QUOTE(contestchris @ Apr 25 2024, 12:34 PM)

Use your logic, what will cause them to declare less dividend?

The Account 3 cannot be gamed. We can’t just pump in money for short term, and then withdraw. Cause, the apportionment is fixed at 75:15:10.

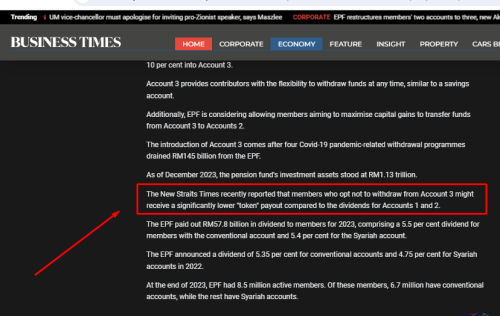

Given that, I find it hard to understand why people expect lower dividend for Account 3.

If anything, if EPF loses 5% of annual dividend declared each year (half of the 10% from Account 3), it would be a lower base and hence higher dividend the following year for those who did not withdraw. This is as long as the withdrawals do not cause liquidity issues, which I don’t think they will given EPF’s asset allocation to cash/money market which is sufficient to absorb this.

Also don't forget, Account 1 allocation has increased from 70% to 75%. This money remains locked till retirement.

Basically, giving you the carrot.... but also holding the stick.The Account 3 cannot be gamed. We can’t just pump in money for short term, and then withdraw. Cause, the apportionment is fixed at 75:15:10.

Given that, I find it hard to understand why people expect lower dividend for Account 3.

If anything, if EPF loses 5% of annual dividend declared each year (half of the 10% from Account 3), it would be a lower base and hence higher dividend the following year for those who did not withdraw. This is as long as the withdrawals do not cause liquidity issues, which I don’t think they will given EPF’s asset allocation to cash/money market which is sufficient to absorb this.

Also don't forget, Account 1 allocation has increased from 70% to 75%. This money remains locked till retirement.

Apr 25 2024, 01:22 PM

Apr 25 2024, 01:22 PM

Quote

Quote

0.0181sec

0.0181sec

0.85

0.85

6 queries

6 queries

GZIP Disabled

GZIP Disabled