QUOTE(budaken @ Apr 26 2024, 09:29 AM)

so means let's say i have 10k in 2nd account, how much really can i draw to my upcoming 3rd account?

As someone said before, max amount is 3.3k if your acc 2 have 10k now.

Explanation:

Any amount more than 3k: 1/3 goes Acc3, 1/6 goes Acc1, 1/2 remain acc2.

So if you have 10k in Acc2, you can opt in for 10k. But only 3.3k will go into Acc3. 1.67k will go into Acc1. 5k remain in Acc2.

Above is max amount. You can opt in lower than 10k. 5k eg is acceptable. Then divide all the amount above by half.

QUOTE(Kr0ll3R @ Apr 26 2024, 04:04 PM)

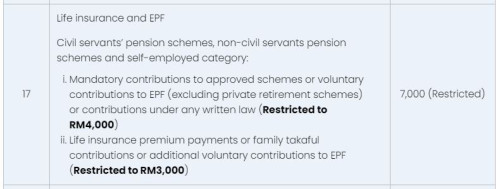

Is it safe to say that at the end of the year, I transfer all my account 3 balance to account 1/2, this consider as voluntary contribution for the tax relief, right?

Doesn’t work that way. You need to physically take that amount out of Acc3 to ur bank acc. Use I-Akaun to deposit 3k back into EPF self contribution. And your acc3 will have rm300 more after that

Apr 26 2024, 04:04 PM

Apr 26 2024, 04:04 PM

Quote

Quote

0.0129sec

0.0129sec

1.03

1.03

5 queries

5 queries

GZIP Disabled

GZIP Disabled