QUOTE(Davidtcf @ Jan 26 2022, 04:59 PM)

Until now I had not gotten my refund on this wrong transfer. It was around SGD 2700.

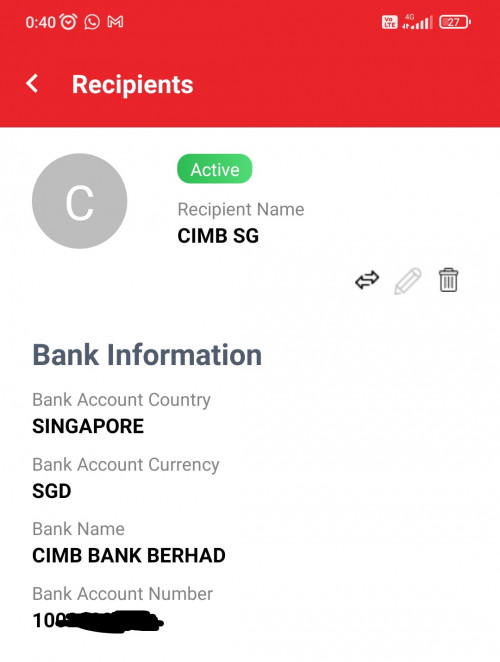

Wrote and called both parties CIMB Bank Malaysia and Wise.

When I contact both parties, both also refuse to help me solve the problem! Wise is saying I have to contact bank myself, that it is against their security protocol to contact bank, but why? What security is involved here? Help customer to followup asking bank to return back a wrong transfer also got problem?

While CIMB bank called me and say Wise has to contact them to ask for the transfer to return back to Wise's account. In the written email the CIMB person explained that Wise might have an intermediary local clearing house hence why they need to contact CIMB for the refund. But another CIMB agent I called say CIMB will auto send back the money to Wise. They can't confirm when I will get back the money. Sounds simple but until now I don't see the money in my Wise yet. Basically 2 answers for a question and I don't know which is right.

End up I am the person getting burnt due to a mistake.

Already wrote email to Securities Commision for help today. Hope will get a reply.

Next might need to write email to Bank Negara if still getting ignored.

Anyone else got any other suggestions please let me know.

Transferwise is good.. but if you fcked up on your transfer to wrong bank/party etc... you are ALONE in this if bank did not send back to you the money.

Always triple check if need to before hitting that "send money" button. Especially if you first time doing the transfer. Better safe than sorry.

If it helps, I'd say you don't need to worry about it.

There is a reason they ask for recipient's full name when transferring, in case the account number doesn't match, the transaction will be bounced back eventually. (The chances of you sending your money to someone with the wrong account number that is valid, at the right bank, with the same exact name as you is astronomically low if not impossible)

I suspect that it's simply out of Wise control, they don't actually get receive confirmation from recipient's bank according to their ambiguous wording. So once the money leave their system, can they only act upon it if the money goes back to them.

QUOTE(Wise)

Our conversion process is fast — and sometimes it’s too late to cancel. Once it’s marked as complete, the money is out of Wise’s system and into the banking system. So if you don’t see the option to cancel:

Get in touch with the person you’re paying

Tell them how you got their bank details wrong

Ask them to contact their bank and find out whether the money can still be delivered, or whether their bank will send it back to Wise

Tip: If the bank sends your money back to us, we’ll get in touch with you via email. You can then choose to set up your transfer with the correct bank details, or cancel your transfer and get a refund.

The recipient bank should have received the money regardless, so this is on CIMB, no choice but to escalate on their side.

I doubt that SC or BNM would be helpful, especially this is likely 99% not SC's scope.

And yeah, as you've said, always triple check sending information, never too careful. I usually do a test transaction for the first transaction on any platform then repeat that transaction in large amount to be safe.

This post has been edited by Hoshiyuu: Jan 26 2022, 05:18 PM

Jan 25 2022, 07:30 PM

Jan 25 2022, 07:30 PM

Quote

Quote

0.0185sec

0.0185sec

0.28

0.28

6 queries

6 queries

GZIP Disabled

GZIP Disabled