Bottom line: they need to be upfront what account 3 dividen going to be.

News EPF Account 3 to go live on May 11

News EPF Account 3 to go live on May 11

|

|

Apr 25 2024, 01:09 PM Apr 25 2024, 01:09 PM

Show posts by this member only | IPv6 | Post

#61

|

Senior Member

1,810 posts Joined: Mar 2007 |

Bottom line: they need to be upfront what account 3 dividen going to be.

|

|

|

|

|

|

Apr 25 2024, 01:09 PM Apr 25 2024, 01:09 PM

|

Senior Member

4,624 posts Joined: Mar 2007 |

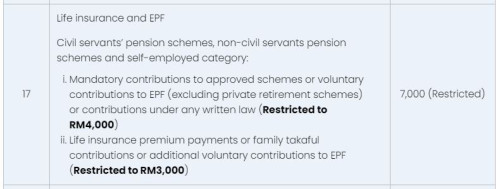

QUOTE(ye0073 @ Apr 25 2024, 01:04 PM) For those who wants to opt out, can withdraw the money from account 3, and put it back thru self-contribution and enjoy tax relief of 7K. don think they so dumb they might implement just like SSPN, nett in, if you withdraw x amount, you put in y, your nett in is y-x |

|

|

Apr 25 2024, 01:10 PM Apr 25 2024, 01:10 PM

|

Senior Member

4,624 posts Joined: Mar 2007 |

QUOTE(jojolicia @ Apr 25 2024, 01:09 PM) speculate only, adui ini orang |

|

|

Apr 25 2024, 01:11 PM Apr 25 2024, 01:11 PM

Show posts by this member only | IPv6 | Post

#64

|

Senior Member

1,886 posts Joined: Jan 2007 From: The Long river ... |

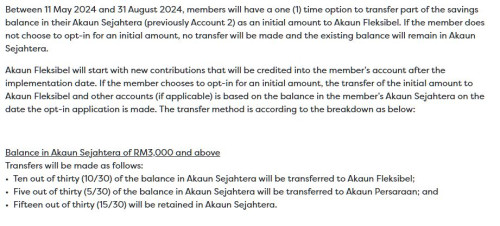

QUOTE(ye0073 @ Apr 25 2024, 12:59 PM) So if got 100,000 at account 2 Errr, the way I understand is Acc 3 will start from 0.• 100,000 x 10/30 = 33,333 to account 3 • 100,000 x 5/30 = 16,667 to account 1 • 100,000 x 15/30 = 50,000 remain in account 2 From now onwards u can choose what will go into Acc 3. 10/30 or 5/30 or 15/30. And not taking whats already in Acc 2 and divided it by 10/30 or 5/30 or 15/30 and put into Acc 3. Do correct me if my understanding is wrong. |

|

|

Apr 25 2024, 01:12 PM Apr 25 2024, 01:12 PM

|

Senior Member

4,624 posts Joined: Mar 2007 |

QUOTE(ye0073 @ Apr 25 2024, 12:59 PM) So if got 100,000 at account 2 more easier is• 100,000 x 10/30 = 33,333 to account 3 • 100,000 x 5/30 = 16,667 to account 1 • 100,000 x 15/30 = 50,000 remain in account 2 account 1 70k account 2 30k end up account 1 75k (account 2 5/30 into here) account 2 15k (account 2 15/30 remain) account 3 10k (account 2 10/30 into here) |

|

|

Apr 25 2024, 01:12 PM Apr 25 2024, 01:12 PM

|

Senior Member

1,129 posts Joined: Feb 2021 |

why dont they allow those with above RM1mil to opt out from Acct 3 completely?

Completely useless this Acct 3 for us This post has been edited by Lembu Goreng: Apr 25 2024, 01:13 PM |

|

|

|

|

|

Apr 25 2024, 01:13 PM Apr 25 2024, 01:13 PM

|

Junior Member

480 posts Joined: Sep 2004 |

QUOTE(ShadowR1 @ Apr 25 2024, 01:11 PM) Errr, the way I understand is Acc 3 will start from 0. Can transfer for 1 time option. From now onwards u can choose what will go into Acc 3. 10/30 or 5/30 or 15/30. And not taking whats already in Acc 2 and divided it by 10/30 or 5/30 or 15/30 and put into Acc 3. Do correct me if my understanding is wrong. QUOTE Between 11 May 2024 and 31 August 2024, members will have a one (1) time option to transfer part of the savings balance in their Akaun Sejahtera (previously Account 2) as an initial amount to Akaun Fleksibel. If the member does not choose to opt-in for an initial amount, no transfer will be made and the existing balance will remain in Akaun Sejahtera.  |

|

|

Apr 25 2024, 01:16 PM Apr 25 2024, 01:16 PM

Show posts by this member only | IPv6 | Post

#68

|

Junior Member

435 posts Joined: Aug 2020 |

If by default not doing anything mean 0% allocation to acc3 Correct?

Can only change once a year? Or once a lifetime? Between 11 May 2024 and 31 August 2024, members will have a one (1) time option to transfer part of the savings balance in their Akaun Sejahtera (previously Account 2) as an initial amount to Akaun Fleksibel. If the member does not choose to opt-in for an initial amount, no transfer will be made and the existing balance will remain in Akaun Sejahtera. Only will touch this if I have no way out. This post has been edited by Koranshita: Apr 25 2024, 01:17 PM |

|

|

Apr 25 2024, 01:16 PM Apr 25 2024, 01:16 PM

Show posts by this member only | IPv6 | Post

#69

|

Senior Member

1,759 posts Joined: Mar 2007 From: _|_ |

|

|

|

Apr 25 2024, 01:17 PM Apr 25 2024, 01:17 PM

|

Junior Member

42 posts Joined: Jun 2015 |

QUOTE(Lembu Goreng @ Apr 25 2024, 01:02 PM) QUOTE(poweredbydiscuz @ Apr 25 2024, 01:03 PM) QUOTE(yhtan @ Apr 25 2024, 01:09 PM) QUOTE(vez @ Apr 25 2024, 01:10 PM) IMO, if account 3 same dividend as account 1 and 2, what is the point of account 3 then?Just make it easier to withdraw from account 2 then (like you can withdraw x% from account 2 once a year etc) This post has been edited by askingquestion: Apr 25 2024, 01:20 PM |

|

|

Apr 25 2024, 01:18 PM Apr 25 2024, 01:18 PM

Show posts by this member only | IPv6 | Post

#71

|

Junior Member

323 posts Joined: May 2020 |

TLDR so far i read >account 3 start with 0 > during May 11 2024 and August 31 2024, member can transfer money from account 2 to account 3 , if they decide no transfer ,at 1 Sep 2024, your account 3 is starting with 0 >75:15:10 contribution, do your calculation >No impact on the EPF’s portfolio, dividend for Account 3 could differ in future >Withdrawal amount of RM50 from account 3 >>only age 55 below, after 55 age above, account 3 and account 2 will go into account 1 my opinion neh, make sure at 60 years old u get 800k 900k 1m in KWSP and leech of the dividend, it is susceptible all of us will live thru pass 60 until 100 or 90 not a good move, this is probably respond to ppl who withdraw money during covid-19 they doing this just to make sure ppl work until 100, no retirement like sg, hk , japan , korea , china , American i am expecting them to push the retirement age from 60 to 70 or 63 source : https://www.malaymail.com/news/malaysia/202...rst-year/130739 This post has been edited by nelson969: Apr 25 2024, 01:20 PM |

|

|

Apr 25 2024, 01:19 PM Apr 25 2024, 01:19 PM

Show posts by this member only | IPv6 | Post

#72

|

Senior Member

3,848 posts Joined: Dec 2009 From: Ampang |

Ok time to withdraw and but in AHB or Tabung Haji.. higher dividen without need for zakat deduction

|

|

|

Apr 25 2024, 01:19 PM Apr 25 2024, 01:19 PM

Show posts by this member only | IPv6 | Post

#73

|

Junior Member

435 posts Joined: Aug 2020 |

|

|

|

|

|

|

Apr 25 2024, 01:19 PM Apr 25 2024, 01:19 PM

|

Senior Member

1,924 posts Joined: Feb 2016 |

QUOTE(joe_star @ Apr 25 2024, 01:09 PM) Correct.Yes or No, that Acc 3 (if unwithdrawn/ untouched) dividen will the same as announced for Acc 1 & 2. This post has been edited by jojolicia: Apr 25 2024, 01:20 PM joe_star liked this post

|

|

|

Apr 25 2024, 01:20 PM Apr 25 2024, 01:20 PM

|

Junior Member

480 posts Joined: Sep 2004 |

QUOTE(Koranshita @ Apr 25 2024, 01:16 PM) If by default not doing anything mean 0% allocation to acc3 Correct? You do or not account 3 is fixed. 10% of the contribution will goes to account 3.Can only change once a year? Or once a lifetime? Between 11 May 2024 and 31 August 2024, members will have a one (1) time option to transfer part of the savings balance in their Akaun Sejahtera (previously Account 2) as an initial amount to Akaun Fleksibel. If the member does not choose to opt-in for an initial amount, no transfer will be made and the existing balance will remain in Akaun Sejahtera. Only will touch this if I have no way out. The account 2 transfer to account 3 is once a lifetime between 11 May 2024 and 31 August 2024. |

|

|

Apr 25 2024, 01:22 PM Apr 25 2024, 01:22 PM

Show posts by this member only | IPv6 | Post

#76

|

Senior Member

3,703 posts Joined: Oct 2005 |

QUOTE(contestchris @ Apr 25 2024, 12:34 PM) Use your logic, what will cause them to declare less dividend? Basically, giving you the carrot.... but also holding the stick.The Account 3 cannot be gamed. We can’t just pump in money for short term, and then withdraw. Cause, the apportionment is fixed at 75:15:10. Given that, I find it hard to understand why people expect lower dividend for Account 3. If anything, if EPF loses 5% of annual dividend declared each year (half of the 10% from Account 3), it would be a lower base and hence higher dividend the following year for those who did not withdraw. This is as long as the withdrawals do not cause liquidity issues, which I don’t think they will given EPF’s asset allocation to cash/money market which is sufficient to absorb this. Also don't forget, Account 1 allocation has increased from 70% to 75%. This money remains locked till retirement. |

|

|

Apr 25 2024, 01:23 PM Apr 25 2024, 01:23 PM

Show posts by this member only | IPv6 | Post

#77

|

Junior Member

325 posts Joined: Aug 2007 |

|

|

|

Apr 25 2024, 01:23 PM Apr 25 2024, 01:23 PM

|

Senior Member

3,839 posts Joined: Oct 2011 |

QUOTE(askingquestion @ Apr 25 2024, 01:17 PM) IMO, if account 3 same dividend as account 1 and 2, what is the point of account 3 then? By your logic, what's the point of account 2 if it has same dividend as account 1? Just make it 30% of account 1 allowed to be withdraw for certain conditions.Just make it easier to withdraw from account 2 then (like you can withdraw x% from account 2 once a year etc) |

|

|

Apr 25 2024, 01:25 PM Apr 25 2024, 01:25 PM

Show posts by this member only | IPv6 | Post

#79

|

Senior Member

3,703 posts Joined: Oct 2005 |

QUOTE(jojolicia @ Apr 25 2024, 12:37 PM) How to opt out for account 3 from May 2024 distribution onwards all together? I think not. Basically all contributors below 55 are "assigned" 3 accounts from May onwards. Only difference is that you can withdraw 10%, but as a "penalty" a 5% .... "retainer fee" goes to Akaun 1 - which you can only withdraw after 55.Is there an opt out option? |

|

|

Apr 25 2024, 01:27 PM Apr 25 2024, 01:27 PM

|

All Stars

13,681 posts Joined: Mar 2006 |

the dividend across 3 accounts same or not? of acc3 will lesser?

|

| Change to: |  0.0182sec 0.0182sec

0.56 0.56

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 21st December 2025 - 02:27 PM |