QUOTE(TOS @ Oct 31 2021, 10:29 PM)

https://www.sinchew.com.my/20211030/%e7%99%...b5%b7%e5%a4%96/

So, tax experts say no need to worry about double taxation as those who are already taxed overseas can enjoy tax relief, and as long as the money does not flow into Malaysia then you don't need to declare tax. Just keep it in your offshore bank accounts.

That means I can look for money changer in SG to convert money into cash and bring to MY to spend when retire, as long as don't deposit large amount in bank, then LHDN won't know and no need to pay tax.

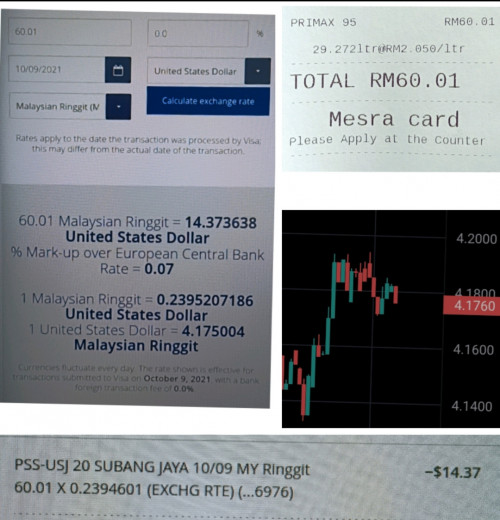

just use your sg debit card lor... mastercard spot rate zero mark up... kaotim... dont need money changerSo, tax experts say no need to worry about double taxation as those who are already taxed overseas can enjoy tax relief, and as long as the money does not flow into Malaysia then you don't need to declare tax. Just keep it in your offshore bank accounts.

That means I can look for money changer in SG to convert money into cash and bring to MY to spend when retire, as long as don't deposit large amount in bank, then LHDN won't know and no need to pay tax.

wise debit already in Japan... soon will be in sg... sg got a few local multicurrency fintech with card too...

that time you already not Malaysian tax residence... why worry

This post has been edited by dwRK: Nov 1 2021, 07:52 AM

Nov 1 2021, 07:50 AM

Nov 1 2021, 07:50 AM

Quote

Quote

0.0396sec

0.0396sec

0.37

0.37

6 queries

6 queries

GZIP Disabled

GZIP Disabled