CIMB Preferred lowered the requirement to RM 150k, for the 1st year.

CIMB

Priority Banking, Everything about Priority Banking

Priority Banking, Everything about Priority Banking

|

|

Nov 12 2014, 12:56 AM Nov 12 2014, 12:56 AM

Return to original view | Post

#1

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

|

|

|

Oct 11 2015, 11:24 PM Oct 11 2015, 11:24 PM

Return to original view | Post

#2

|

Senior Member

2,338 posts Joined: Oct 2014 |

Eh guys, which Bank's PB does not impose penalty/fees when balance below requirement ah? I plan to move my limited funds around

|

|

|

Oct 11 2015, 11:39 PM Oct 11 2015, 11:39 PM

Return to original view | Post

#3

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

Oct 12 2015, 07:40 AM Oct 12 2015, 07:40 AM

Return to original view | Post

#4

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(Ramjade @ Oct 12 2015, 01:14 AM) ahhh, found it thank you, i must share thiz"I have Privilege Banking status with UOB Bank and Alliance Bank, Premier Banking status with OCBC Bank and RHB Bank, Priority Banking status with Hong Leong Bank and Premier Wealth Banking with Maybank. And why did I sign up for the PB status with these banks? Well, it is because I will not be penalized a sen should my Assets Under Management (AUM) with these banks fall below the requirement to be eligible for PB status." (GenX, 2015) |

|

|

Oct 12 2015, 09:38 AM Oct 12 2015, 09:38 AM

Return to original view | Post

#5

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

Oct 12 2015, 12:28 PM Oct 12 2015, 12:28 PM

Return to original view | Post

#6

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

|

|

|

Jan 27 2016, 08:31 AM Jan 27 2016, 08:31 AM

Return to original view | Post

#7

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

Aug 1 2016, 10:43 PM Aug 1 2016, 10:43 PM

Return to original view | Post

#8

|

Senior Member

2,338 posts Joined: Oct 2014 |

Apparently there's a new segment from UOB called "Wealth Banking"

150k to join, not sure if there is a lounge and coffee http://www1.uob.com.my/wealthbanking/about.html |

|

|

Dec 15 2016, 03:32 PM Dec 15 2016, 03:32 PM

Return to original view | Post

#9

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(bbgoat @ Dec 15 2016, 08:58 AM) For Penang: OCBC best PB lounge, leng lui serving coffee. Free parking if can get one. UOB outdated lounge. Fast service in PB as compared to normal banking area. Free coffee as usual. CB, big PB lounge. Good service. Called to join free dinner for investment talks. SCB called to give free dinner and wine tasting. BR best in terms of Xclusive gifts. Good service. AmBank RM said can give better fx and fd rates. CIMB seems to have good investment products. RHB, HL just getting no queue service, nothing special yet. Other than introductory gifts. MBB was given Private Banking card. But never receive calls from RM and pulled out years ago. How about Klang Valley side ? They seemed to receive awards for their Private/Priority Banking service years ago. QUOTE(Icona Pop @ Dec 15 2016, 02:44 PM) And that's just tip of an iceberg |

|

|

Dec 15 2016, 05:28 PM Dec 15 2016, 05:28 PM

Return to original view | Post

#10

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

Dec 31 2016, 12:57 PM Dec 31 2016, 12:57 PM

Return to original view | Post

#11

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(thtan @ Dec 30 2016, 03:22 PM) Hi guys, They will hard sell you unit trust, insurance to milk $ from you.I've thread through so many pages of this thread but very little discussion on how much more can you earn through priority banking services. In terms of investment opportunities, do they give much higher returns than conventional investments and what are the potential profits like? Any specific bank recommended. To me prestige is crap, I just want to know whether the bank can help me earn more money. |

|

|

Jan 6 2017, 07:49 PM Jan 6 2017, 07:49 PM

Return to original view | Post

#12

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(bbgoat @ Jan 6 2017, 08:58 AM) U are too humble ! Dude, which bank does not charges fee/ close account should balance lower than required? I've only dealt with HLB pb so farI never have single FD cert of 1 mil ! My PB membership maybe are recycle ones, meaning get one, move out, join another one leh ! U have already joined MBB Premier Wealth, right ? I am their Premier Wealth in name only. Nothing in tiger bank due to their promo not that good last 1 to 2 years. |

|

|

Jan 7 2017, 10:32 AM Jan 7 2017, 10:32 AM

Return to original view | Post

#13

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(bbgoat @ Jan 6 2017, 08:52 PM) As I said before, I have moved out from SCB PB. As scared that they will charge me monthly fees. Good to know that maybank doesnt impose chargesMBB one they did not bother about me and I seldom go there anyway for last 1 or 2 years. Some of the banks claimed that they will remove you as PB member if u did not top up. Some said so far no charges as they do not want to lose the customer. Some of course said will charge u. U deal with HLB only ? I thought u are PB member for sooo many banks ! |

|

|

|

|

|

Jan 10 2017, 06:34 PM Jan 10 2017, 06:34 PM

Return to original view | Post

#14

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(wodenus @ Jan 9 2017, 01:08 AM) Why? just imagine how much they are losing to inflation Imagine you have 1 mil disposable, what will be your strategy? Kindly enlighten unker here.QUOTE(sandkoh @ Jan 9 2017, 11:24 AM) bro, come here & talk about it when u have the same $ as mr lim. As age progressing, unker's sharpness and risk appetite is no longer up to par. Lets see whats the young man can tell.QUOTE(drbone @ Jan 9 2017, 11:44 AM) That was the safest bet at 2014/15, better than losing 20% in the share market. |

|

|

Jan 16 2017, 10:52 AM Jan 16 2017, 10:52 AM

Return to original view | Post

#15

|

Senior Member

2,338 posts Joined: Oct 2014 |

bbgoat i found one thing fun with Maybank premier.

You can give the teller your Asnb passbooks, let em take their sweet time trying to top up, while you are peacefully sipping latte, reading New Straits Times in the Premier banking lounge. |

|

|

Jan 16 2017, 03:17 PM Jan 16 2017, 03:17 PM

Return to original view | Post

#16

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(gchowyh @ Jan 16 2017, 02:33 PM) I have to admit, mine was nescafe latte. QUOTE(Ancient-XinG- @ Jan 16 2017, 01:07 PM) With the present of ASM. I think hard for me to lock 250k with them lol 50k also struggle. masuk jer lah, they will be too polite to chase you outStill have to thanks them for the 15xx for smooth asm transaction lol by cutting in But can ASPIRE enter the lounge? This post has been edited by cklimm: Jan 16 2017, 03:54 PM |

|

|

Jan 20 2017, 02:48 PM Jan 20 2017, 02:48 PM

Return to original view | Post

#17

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

Jan 26 2017, 11:14 PM Jan 26 2017, 11:14 PM

Return to original view | Post

#18

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(henrytanck @ Jan 25 2017, 07:20 PM) Start from January 2017, Citibank increases their Priority and Citigold AUM requirements as well: Priority: 100K Citigold: 400k QUOTE(edcyf @ Jan 25 2017, 07:48 PM) Previously was 200k , then increased to 300k if not mistaken. Then now is 400k If i have 400k, i rather join 2 banks' priority which requirement is 200k each QUOTE(bbgoat @ Jan 25 2017, 08:02 PM) It seems to me not many Citigold customer in this forum or they are being quiet about it. Only 100k to join Citi priority? Does it entitle poor old fags like me to enter priority banking hall+coffee+free parking?I have been a surviving one but have to have investment product with them. Their FD rate is just plain board rate. Lets see if I can survive the 400k limit ! |

|

|

Jan 27 2017, 10:13 AM Jan 27 2017, 10:13 AM

Return to original view | Post

#19

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(bbgoat @ Jan 27 2017, 08:37 AM) I doubt so. Rich Uncle can give it a try, anyway ! Citi has no pure FD promo, their FD + UT promo, the sales charge alone eats up the promo interest already,If denied entry, show a cheque of >400k, say want to join the rank ! while their board rate is pathetic. 100k try for fun, okay. 400k, not cost efficient anymore |

|

|

Feb 2 2017, 03:24 PM Feb 2 2017, 03:24 PM

Return to original view | Post

#20

|

Senior Member

2,338 posts Joined: Oct 2014 |

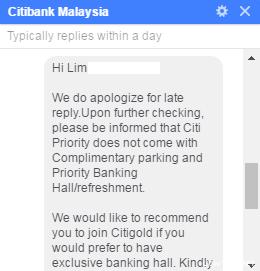

ok folks, I asked Citibank if there is any free parking and drinks for citi priority (min 100k) customers,

and here's their respond: This post has been edited by cklimm: Feb 2 2017, 03:29 PM Attached image(s)  |

| Change to: |  0.0674sec 0.0674sec

0.18 0.18

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 05:34 AM |