If you intend to convert your MYR to EUR first, and store your EUR balance and use at a later date, then Wise is a considerable option. But MYR has been appreciating lately though...

If you just want to use MYR balance and make payments in Europe (which it'll auto convert to EUR currency) then in my opinion, although it is true Wise refers to mid market exchange rate, but eventually the total amount you pay in a foreign transaction, which will includes their Service fee, may appear slightly higher than VISA/Mastercard 0% bank fee rate.

If you plan to allocate RM10k for foreign spending, you can consider Touch n Go VISA Debit Card (not to be confused with their normal TnG card, or their NFC card).

That one uses VISA and it has 0% bank fee, but it has annual fee of RM8. But it shouldn't be an issue if you intend to spend a lot in foreign currencies, as the savings you get from 0% bank fee can eventually breakeven with the RM8 annual fee.

Also, there's a one time application fee of RM15, annual fee will be waived for the first year.

For GX Bank, it uses Mastercard's 0% bank fee, and there's no annual fee. Since it is relatively a new bank, they had to use the latest 8 digits BIN number standard for its card number.

It is the future card number standards for Mastercard and VISA, and meant to supersede the current standard of 6-digits BIN number that is in use since long long time ago.

But it is believed that some overseas merchants did not or have not update their POS systems to support 8 digits BIN number from Mastercard/VISA cards due to technical and other reasons, which is what you're referring to "may not be accepted everywhere". Therefore as a result from the end user, the transaction would get declined. I believe this issue won't happen if the merchant system is properly updated to support 8 digits BIN number.

This is more towards the merchant's problem, nothing got to do with the country you visit.

Regardless of which one you go for, the rates of using Wise card would often times still better than convert to cash at a money changer shop.

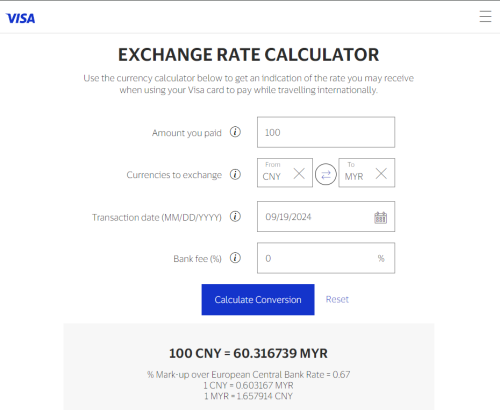

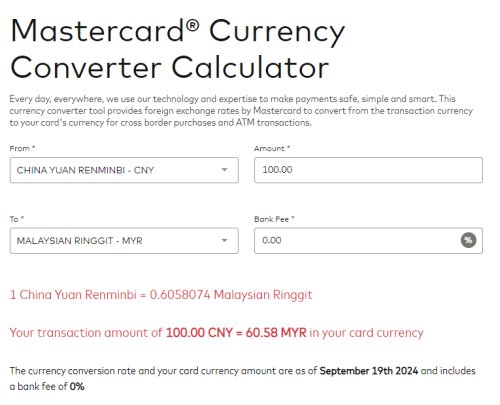

You can compare the rates yourself here:

https://wise.com/my/pricing/card-fees?sourc...R&targetCcy=EURhttps://www.visa.com.my/support/consumer/tr...calculator.htmlhttps://www.mastercard.us/en-us/personal/ge...t-currency.htmlThis doesn't factor in the exchange rate, and Mastercard generally provides the best rate most of the time over the other two.

Sep 25 2024, 07:05 PM

Sep 25 2024, 07:05 PM

Quote

Quote

0.0216sec

0.0216sec

0.21

0.21

6 queries

6 queries

GZIP Disabled

GZIP Disabled