. MBB wise, I am tagged as their PB but actually nothing in there.  Yup, MBB RM is pretty useless compared to the other banks. |

|

|

|

|

|

edcyf

|

Jan 25 2017, 09:33 PM Jan 25 2017, 09:33 PM

|

Getting Started

|

CIMB seem to have the most priority banking centres among all banks.

|

|

|

|

|

|

bbgoat

|

Jan 26 2017, 08:56 AM Jan 26 2017, 08:56 AM

|

|

QUOTE(henrytanck @ Jan 25 2017, 08:37 PM) Awesome!!! Your sharing and experience is priceless. Can you share how you find UOB team is solid? I suggest u make an appointment with UOB to discuss about their PB program. I did the same before joining their PB. Do the same thing for other banks. Then decide for yourself.  |

|

|

|

|

|

vseries

|

Jan 26 2017, 03:48 PM Jan 26 2017, 03:48 PM

|

Getting Started

|

QUOTE(lamode @ Jan 26 2017, 11:26 AM) anyone with alliance bank PB know the fees if fall below the PB criteria?   I only remember stanchart will charge RM100 but negotiateable. |

|

|

|

|

|

cklimm

|

Jan 26 2017, 11:14 PM Jan 26 2017, 11:14 PM

|

|

QUOTE(henrytanck @ Jan 25 2017, 07:20 PM) Start from January 2017, Citibank increases their Priority and Citigold AUM requirements as well: Priority: 100K Citigold: 400k QUOTE(edcyf @ Jan 25 2017, 07:48 PM) Previously was 200k , then increased to 300k if not mistaken. Then now is 400k If i have 400k, i rather join 2 banks' priority which requirement is 200k each QUOTE(bbgoat @ Jan 25 2017, 08:02 PM) It seems to me not many Citigold customer in this forum or they are being quiet about it. I have been a surviving one but have to have investment product with them. Their FD rate is just plain board rate. Lets see if I can survive the 400k limit !  Only 100k to join Citi priority? Does it entitle poor old fags like me to enter priority banking hall+coffee+free parking? |

|

|

|

|

|

bbgoat

|

Jan 27 2017, 08:37 AM Jan 27 2017, 08:37 AM

|

|

QUOTE(cklimm @ Jan 26 2017, 11:14 PM) Only 100k to join Citi priority? Does it entitle poor old fags like me to enter priority banking hall+coffee+free parking? I doubt so. Rich Uncle can give it a try, anyway !  If denied entry, show a cheque of >400k, say want to join the rank !  This post has been edited by bbgoat: Jan 27 2017, 08:41 AM This post has been edited by bbgoat: Jan 27 2017, 08:41 AM |

|

|

|

|

|

cklimm

|

Jan 27 2017, 10:13 AM Jan 27 2017, 10:13 AM

|

|

QUOTE(bbgoat @ Jan 27 2017, 08:37 AM) I doubt so. Rich Uncle can give it a try, anyway !  If denied entry, show a cheque of >400k, say want to join the rank !  Citi has no pure FD promo, their FD + UT promo, the sales charge alone eats up the promo interest already, while their board rate is pathetic. 100k try for fun, okay. 400k, not cost efficient anymore |

|

|

|

|

|

bbgoat

|

Jan 27 2017, 10:18 AM Jan 27 2017, 10:18 AM

|

|

QUOTE(cklimm @ Jan 27 2017, 10:13 AM) Citi has no pure FD promo, their FD + UT promo, the sales charge alone eats up the promo interest already, while their board rate is pathetic. 100k try for fun, okay. 400k, not cost efficient anymore I have pulled out all my FD from them about 2 years ago. After I realized being stupid to keep some FD there.  So now just have investment products with them. Last year they do have 4.5% FD for like 1 week for Citigold customers only. Other than that, board rates ! Worst among the foreign banks ! I said show them the cheque if they stopped u. But still keep it with u when u come out !  |

|

|

|

|

|

aspartame

|

Jan 27 2017, 10:40 AM Jan 27 2017, 10:40 AM

|

|

Most of my banking done online now. The only times I need to go to the bank are mostly for cheque or cash deposit and withdrawal and these are done through machines. I think the only benefit maybe is to be able to do DCI? That also unless you are doing business or have constant need to exchange into foreign currency, the savings is negligible.

This post has been edited by aspartame: Jan 27 2017, 10:43 AM

|

|

|

|

|

|

bbgoat

|

Jan 27 2017, 10:47 AM Jan 27 2017, 10:47 AM

|

|

QUOTE(aspartame @ Jan 27 2017, 10:40 AM) Most of my banking done online now. The only times I need to go to the bank are mostly for cheque or cash deposit and withdrawal and these are done through machines. I think the only benefit maybe is to be able to do DCI? That also unless you are doing business or have constant need to exchange into foreign currency, the savings is negligible. Each person has different needs of going to bank. For others, placement of FD promo, buy UT, wasting time (like some rich uncles here  ) etc etc.  |

|

|

|

|

|

drbone

|

Jan 28 2017, 04:21 PM Jan 28 2017, 04:21 PM

|

|

Invested in 5 yr FD with AmBank for 4.35% , their premier banking service is not too bad

|

|

|

|

|

|

troller2

|

Jan 29 2017, 09:39 PM Jan 29 2017, 09:39 PM

|

Getting Started

|

Does investing in Bonds compounded?

If it is not compounded, it's better to put in FD, even if the value is slightly lower than Bonds.

|

|

|

|

|

|

char_les

|

Jan 31 2017, 02:14 PM Jan 31 2017, 02:14 PM

|

Getting Started

|

QUOTE(troller2 @ Jan 29 2017, 09:39 PM) Does investing in Bonds compounded? If it is not compounded, it's better to put in FD, even if the value is slightly lower than Bonds. you mean bonds paper ? if it is, i think it is not, as the coupon will paid to your investment account according to the coupon payment set for that particular issuance. Unless you pull it out and reinvest. Also, generally, foreign bond paper offers better coupon higher than FD rate. Just the product risk rating is different. It depends, cos bonds are more interest sensitive & global political & economical factor, if it is in your favor, you will enjoy the upside significantly, unlike FD (lowest risk). |

|

|

|

|

|

troller2

|

Jan 31 2017, 06:52 PM Jan 31 2017, 06:52 PM

|

Getting Started

|

QUOTE(char_les @ Jan 31 2017, 02:14 PM) you mean bonds paper ? if it is, i think it is not, as the coupon will paid to your investment account according to the coupon payment set for that particular issuance. Unless you pull it out and reinvest. Also, generally, foreign bond paper offers better coupon higher than FD rate. Just the product risk rating is different. It depends, cos bonds are more interest sensitive & global political & economical factor, if it is in your favor, you will enjoy the upside significantly, unlike FD (lowest risk). Thanks for the reply. What I meant was the Bonds traded in the exchanges, where you can buy and sell through an exchange. |

|

|

|

|

|

char_les

|

Jan 31 2017, 10:30 PM Jan 31 2017, 10:30 PM

|

Getting Started

|

QUOTE(troller2 @ Jan 31 2017, 06:52 PM) Thanks for the reply. What I meant was the Bonds traded in the exchanges, where you can buy and sell through an exchange. Exchange traded bond?, it's the same, bond paper, debt instrument issued for big corp. funding needs. Just that buying in the capacity of priority or private banking allows bigger chunk like SGD 250,000, thus better pricing compare to retail via exchange, allows smaller chunk like SGD 1,000. |

|

|

|

|

|

troller2

|

Feb 1 2017, 06:25 PM Feb 1 2017, 06:25 PM

|

Getting Started

|

QUOTE(char_les @ Jan 31 2017, 10:30 PM) Exchange traded bond?, it's the same, bond paper, debt instrument issued for big corp. funding needs. Just that buying in the capacity of priority or private banking allows bigger chunk like SGD 250,000, thus better pricing compare to retail via exchange, allows smaller chunk like SGD 1,000. Thanks. |

|

|

|

|

|

cklimm

|

Feb 2 2017, 03:24 PM Feb 2 2017, 03:24 PM

|

|

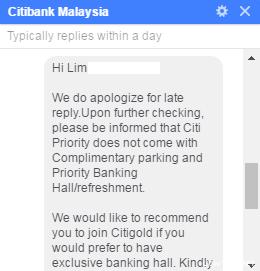

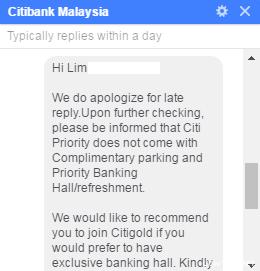

ok folks, I asked Citibank if there is any free parking and drinks for citi priority (min 100k) customers, and here's their respond: This post has been edited by cklimm: Feb 2 2017, 03:29 PM Attached image(s) |

|

|

|

|

|

bbgoat

|

Feb 2 2017, 03:35 PM Feb 2 2017, 03:35 PM

|

|

QUOTE(cklimm @ Feb 2 2017, 03:24 PM) ok folks, I asked Citibank if there is any free parking and drinks for citi priority (min 100k) customers, and here's their respond: Would have expected that. For Uncle Lim, if really want to experience Citigold, no issue for u !  My best experience of PB is with Citigold. They gave me a Swatch Swiss made watch years ago (when joining). Still looking new and running accurately other than changing of the battery. Come come, join Citigold !  This post has been edited by bbgoat: Feb 2 2017, 03:38 PM This post has been edited by bbgoat: Feb 2 2017, 03:38 PM |

|

|

|

|

Jan 25 2017, 08:37 PM

Jan 25 2017, 08:37 PM

Quote

Quote

0.0313sec

0.0313sec

0.68

0.68

6 queries

6 queries

GZIP Disabled

GZIP Disabled