QUOTE(slee03 @ Oct 23 2020, 11:47 PM)

So, you own at least one, Aries/Dremien or Cora/Nara. Either of these, should be fortunate and grateful that both Huni and Floria (future launch of RSKU) provide the much needed building block away from that awful HTC.

Hope you are not discouraging us who have signed up for a unit at duduk, either Huni or Se.Ruang 😎 as some of us are M40 group. We may not be staying there permanently, as getting a landed for the so-called dream home will be a terrible mistake for 1st or 2nd property. Renting it out as short/long term still fine. Even if I need to cough up the sum, only cost a monthly installment of Honda City. Just a fraction of my net income.

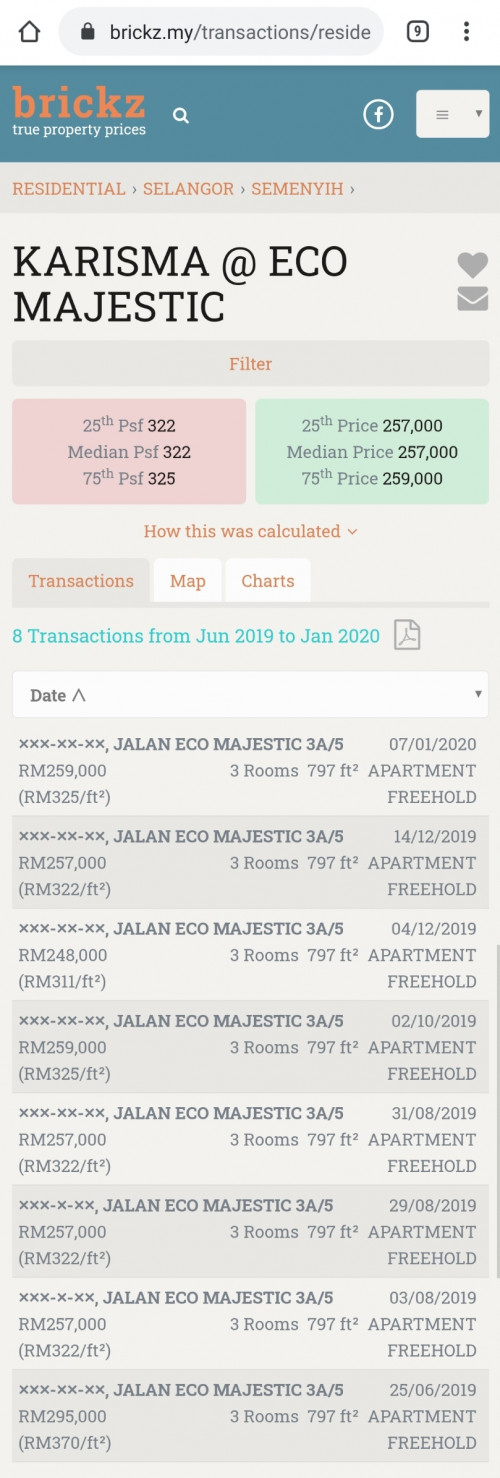

Never in my mind to consider places like Semenyih for the next 10 years. Besides, Karisma is an apartment, different league bro.

Although I am disappointed with cement-rendered corridor, only can wish the layout and finishing will be better than previous ones. We pay for what is required and most importantly, feeling more secured. Other places may be similar but look at the amount of defects and abandoned projects.

Last but not least, I do know some "gurus" out there waiting desperately to buy units in bulk, by entire floor at a discount. Then sell to their participants, loan compression etc. Too bad, it will not happen for Huni. May try their luck at other locations.

Actually in any organic township, the inclusion of affordable housings are part of the requirements; and very essential in bringing in the population and to foster growth. Together with critical mass from adjacent neighborhood it would have spillover effects that brings up an area towards urbanization.

Semenyih and Setia Alam, both shared similar expectancy of maturity years i.e. minimum 10 years. Just that SP Setia & Sime Darby started it way earlier. Project wise, if you notice, EW treated anything below 500k as same range hence you see the marketing strategy / tagline of "Duduk" already define their target audience & pointing to the mass market locally.

Getting a landed as 1st home may not be wrong too, especially when you hit the right spot with strategic reasons OR below market entry price. Everywhere is investable provided we did enough homework to minimize our risks. I knew someone who got Desa Park & Sunway SPK landed at 500k in early days and able to cash out more than 1-2mil from same the property today.

As said earlier, it's still good to go to sign up HUNI after made an informed decision and proper due diligence. Nothing wrong with the cement render or HTC though, as the expectations are always with the developer for building an end-state matching the price tag, if not better (Rumahwip and PPA1M that I visited have corridor tiles and nice lobby & facilities though). The barking sound from poor neighbor like Sam sounds more pathetic in any sense.

Buying for own stay must be also good for investment. As circumstances would change and you would have expanded family members or pursue for higher/different lifestyle hence getting stuck with something not easily dispose is against the way.

Yes those buying in bulks with uplifted price and transferring back to the "students" are unprofessional and we shouldn't encourage that type of behavior or approach. Usually the intention is to help 2nd tier developers in clearing the unsold stocks leveraging the close relationship and getting commission on the joint sales.

Oct 23 2020, 11:47 PM

Oct 23 2020, 11:47 PM

Quote

Quote

0.0532sec

0.0532sec

0.31

0.31

6 queries

6 queries

GZIP Disabled

GZIP Disabled