QUOTE(TaiGoh @ Jul 17 2021, 02:48 PM)

Hi all, I am currently 32 years old, non smoker, and I am considering an ILP plan between Prudential PRUMillion Med with 300 deductible and Allianz MediSafe Infinite+ with 5k deductible and retirement option, since I have company insurance to cover until I retire.

Would like to seek for advice which one you will recommend:

1. If I planning to go Singapore to work for few years, which plan will be more suitable for me?

Allianz

If the Life Assured resides or travels outside Malaysia, Singapore and Brunei for more than ninety (90) consecutive days from the day the Life Assured leaves Malaysia, no benefit will be payable for any medical treatment received by the Life Assured outside Malaysia apart from Singapore and Brunei.

Is that mean that if I need medical treatment in Singapore, it will be covered?

Yes as stated ... apart from Singapore and Brunei.

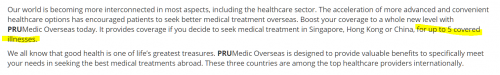

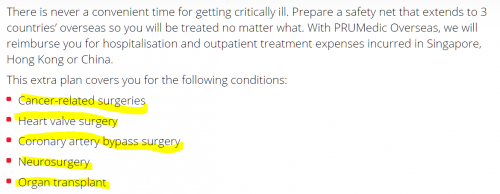

Prudential

If you choose to have or if you have been referred to be treated outside Malaysia, the benefits for the treatment are limited to the reasonable and customary medically necessary charges for equivalent local treatment in Malaysia and subject to 90 days residence limit.

Is that mean that if I am out from Malaysia for 90 days, then I will not be covered?

If you exceeded the 90 days, it's not covered

2. What happen if I want to opt for higher R&B when I get hospitalized?

For Allianz

You shall bear the difference in the Hospital Room and Board charges if the Life Assured is hospitalised at a Room and Board which is higher

than his/her eligible benefit.

Is that mean that if I have a medical card with R&B 200 and I opt for R&B 300 during hospitalized, I will need to pay for 100 per day only? I remember that some other insurance companies might need to pay 10-20% on top?

You just pay the diff on the R&B cost

How about Prudential in this case?

- same as AZ

Thanks a lot for your help!

Would like to seek for advice which one you will recommend:

1. If I planning to go Singapore to work for few years, which plan will be more suitable for me?

Allianz

If the Life Assured resides or travels outside Malaysia, Singapore and Brunei for more than ninety (90) consecutive days from the day the Life Assured leaves Malaysia, no benefit will be payable for any medical treatment received by the Life Assured outside Malaysia apart from Singapore and Brunei.

Is that mean that if I need medical treatment in Singapore, it will be covered?

Yes as stated ... apart from Singapore and Brunei.

Prudential

If you choose to have or if you have been referred to be treated outside Malaysia, the benefits for the treatment are limited to the reasonable and customary medically necessary charges for equivalent local treatment in Malaysia and subject to 90 days residence limit.

Is that mean that if I am out from Malaysia for 90 days, then I will not be covered?

If you exceeded the 90 days, it's not covered

2. What happen if I want to opt for higher R&B when I get hospitalized?

For Allianz

You shall bear the difference in the Hospital Room and Board charges if the Life Assured is hospitalised at a Room and Board which is higher

than his/her eligible benefit.

Is that mean that if I have a medical card with R&B 200 and I opt for R&B 300 during hospitalized, I will need to pay for 100 per day only? I remember that some other insurance companies might need to pay 10-20% on top?

You just pay the diff on the R&B cost

How about Prudential in this case?

- same as AZ

Thanks a lot for your help!

Jul 17 2021, 03:01 PM

Jul 17 2021, 03:01 PM

Quote

Quote

0.0255sec

0.0255sec

0.35

0.35

6 queries

6 queries

GZIP Disabled

GZIP Disabled