House loan also scared. Why need to scared, no money can sell get some profit, can rent. Unless you buy very bad property, than die lo.

Housing loan is scary

Housing loan is scary

|

|

Oct 10 2023, 04:37 PM Oct 10 2023, 04:37 PM

|

Junior Member

198 posts Joined: Jan 2022 |

House loan also scared. Why need to scared, no money can sell get some profit, can rent. Unless you buy very bad property, than die lo.

|

|

|

|

|

|

Oct 10 2023, 04:37 PM Oct 10 2023, 04:37 PM

|

Senior Member

1,720 posts Joined: Feb 2006 |

|

|

|

Oct 10 2023, 04:40 PM Oct 10 2023, 04:40 PM

|

Senior Member

1,773 posts Joined: Dec 2013 |

|

|

|

Oct 10 2023, 04:40 PM Oct 10 2023, 04:40 PM

|

Junior Member

438 posts Joined: Oct 2009 |

QUOTE(metaled @ Oct 10 2023, 04:09 PM) unker always advise younger kolik upon their asking, stop focusing on how much you want to spend on renovate your house nicer, instead focus how to cut down on unnecessary renovation and increase your down payment or how to grow income with those. why not, i do plan to reno house kaw2.. at least when came back home.. rumah nampak cantik, suci murni. All those young kids rileks je spending more then 100k cash on this sort of things. In the end, you a grown adult, your own money, no need other people to tell you how to spend them. |

|

|

Oct 10 2023, 04:43 PM Oct 10 2023, 04:43 PM

Show posts by this member only | IPv6 | Post

#245

|

Junior Member

359 posts Joined: Jan 2015 |

|

|

|

Oct 10 2023, 04:46 PM Oct 10 2023, 04:46 PM

Show posts by this member only | IPv6 | Post

#246

|

Junior Member

359 posts Joined: Jan 2015 |

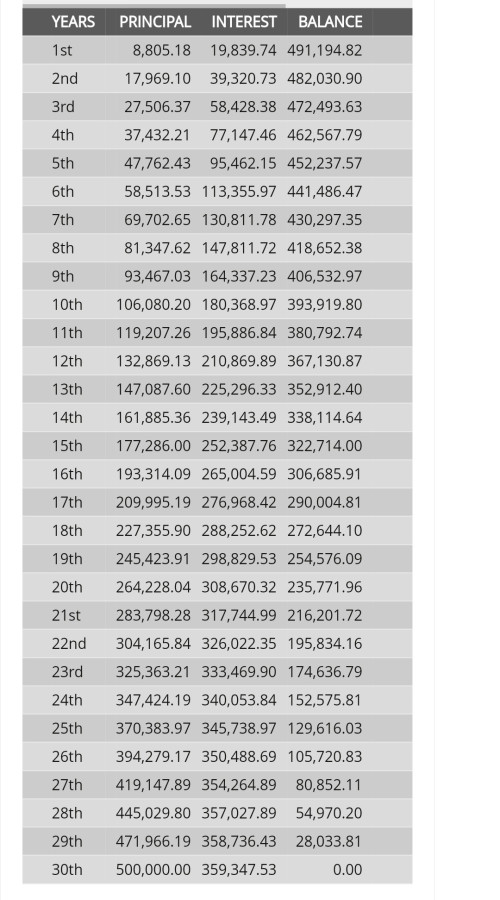

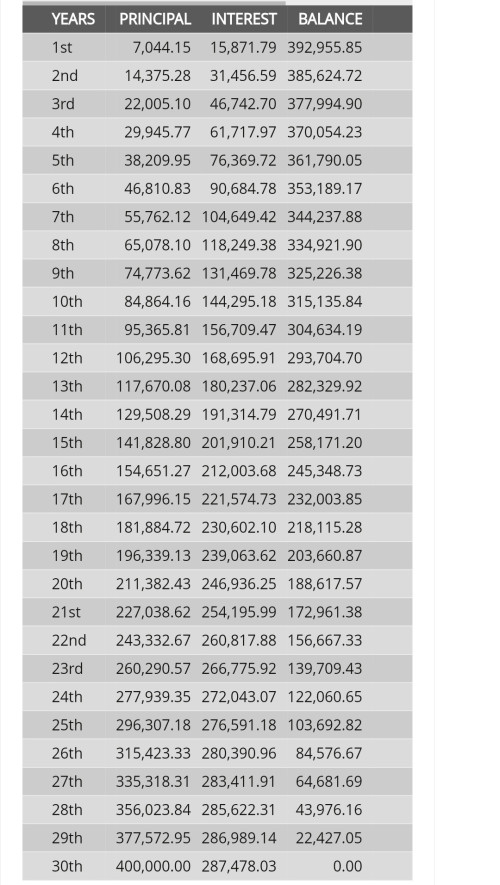

QUOTE(poweredbydiscuz @ Oct 10 2023, 04:36 PM) simple math la come on. use house loan calculator/compounding calculator to count and u will see the numbers.as long as interest u can earn > house loan interest then u are safe to keep there. 500k  400k  and for 100k that u put in epf with 5.5% u will get 4.96x 100k after 30 years This post has been edited by darkterror15: Oct 10 2023, 04:49 PM |

|

|

|

|

|

Oct 10 2023, 04:46 PM Oct 10 2023, 04:46 PM

Show posts by this member only | IPv6 | Post

#247

|

Senior Member

9,206 posts Joined: Jun 2006 |

QUOTE(froggyx @ Oct 10 2023, 09:48 AM) Thats why unker buy 4 acres of land with pertanian status.........when cheap only cost 360k.....build house with 5 rooms 20X25 02 halls 30X25..02 parking garage....3 porch..... How far from klang valley ? Untung if near those major highway or kl /pjall without the hassle of approval from local counsil because of the status of the land..........and best of all it only cost me 160k..... |

|

|

Oct 10 2023, 04:48 PM Oct 10 2023, 04:48 PM

|

Junior Member

196 posts Joined: Jan 2003 |

After 6 years now act scared? Surprised?

Before taking loan, never calculate properly meh? Silap sendiri.... |

|

|

Oct 10 2023, 05:00 PM Oct 10 2023, 05:00 PM

|

Senior Member

3,834 posts Joined: Oct 2011 |

QUOTE(darkterror15 @ Oct 10 2023, 04:46 PM) simple math la come on. use house loan calculator/compounding calculator to count and u will see the numbers. I agree keep in epf is better, but not as much as shown in your calculation. as long as interest u can earn > house loan interest then u are safe to keep there. 500k » Click to show Spoiler - click again to hide... « 400k » Click to show Spoiler - click again to hide... « and for 100k that u put in epf with 5.5% u will get 4.96x 100k after 30 years You see, 500k/30y you pay monthly RM2387.08, but 400k/30y you only pay RM1909.66. Difference is RM477.42/month. If you put RM477.42/month into epf, you will have RM414,620.68. Plus the RM72k, you will get RM486,620.68. Just RM11k less only. kidmad liked this post

|

|

|

Oct 10 2023, 05:02 PM Oct 10 2023, 05:02 PM

Show posts by this member only | IPv6 | Post

#250

|

Junior Member

83 posts Joined: Jul 2006 |

you need to check with the bank the formula, different bank has different formula, some even you pay more monthly, it is not going help much, it just help to save interest only but the principal still remain the same, thats why you see the principal deduction is little even after years

|

|

|

Oct 10 2023, 05:08 PM Oct 10 2023, 05:08 PM

Show posts by this member only | IPv6 | Post

#251

|

Junior Member

359 posts Joined: Jan 2015 |

QUOTE(poweredbydiscuz @ Oct 10 2023, 05:00 PM) I agree keep in epf is better, but not as much as shown in your calculation. ok, my bad. forgot to count the difference in monthly loan if it were put into epf as well.You see, 500k/30y you pay monthly RM2387.08, but 400k/30y you only pay RM1909.66. Difference is RM477.42/month. If you put RM477.42/month into epf, you will have RM414,620.68. Plus the RM72k, you will get RM486,620.68. Just RM11k less only. |

|

|

Oct 10 2023, 05:11 PM Oct 10 2023, 05:11 PM

|

Senior Member

4,954 posts Joined: Jul 2010 |

QUOTE(darkterror15 @ Oct 10 2023, 04:15 PM) lets say u borrow 500k for 30 year 4%, at the end u have to pay 359k interest on top of the 500k. Borrow 400k, va 500k. You pay less monthly installments for 400k loan. but if u pay 100k downpayment and borrow 400k for 30 years at 4%, at the end u have to pay 287k interest on top of 500k. difference is u save rm 72k on interest but, if u take that 100k and dump into epf lets say 5.5% for 30 years, u will have 498k after 30 years. minus the 72k due to house loan interest difference, u still have 426k extra. so for me, is really no brainer la, i sure whack highest loan tenure as possible and save the money elsewhere with higher return than house loan. but will get in trouble if use it to leverage and borrow more to goreng house. once opr hike more than epf rate then gg You forgot to add the interest you will gain if you invest this installment difference every month by putting inside epf. |

|

|

Oct 10 2023, 05:21 PM Oct 10 2023, 05:21 PM

|

Junior Member

94 posts Joined: Sep 2020 |

how to pay principal if u have flexi loan account

i use cimb online the cibai sotong dun let me pay, macam need to raise instructions over the counter |

|

|

|

|

|

Oct 10 2023, 05:22 PM Oct 10 2023, 05:22 PM

Show posts by this member only | IPv6 | Post

#254

|

Junior Member

359 posts Joined: Jan 2015 |

QUOTE(mushigen @ Oct 10 2023, 05:11 PM) Borrow 400k, va 500k. You pay less monthly installments for 400k loan. yup, forgot to add in the saving per month if borrow less.You forgot to add the interest you will gain if you invest this installment difference every month by putting inside epf. but anyway, now most of the house loan are semi flexy or even full flexy. you can pay extra if u have more money and no place to put. |

|

|

Oct 10 2023, 05:23 PM Oct 10 2023, 05:23 PM

|

Junior Member

80 posts Joined: Mar 2011 |

Buy land, pay cash. Build a hut, then upgrade to tiny house. Then build your real house for few years on your own. No need to take loan this way.

|

|

|

Oct 10 2023, 05:24 PM Oct 10 2023, 05:24 PM

Show posts by this member only | IPv6 | Post

#256

|

Junior Member

359 posts Joined: Jan 2015 |

|

|

|

Oct 10 2023, 05:24 PM Oct 10 2023, 05:24 PM

|

Senior Member

4,954 posts Joined: Jul 2010 |

|

|

|

Oct 10 2023, 05:30 PM Oct 10 2023, 05:30 PM

Show posts by this member only | IPv6 | Post

#258

|

Junior Member

462 posts Joined: Jan 2011 |

own nothing n be happy xiaojohn liked this post

|

|

|

Oct 10 2023, 05:34 PM Oct 10 2023, 05:34 PM

Show posts by this member only | IPv6 | Post

#259

|

Junior Member

229 posts Joined: Feb 2022 |

|

|

|

Oct 10 2023, 05:35 PM Oct 10 2023, 05:35 PM

Show posts by this member only | IPv6 | Post

#260

|

Junior Member

229 posts Joined: Feb 2022 |

|

| Change to: |  0.0217sec 0.0217sec

0.31 0.31

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 06:25 AM |