QUOTE(ryan18 @ Dec 16 2021, 12:06 AM)

You cannot hide AEOI applies to all financial institutions including broker firms.I need to fill in the AEOI form from my Australian and SGX broker

What is AEOI form?tax for oversea trading /dividend, its become more complicated

|

|

Dec 16 2021, 12:18 AM Dec 16 2021, 12:18 AM

|

Senior Member

4,174 posts Joined: Dec 2008 |

|

|

|

|

|

|

Dec 16 2021, 12:33 AM Dec 16 2021, 12:33 AM

Show posts by this member only | IPv6 | Post

#142

|

Senior Member

2,106 posts Joined: Jul 2018 |

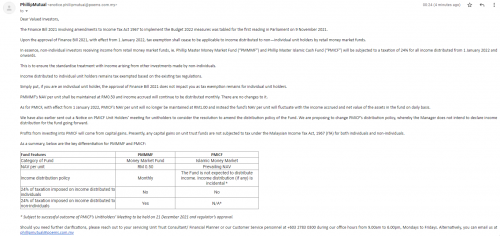

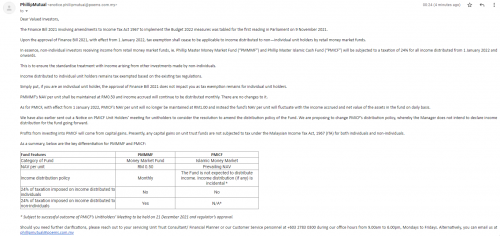

Received this mail from phillipmutual, for our gauge on the impact of proposed Finance Bill 2021 to Investors investing in their Money Market Fund (MMF)

DESCLAIMER: I do not know if the rule explained in the mail applied to other/all MMF or any other fund type beside MMF » Click to show Spoiler - click again to hide... «  |

|

|

Dec 16 2021, 01:42 AM Dec 16 2021, 01:42 AM

Show posts by this member only | IPv6 | Post

#143

|

All Stars

24,432 posts Joined: Feb 2011 |

QUOTE(TOS @ Dec 15 2021, 10:40 PM) Even if put money in overseas, AEOI will ensure exchange of bank accounts information. So if they can know your foreign assets, there is no reason they can't know your own onshore assets. You cannot hide if you are normal person. Why? All brokerage will ask for TIN. By asking for TIN that's your automatic tax exchange.Anyway, I will put less money in Malaysia, privacy reasons plus lack of investible assets. Hansel Can I hide my money in shares/brokerage accounts? I know they can check your money in foreign banks, but what if I hide them in my shares/bonds? Does the AEOI apply to brokers? Well unless you have private banking, able to do stuff like Jho Low then yes you can hide your money TOS liked this post

|

|

|

Dec 16 2021, 07:49 AM Dec 16 2021, 07:49 AM

Show posts by this member only | IPv6 | Post

#144

|

Senior Member

2,406 posts Joined: Jul 2010 From: bandar Sunway |

QUOTE(elea88 @ Dec 16 2021, 12:18 AM) Sorry it should be FATCA self certification of tax residency status https://www.dbs.com.sg/personal/deposits/ba...orting-standard |

|

|

Dec 16 2021, 08:55 AM Dec 16 2021, 08:55 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Thanks everyone. Got your points.

|

|

|

Dec 16 2021, 09:12 AM Dec 16 2021, 09:12 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE 15. Is income derived from outside Malaysia taxable? In general, income from employment should be taxable in the country where the services are performed regardless of the place where the contract is signed or where the remuneration is paid. However, from the Year of Assessment 2004, income received in Malaysia from outside Malaysia is tax exempt. Therefore, any income received by resident or non-resident taxpayers in Malaysia are taxable (Paragraph 28 (1), Schedule 6 of the Income Tax Act 1967). If you have worked abroad and the work carried out is related to the employment carried out in Malaysia, thus the employment income received will be taxable in Malaysia. Kindly log on to IRBM Official Portal, https://www.hasil.gov.my >> Legislation >> Public Ruling >> No.1/2011 – Taxation of Malaysian Employees Seconded Overseas for further information. https://www.hasil.gov.my/bt_goindex.php?bt_...=5000&bt_sequ=1 This page is updated on Dec. 13. Can't remember if this is a new addition. This is the public ruling paper: https://phl.hasil.gov.my/pdf/pdfam/PR1_2011.pdf |

|

|

|

|

|

Dec 16 2021, 09:41 AM Dec 16 2021, 09:41 AM

Show posts by this member only | IPv6 | Post

#147

|

Senior Member

3,520 posts Joined: Jan 2003 |

Confirm liao LHDN can check our bank accounts. And we won’t be informed about it:

https://www.thestar.com.my/news/nation/2021...=smartech#close Starting year 2022. |

|

|

Dec 16 2021, 09:46 AM Dec 16 2021, 09:46 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(tadashi987 @ Dec 16 2021, 12:33 AM) Received this mail from phillipmutual, for our gauge on the impact of proposed Finance Bill 2021 to Investors investing in their Money Market Fund (MMF) They didn't say anything on foreign dividends/interests for mutual funds/UTs that hold foreign shares/bonds?DESCLAIMER: I do not know if the rule explained in the mail applied to other/all MMF or any other fund type beside MMF » Click to show Spoiler - click again to hide... «  |

|

|

Dec 16 2021, 10:00 AM Dec 16 2021, 10:00 AM

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(TOS @ Dec 16 2021, 09:46 AM) They didn't say anything on foreign dividends/interests for mutual funds/UTs that hold foreign shares/bonds? nope they didn't, guess the details are still in speculations TOS liked this post

|

|

|

Dec 16 2021, 11:14 AM Dec 16 2021, 11:14 AM

|

Junior Member

489 posts Joined: Jun 2009 |

dont 4gt Finance Minister has power to give exemption

cant wait for black & white doc, what a very super last min works.... sigh |

|

|

Dec 16 2021, 02:49 PM Dec 16 2021, 02:49 PM

|

Senior Member

9,363 posts Joined: Aug 2010 |

Bros,... only individuals deemed to be able to pay higher taxes but NOT DOING SO will be pursued, there is no time to go after everybody ! So,... how do they decide who these individuals are ? You'll have to think like this. TOS liked this post

|

|

|

Dec 16 2021, 04:56 PM Dec 16 2021, 04:56 PM

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Hansel @ Dec 16 2021, 02:49 PM) Bros,... only individuals deemed to be able to pay higher taxes but NOT DOING SO will be pursued, there is no time to go after everybody ! So,... how do they decide who these individuals are ? You'll have to think like this. if they really impose this.. i bet u many won't declare.. wait LHDN come after us haha if scare detection people might withdraw bit by bit. LHDN got time then come hunt us la. bring back money to spend in malaysia pay your SST and whatever tax still not enough? wanna make us poorer. If only your local bursa performing well 99% of us will invest locally instead! go make sure our local politicians not abusing money, rasuah all.. big fishes don't catch wanna make rakyat life miserable! This post has been edited by Davidtcf: Dec 16 2021, 04:58 PM Hansel liked this post

|

|

|

Dec 16 2021, 09:27 PM Dec 16 2021, 09:27 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Davidtcf @ Dec 16 2021, 09:41 AM) Confirm liao LHDN can check our bank accounts. And we won’t be informed about it: https://www.theedgemarkets.com/article/dont...%80%94-deloittehttps://www.thestar.com.my/news/nation/2021...=smartech#close Starting year 2022. They need "court order". If you can be informed of the "court order", I wonder why they need to amend the legislation, since asking the bank for details and asking court to approve via garnishee will still result in informing the person (owner of bank account). |

|

|

|

|

|

Dec 16 2021, 09:48 PM Dec 16 2021, 09:48 PM

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(TOS @ Dec 16 2021, 09:27 PM) https://www.theedgemarkets.com/article/dont...%80%94-deloitte a garnishee order.... and ability to freely look and analyze your banking data are 2 different thingsThey need "court order". If you can be informed of the "court order", I wonder why they need to amend the legislation, since asking the bank for details and asking court to approve via garnishee will still result in informing the person (owner of bank account). actually I prefer that they can get access to it themselves... so I don't have to request and pay the banks to print prior years' statements... lol This post has been edited by dwRK: Dec 16 2021, 09:48 PM TOS liked this post

|

|

|

Dec 16 2021, 10:30 PM Dec 16 2021, 10:30 PM

|

Junior Member

501 posts Joined: Apr 2020 |

|

|

|

Dec 16 2021, 11:50 PM Dec 16 2021, 11:50 PM

Show posts by this member only | IPv6 | Post

#156

|

All Stars

24,432 posts Joined: Feb 2011 |

|

|

|

Dec 20 2021, 03:44 PM Dec 20 2021, 03:44 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Dec 21 2021, 09:29 AM Dec 21 2021, 09:29 AM

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(TOS @ Dec 20 2021, 03:44 PM) QUOTE “This question of [tax treatment on] foreign funds [concerning FSIE] then came about. And it is also unclear. FIMM said it is talking to the SC (Securities Commission Malaysia) on the implementation. As details of the implementation are absent, industry players are drawing their own conclusions.” The government did not engage players in the asset management industry before announcing the FSIE withdrawal, says Lim. “From what we know, there was no prior engagement with the asset management industry to gather views and feedback on this matter. It would be helpful if asset managers are given more time to reposition their portfolios in anticipation of tax changes.” Tax matters can be complicated, especially when it involves funds that invest in overseas markets, says Chew. “For instance, a foreign fund can have 30 stocks in its portfolio. How will this be done if each stock distributes dividends, and we have to provide the IRB with all the necessary documents [to claim for double tax relief]? “Assuming this is the case, we would need to set up a system to track these distributions. What if some of these stocks distribute dividends three to four times a year? It is a lot of administrative work.” This post has been edited by tadashi987: Dec 21 2021, 09:30 AM |

|

|

Dec 21 2021, 12:39 PM Dec 21 2021, 12:39 PM

Show posts by this member only | IPv6 | Post

#159

|

All Stars

24,432 posts Joined: Feb 2011 |

|

|

|

Dec 21 2021, 02:52 PM Dec 21 2021, 02:52 PM

|

Senior Member

9,363 posts Joined: Aug 2010 |

QUOTE(Ramjade @ Dec 21 2021, 12:39 PM) That's why up to us to keep record. If we don't keep record, lhdn very easy job. No evidence means never declare properly. Kena tax plus penalty. You are talking as an individual,... you are missing the point. Read the article again,... are they talking abt an individual ? |

| Change to: |  0.0323sec 0.0323sec

1.29 1.29

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 23rd December 2025 - 11:37 PM |