QUOTE(Rinth @ Sep 8 2023, 10:44 AM)

my objective is to understand my policy better and for financial security. how do i ensure my agent or insurance company earn less? dun buy then they dun earn lo lol..

because all my insurance policy i bought is before i stumble to this post... and frankly said i dun really understand how it work previously and just buy and hope that whatever bad things happen it can cover for me & my family. I'm those that agent say "just need to pay to certain age then the policy will run itself untill end tenure/i died" , but after reading here it not the case, the policy might need top up anytime or have to continue paying untill end tenure to ensure the policy doesnt lapse...

and for that particular example, its my son medical policy bought year 2019 when he just 2-3 months old, is this policy considered new?

Okay bro, chill sikit. Here we memang will tekan a bit.

Just food for thought ya

No worries, it's good that you have something started.

I am new father, I can understand where you coming from. At least from my narrow perspective.

So if I were you, this is what I will flip through the policy contract to look for:

1. Maturity - at what age does the policy mature/expire?

Why this is important leh?

Because let's say I want to save some money, I choose a lower age of maturity, say age 70. Premium lower, of course I happy.

And what that means is that at age 70, the policy ends. Should there be extra funds in the policy, I may have the option to let the coverage continue until the funds in the policy runs out, but I cannot continue to pay premiums into it, sebab the contractual term dah tamat.

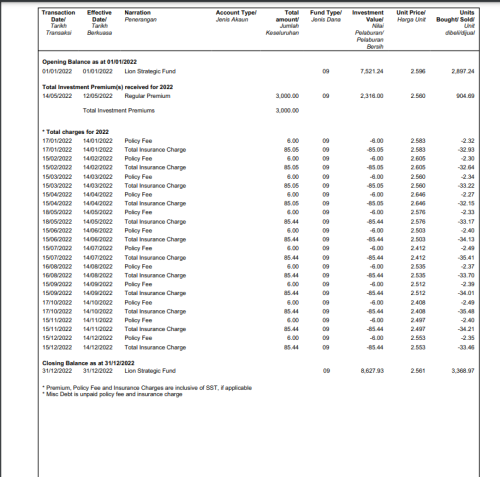

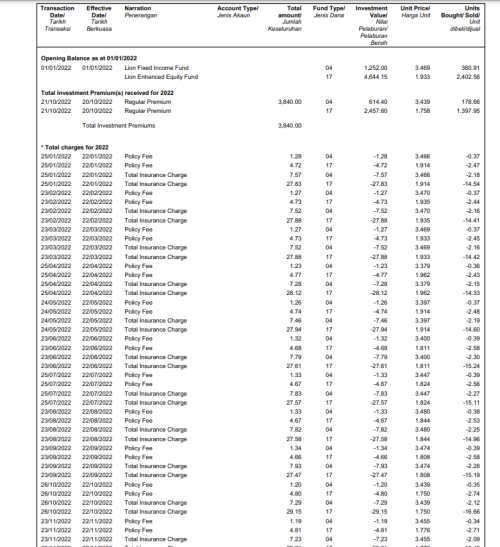

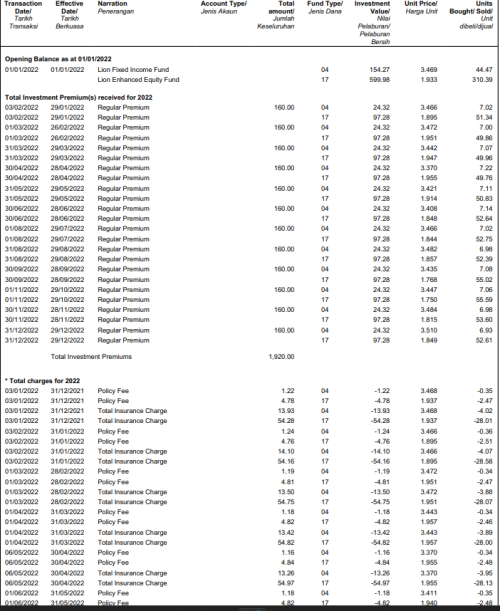

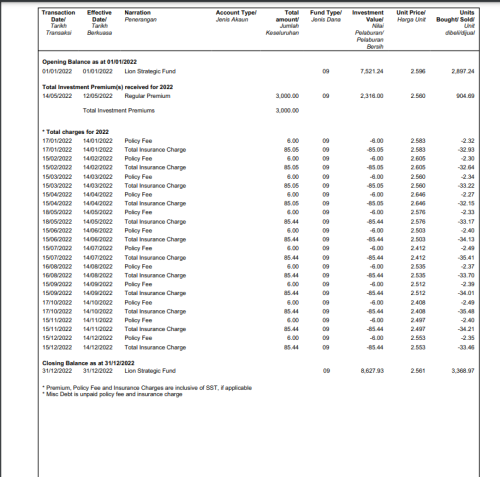

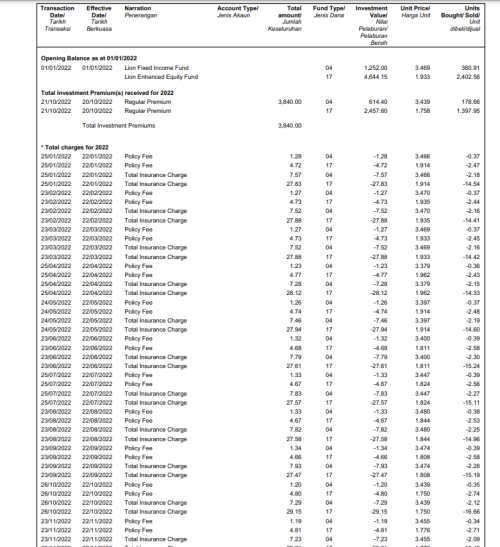

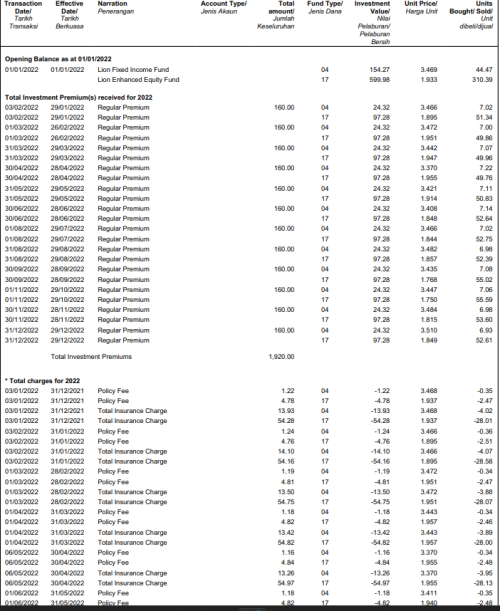

2. Account value projection - look for a chart with the non-guaranteed account value, with scenario 1 and scenario 2.

Why this is important leh?

It's important to you because your objective is clearly for some level of security.

SO if the projection levels at age 70 is just a "-", what I would do is to put up more money into the regular premiums.

Personal preference: I would much rather put up small tickets along the way, rather than be given a big surprise in my golden years.

In what scenario would you need to cough up more money, aka, top-up?

How insurance started is based on the guiding principle of mutual assurance. The same guiding principle is still well and alive today, just that it also developed with the times into all the different selections that we see today. No right no wrong, it just caters to different market segments. So to each, its own.

With that in mind, comes my first point: we are sharing into this medical insurance pool with all the customers of your respective insurance company. Should the claims experience be above and beyond what was projected, everybody that shares into the pool would naturally have to pull more weight.

Secondly, we also need to understand the nature of an investment linked policy.

When interest rates are up, naturally it demands less money from us to sustain the policy.

When interest rates are down, naturally it demands more money from us to sustain the policy.

Of course there are going to be exceptional cases. And the example I illustrated above is just a general guide to understand it.

So with this in mind, we can actually have a proactive role with our policy (hence the importance of reviewing regularly).

Sep 8 2023, 10:18 AM

Sep 8 2023, 10:18 AM

Quote

Quote

0.0213sec

0.0213sec

0.39

0.39

6 queries

6 queries

GZIP Disabled

GZIP Disabled