Hi sifus,

Wanna see some advice regarding to my insurance coverage. Read some recent posts above and this made me worried as it seems that I don't really know in detail about the coverage that I have. All the policies that I have below were done quite some time ago with parents' friend/relative so I guess they just want to sell the products at that time

For AIA I have the following, extracted from the info that I can see at the MyAIA website:

1) ENHC HEALTHGUARD / ENHC PA HG (Critical Illness Protection) - annual premium is RM780, coverage amount is RM100k. Actually what is this 100k means ya? Yearly limit?

2) EXCELPLUS - coverage amount RM50k - also what is this about?

3) TERM - coverage amount RM5k - again what is this about?

Also the (2) and (3) above was under the same policy and they are now under the "IN FORCE DISAPPEARING PREMIUM OPTION". May I know if I shall let it be like this or better to continue paying for the premiums?

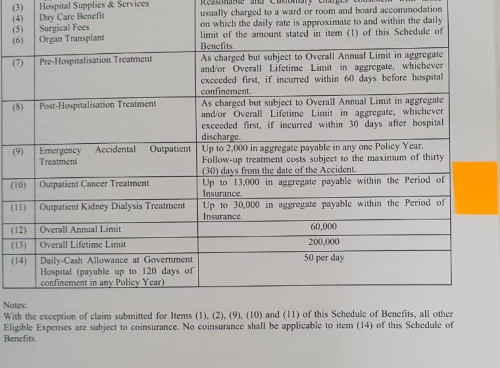

For Great Eastern, I have the "CENTENNIAL ADDVANTAGE INSURANCE", paying RM200 per month. If I see it correctly, the medical limit is 180k annual limit / 1.2mil lifetime limit. I guess this is those medical card where I can use it during hospitalisation right?

My main concern is on the medical coverage, especially after retirement or when the company's medical coverage limit is exceeded. Also I see above, there was discussion about the waiver of premium paying when got illness, etc. May I know how do I check this and how shall I start from here? And how to see if the coverage is sufficient for an average treatment at private hospitals when needed to? Average meaning I'm ok with 2-person room, etc.

Also would like to see, if there's any redundant policies? Or any outdated policies that it's better that I surrender it and get a current one instead?

Thanks in advance

May 17 2024, 09:24 AM

May 17 2024, 09:24 AM

Quote

Quote

0.0168sec

0.0168sec

0.40

0.40

6 queries

6 queries

GZIP Disabled

GZIP Disabled