QUOTE(Medufsaid @ Aug 22 2022, 09:11 AM)

US could drop further this week, after Fed say they not done with raising interest rates yet. Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

|

|

Aug 22 2022, 10:09 AM Aug 22 2022, 10:09 AM

Return to original view | Post

#141

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

|

|

|

|

|

Aug 22 2022, 10:27 AM Aug 22 2022, 10:27 AM

Return to original view | Post

#142

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

|

|

Sep 2 2022, 04:08 PM Sep 2 2022, 04:08 PM

Return to original view | Post

#143

|

Senior Member

3,520 posts Joined: Jan 2003 |

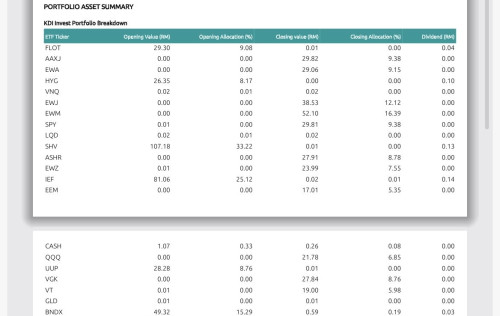

QUOTE(jutamind @ Sep 2 2022, 11:09 AM) this morning got apps notification on Aug statement release but now seems like not available anymore. I went to app to download statement, at My Account > StatementThis month KDI Invest started adding QQQ and SPY for aggressive portfolio. They buying at the bottom. Good.  Ramjade liked this post

|

|

|

Sep 2 2022, 11:23 PM Sep 2 2022, 11:23 PM

Return to original view | IPv6 | Post

#144

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Medufsaid @ Sep 2 2022, 07:23 PM) i don't think KDI Invest is transparent with how they time the market. so better you ask yourself if you want to take the leap of faith or not. if market is bad they'll help you time the market anyway Yes this. They buy and sell quite often depending on market conditions. Last month majority of my holdings were bonds. Would suggest aggressive growth, as last time when using conservative I see my returns decline. This post has been edited by Davidtcf: Sep 2 2022, 11:25 PM |

|

|

Sep 14 2022, 02:46 PM Sep 14 2022, 02:46 PM

Return to original view | Post

#145

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(lim47 @ Sep 14 2022, 06:51 AM) I switch to aggressive growth and try 1 month, rugi 80%keep going down.i cut lost , switch conservative now untung 20%😁 mine still green but ya paper profits dropped a bit. The robot no switch fund ? 🤔 now suddenly bear market la.. maybe the robo fail to respond in time, fall too fast wei. Yesterday the moment CPI report stated that figure, terus many people sell off like mad. If you human wanna sell also gonna be hard. if invest in long term then chill, up and downs are normal. January to April this year was when stock prices fall a lot, as of now should not repeat it again since stock prices already at bottom + factored in rising interest rates. CommodoreAmiga and lim47 liked this post

|

|

|

Sep 15 2022, 12:16 PM Sep 15 2022, 12:16 PM

Return to original view | IPv6 | Post

#146

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(CommodoreAmiga @ Sep 14 2022, 06:28 PM) recommend small amounts ya.. safer to DCA than big lump sum.. example DCA few hundred this month, next month DCA few hundred again, and so forth. If got more money to invest then can increase the numbers. Now uncertain times in the stock market.. |

|

|

|

|

|

Sep 15 2022, 02:07 PM Sep 15 2022, 02:07 PM

Return to original view | IPv6 | Post

#147

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

|

|

Sep 20 2022, 04:17 PM Sep 20 2022, 04:17 PM

Return to original view | Post

#148

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(skyvisionz @ Sep 18 2022, 01:13 PM) I'm facing some paper losses for many of the SG REITs I owned.. but not much around few % since they are REITs.but for beginner you can try Mappletree REITS.. they have a few type. So far these are giving me the best returns out of my list. Ascendas REIT also quite steady. before buying them please do your own research. Better to DCA than buy them lump sum (esp in this volatile times), in case if their prices drop later. stay away from Keppel DC Reit until their quarterly results improve. This post has been edited by Davidtcf: Sep 20 2022, 04:19 PM skyvisionz liked this post

|

|

|

Oct 3 2022, 01:56 PM Oct 3 2022, 01:56 PM

Return to original view | Post

#149

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

|

|

Oct 3 2022, 07:05 PM Oct 3 2022, 07:05 PM

Return to original view | IPv6 | Post

#150

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

|

|

Oct 3 2022, 07:10 PM Oct 3 2022, 07:10 PM

Return to original view | IPv6 | Post

#151

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(guy3288 @ Oct 3 2022, 06:13 PM) good the higher the better but Ok la still higher than Versa which gives 3.2%that 3.5% was abit of an exaggeration. Yes marketing gimmick. are you sure is 3.5%? i checked min only 3.44% , 1day interest RM4.26 If really 3.5%, it should be RM4.33 i checked other 4 accs all same 3.44% no such thing as 3.5% KDI Save so far still the highest for this product. guy3288 liked this post

|

|

|

Oct 17 2022, 09:19 AM Oct 17 2022, 09:19 AM

Return to original view | Post

#152

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(TOS @ Oct 14 2022, 08:58 PM) That's a very misleading statement. Lehman Brother's MMF broke the buck before the firm itself went broke, for instance. if any bad news break out for Kenanga investment bank.. then best withdraw to others first. Of course that was institutional risk. For MMF that hold short-term corporate credit products like commercial papers, short-term loans etc. there is corporare risk if the liqudiity of the companies are not strong enough. And even before the papers mature their market value may have dropped significantly due to adverse conditions, in which case the MMF will suffer significant capital loss. These days to "enchance yield", MMFs have already shifted to the riskier end of product offerrings. Make sure you read the prospectus and product highligh sheets to carefully inspect what kind of instruments (and their maturities) the fund is allowed to invest into before dealing any further. Low risk != no risk Too often people underestimate risk metrics... So far don't have such news.. if scare of risk then don't use. Stick to FD at banks. right now ongoing issue with Credit Suisse, multiple bad news out also they haven't bankrupt yet. Usually there are signs and warnings before they crash. Also Kenanga is a public listed.. every detail of their accounts they need to declare. This post has been edited by Davidtcf: Oct 17 2022, 09:20 AM TOS liked this post

|

|

|

Oct 18 2022, 04:53 PM Oct 18 2022, 04:53 PM

Return to original view | Post

#153

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(download88 @ Oct 18 2022, 02:12 PM) next year could happen if inflation in US doesn't tame down. Stock market everywhere will keep tank as a result if no improvement also.there's a possibility to see 4.5 - 5% interest earned via MMF or FD also. Let's hope we won't go there. This post has been edited by Davidtcf: Oct 18 2022, 04:54 PM lovelyuser liked this post

|

|

|

|

|

|

Oct 19 2022, 02:25 PM Oct 19 2022, 02:25 PM

Return to original view | IPv6 | Post

#154

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(guy3288 @ Oct 19 2022, 01:53 PM) Versa only first RM30k can earn 4%.KDI save first RM50k can earn 3.5% https://versa.com.my/versa-cash-3-2-net-ret...rate-promotion/ Best to split out between the two if u have large funds. Remaining funds allocate to which is higher. QUOTE(Ramjade @ Oct 19 2022, 02:05 PM) 1st November start bro. Continue use KDI Save first 😄This post has been edited by Davidtcf: Oct 19 2022, 02:26 PM |

|

|

Oct 20 2022, 10:50 AM Oct 20 2022, 10:50 AM

Return to original view | Post

#155

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(TOS @ Oct 19 2022, 10:47 PM) Burn cash to capture market share, competitor driven out, then slaughter your customer! why so negative towards Kenanga.. Embrace, Extend, Extinguish! read their history here, if they really wanna slaughter customers earlier would have done it: https://www.kenanga.com.my/who-we-are/our-history/ check 4.3 Balance Sheet: https://simplywall.st/stocks/my/diversified...d-shares/health |

|

|

Oct 20 2022, 11:01 AM Oct 20 2022, 11:01 AM

Return to original view | Post

#156

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(TOS @ Oct 20 2022, 10:58 AM) By the way, Kenanga is good, nothing wrong. I am just commenting on the heated competition between them and Affin Hwang for robbing market share for MMF products. I also wonder how SC approves the marketing of such products without requiring Kenanga to disclose the underlying fund's documents. At least versa told you the underlying (Enhanced Deposit) fund and you know its holding details, volatility etc. Things can be quantified a lot there. yea will be more transparent if KDI has a detailed PDF on their website for their KDI Save product. TOS liked this post

|

|

|

Oct 27 2022, 03:22 PM Oct 27 2022, 03:22 PM

Return to original view | Post

#157

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(cybpsych @ Oct 25 2022, 09:55 PM) i dont like FD as there is no quick withdrawal method. Money lock there for x amount of time can't touch.. withdraw out before due will burn all the interests. What happens if you really need the money later? Can you foresee the future? KDI Save and Versa is for me. Really need money then withdraw out, wait next day money ready in bank account to use. If got credit card option then pay with credit card or TNG first.. nowadays use less cash as possible. Live with credit as long pay back on time. Imma risk taker put all my emergency savings with either that is offering higher. Don't follow me if no dare. If really shit happens then time to beg from parents or liquidate my stocks. And will anti that company forever or even go protest at their building.. lol. This post has been edited by Davidtcf: Oct 27 2022, 03:34 PM edwinlim liked this post

|

|

|

Oct 28 2022, 10:20 AM Oct 28 2022, 10:20 AM

Return to original view | Post

#158

|

Senior Member

3,520 posts Joined: Jan 2003 |

anyone switching over to Versa on 1st November? Just found out Versa has 0.3% management fee + 0.05% trustee fee per annum. Meaning 4% Versa interest - 0.35 = 3.65%. Just 0.15% higher than KDI Save. KDI Save doesn't have any of these fees. Also Versa pays out interest monthly rather than daily which KDI Save does.

Yet KDI Save has faster withdrawal speeds (small difference tho) Source: https://versa.com.my/#:~:text=The%20Versa%2...20trustee%20fee. "For Versa Cash, there are 0.30% per annum management fees and 0.05% per annum trustee fee." This post has been edited by Davidtcf: Oct 28 2022, 10:22 AM |

|

|

Oct 28 2022, 10:25 AM Oct 28 2022, 10:25 AM

Return to original view | Post

#159

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(chenfany @ Oct 27 2022, 11:55 PM) play around with it, start with RM10 till you are familiar before putting more. It is quite straightforward. Just remember to put into KDI Save and not KDI Invest. KDI save is the one giving 3.5% interest like a FD. then test out their withdrawal also to know how it works. This post has been edited by Davidtcf: Oct 28 2022, 10:25 AM |

|

|

Oct 28 2022, 10:43 AM Oct 28 2022, 10:43 AM

Return to original view | Post

#160

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(cybpsych @ Oct 28 2022, 10:37 AM) just their disclosure ic okok.. my bad then.. yea at their site stated "net" also: https://versa.com.my/versa-cash-3-2-net-ret...rate-promotion/what we are getting 3.2% or 4% is nett returns = after deducted the Management fee of 0.3% & Trustee fee of 0.05% means really 4% is ours to keep. don't need to think then.. straight switch to Versa on 1st November cybpsych liked this post

|

| Change to: |  0.1045sec 0.1045sec

0.72 0.72

8 queries 8 queries

GZIP Disabled GZIP Disabled

Time is now: 18th December 2025 - 08:24 PM |