QUOTE(Wolves @ Aug 4 2022, 11:14 AM)

Thread looks quiet so i bump by asking a qs. Does the switch/buy-sell incur any charges or its free? Do they sell/switch back to RM then buy/switch back to USD when buy when they do that (as in we incur exchange rate difference)? If none, then is there any other charges for putting in invest besides the annual fee (3k free, then 0.3 to 0.7% per annum depending on the sum invested) ETF shouldn't have any fees right? So is the management fee (0.3% to 0.7% per annum) worth it since we using AI to help us 24/7? What's your view on that as compare to DIY. DIY might be cheaper but you cannot monitor 24/7 and technically won't be able to react fast enough. Has the AI proven it is very good at switching fast enough to protect capital?

Edit: oh, what about the issue with US tax system and witholding tax? Is this qs too early to ask? 😂 Stashaway help us claim the tax after one year. Will kdi do the same?

all robo advisors will use US etf, hence by default all dividends are charged 30% tax. The amount you receive is after tax.

no estate tax if we use robo advisors since the companies like Stashaway are the custodian.. they using their account to buy ETFs on behalf of us. Also if you read the page on Stashaway your investments is safe even if they go bankrupt:

https://www.stashaway.my/help-center/360009...s-my-money-keptKDI also same, under Saxo:

https://digitalinvesting.com.my/faq/ (read under Security and Protection section> "What happens to my investments if Kenanga Digital Investing (KDI) closes down, gets acquired/goes public?")

If you self invest in US stocks or ETFs, estate tax only applies if you have USD60k and above in brokers like IBKR. Some people workaround this by sharing their login and passwords with their loved ones (as long you don't get caught).

If wanna self invest and avoid estate tax, then invest into Irish Domiciled ETFs e.g. VWRA, VUAA, CSPX, etc (these are similar to US etfs but are for European or non US people to invest in - they will have the word "UCITS" in their ETF name). They also charge lower dividend tax at 15%. Why robo advisors don't invest in them? Their excuse is liquidity. I am guessing it's due to higher fees involve when buying them too.

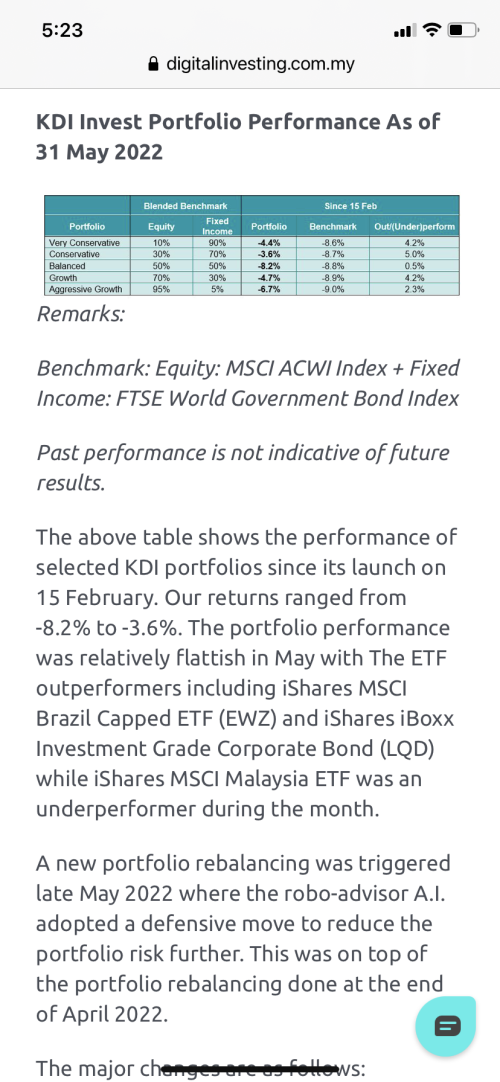

whether KDI will help us claim back withholding tax you can send a chat inquiry to KDI via their site.. I think got people here ask before. But so far from most people who use Invest the performance is better than Stashaway.

Yes 0.3 to 0.7% is their management fees depending on the amount you invest in KDI Invest. All robo advisors got this fee. You can try below RM3k if wanna avoid this fee.

If hate this fee, I suggest self invest using IBKR.. but using that you'll need to pay Wise transfer fee also.. And also currency conversion fees. However they are 1 off. Also need to learn more on how to do them. You can check Ziet Invest youtube video on how to open SG CIMB account, using Wise transfer to IBKR.. all in his videos.

This post has been edited by Davidtcf: Aug 5 2022, 11:04 AM

Jul 5 2022, 12:31 AM

Jul 5 2022, 12:31 AM

Quote

Quote

0.0292sec

0.0292sec

0.96

0.96

7 queries

7 queries

GZIP Disabled

GZIP Disabled