Is anyone here tried to add Wise card to Alipay app and/or WeChat Pay, and whether it works in China?

Wise (Transferwise) Malaysia Discussion, v1.0

Wise (Transferwise) Malaysia Discussion, v1.0

|

|

Sep 20 2024, 12:24 AM Sep 20 2024, 12:24 AM

Return to original view | IPv6 | Post

#1

|

Senior Member

7,798 posts Joined: Dec 2014 From: Malaysia |

Is anyone here tried to add Wise card to Alipay app and/or WeChat Pay, and whether it works in China?

|

|

|

|

|

|

Sep 25 2024, 01:15 PM Sep 25 2024, 01:15 PM

Return to original view | Post

#2

|

Senior Member

7,798 posts Joined: Dec 2014 From: Malaysia |

QUOTE(poooky @ Sep 25 2024, 11:40 AM) Anyone use Wise card in Europe before? Thinking registering for travel use. Load up RM10k and be mainly using it for expenses. If you intend to convert your MYR to EUR first, and store your EUR balance and use at a later date, then Wise is a considerable option. But MYR has been appreciating lately though... Thought about GX Card, but 1% cashback only until Nov this year. Also GX Card doesn't seem to be accepted everywhere. Also, worth it to convert some into local Europa currency? or keep all in MYR, and just let it auto convert when making payment? If you just want to use MYR balance and make payments in Europe (which it'll auto convert to EUR currency) then in my opinion, although it is true Wise refers to mid market exchange rate, but eventually the total amount you pay in a foreign transaction, which will includes their Service fee, may appear slightly higher than VISA/Mastercard 0% bank fee rate. If you plan to allocate RM10k for foreign spending, you can consider Touch n Go VISA Debit Card (not to be confused with their normal TnG card, or their NFC card). That one uses VISA and it has 0% bank fee, but it has annual fee of RM8. But it shouldn't be an issue if you intend to spend a lot in foreign currencies, as the savings you get from 0% bank fee can eventually breakeven with the RM8 annual fee. Also, there's a one time application fee of RM15, annual fee will be waived for the first year. For GX Bank, it uses Mastercard's 0% bank fee, and there's no annual fee. Since it is relatively a new bank, they had to use the latest 8 digits BIN number standard for its card number. It is the future card number standards for Mastercard and VISA, and meant to supersede the current standard of 6-digits BIN number that is in use since long long time ago. But it is believed that some overseas merchants did not or have not update their POS systems to support 8 digits BIN number from Mastercard/VISA cards due to technical and other reasons, which is what you're referring to "may not be accepted everywhere". Therefore as a result from the end user, the transaction would get declined. I believe this issue won't happen if the merchant system is properly updated to support 8 digits BIN number. This is more towards the merchant's problem, nothing got to do with the country you visit. Regardless of which one you go for, the rates of using Wise card would often times still better than convert to cash at a money changer shop. You can compare the rates yourself here: https://wise.com/my/pricing/card-fees?sourc...R&targetCcy=EUR https://www.visa.com.my/support/consumer/tr...calculator.html https://www.mastercard.us/en-us/personal/ge...t-currency.html This post has been edited by joshhd: Sep 25 2024, 01:18 PM poooky liked this post

|

|

|

Sep 25 2024, 07:05 PM Sep 25 2024, 07:05 PM

Return to original view | Post

#3

|

Senior Member

7,798 posts Joined: Dec 2014 From: Malaysia |

QUOTE(knwong @ Sep 25 2024, 02:37 PM) This TnG Visa…can it be added into Apple Pay? Nope. TnG Visa card doesn't support Apple Pay, Samsung Pay and Google Wallet at the moment. If yes can cancel the card and avoid paying annual fee? You'll be getting a physical card which will be shipped to your address. Do note that apply the card now will have one time application fee of RM15. Previously I read Lowyat Forum discussion on TnG ewallet thread, mentioned that one of them successfully cancel the card before TnG trigger the annual fee. You'll have to contact their customer service to do so, and may take few working days. |

|

|

Sep 30 2024, 12:14 AM Sep 30 2024, 12:14 AM

Return to original view | Post

#4

|

Senior Member

7,798 posts Joined: Dec 2014 From: Malaysia |

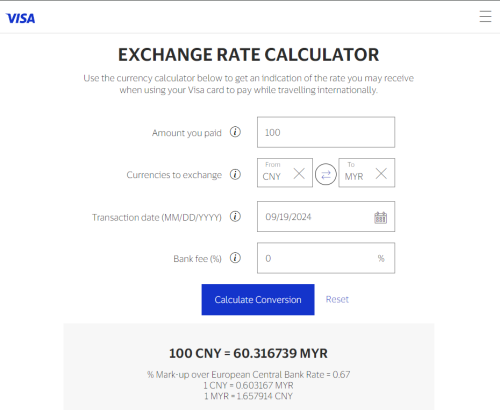

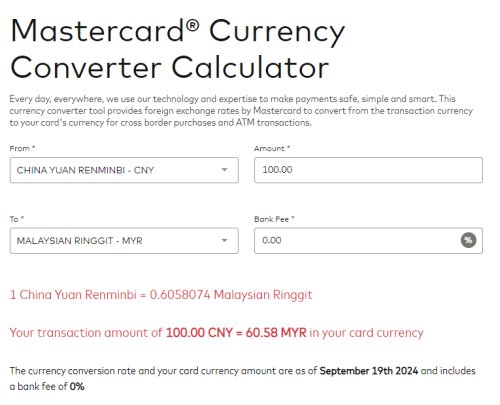

QUOTE(Steve78 @ Sep 29 2024, 11:48 PM) This doesn't factor in the exchange rate, and Mastercard generally provides the best rate most of the time over the other two. As a general rule, yes, we may assume that for Mastercard, but not all the time... Because sometimes, there is a possibility that VISA's rate would appear better than Mastercard in some days. Here's an example for China's Renminbi (CNY), for 19 Sep 2024:   It still depends on which transaction currency also. So yeah, for those who's looking for the best exchange rate out there (after factor in their service fee), Wise would not be the primary choice. But Wise is indeed useful if you intend to convert to a foreign currency (as if to "lock in" this exchange rate against MYR) and then store the balance for later use. This post has been edited by joshhd: Sep 30 2024, 12:17 AM cheongzewei liked this post

|

|

|

Oct 2 2024, 08:10 AM Oct 2 2024, 08:10 AM

Return to original view | Post

#5

|

Senior Member

7,798 posts Joined: Dec 2014 From: Malaysia |

|

|

|

Oct 2 2024, 11:50 PM Oct 2 2024, 11:50 PM

Return to original view | Post

#6

|

Senior Member

7,798 posts Joined: Dec 2014 From: Malaysia |

QUOTE(CommodoreAmiga @ Oct 2 2024, 04:53 PM) I don't hae Alipay. Can open Alipay in Malaysia and link to WISE? I don't hae Alipay. Can open Alipay in Malaysia and link to WISE?Another question. If i have Yuan inside my WISE, Alipay will know to deduct Yuan instead of RM? Yes you can. Sign up using Malaysian mobile number > you'll receive OTP > perform eKYC (identity verification) by uploading a photo of your passport and a selfie. Another question. If i have Yuan inside my WISE, Alipay will know to deduct Yuan instead of RM? Then it will deduct your CNY currency first. Until your CNY not enough or finishes, then it will deduct the remaining amount from your MYR balance. If you have other currency balances in your Wise (other than CNY or MYR), then it will auto deduct whichever has lower fee first. This post has been edited by joshhd: Oct 2 2024, 11:51 PM CommodoreAmiga liked this post

|

|

|

|

|

|

Oct 3 2024, 08:46 AM Oct 3 2024, 08:46 AM

Return to original view | Post

#7

|

Senior Member

7,798 posts Joined: Dec 2014 From: Malaysia |

QUOTE(Steve78 @ Oct 3 2024, 03:59 AM) Actually, the currency converters for Visa and Mastercard have different cutoff times due to time zone differences, so you can't directly compare their rates by just selecting the same date. Yes correct. It is just for reference purposes. The cutoff times (after converting to Malaysia time) are: VISA = Next day 6:00am Malaysia time Mastercard = Next day 2:00am Malaysia time |

|

|

Oct 3 2024, 03:43 PM Oct 3 2024, 03:43 PM

Return to original view | Post

#8

|

Senior Member

7,798 posts Joined: Dec 2014 From: Malaysia |

QUOTE(CommodoreAmiga @ Oct 3 2024, 09:17 AM) QUOTE(magika @ Oct 3 2024, 11:12 AM) Alipay n Weixin Pay for foreigners is hit n miss due to restrictions on peer to peer transfer. Cash is better in China. Japan can get by with minimal cash. CommodoreAmiga A thing to take note is, some QR code you see on merchant (e.g. Food court, street food?) might use their own personal QR to accept payments from customers, rather than a proper business merchant QR. This is also happening in Malaysia actually. If it's a personal QR, then it'll be considered as a peer to peer transfer (just like transfer money to your friend/family). Alipay and WeChat don't allow such transactions if it is linked through international bank cards. QUOTE(touristking @ Oct 3 2024, 11:13 AM) The acceptance of TnG ewallet in China, also depends whether the merchant supports Alipay+ or not. If it supports only Alipay but not Alipay+, then you'll see "invalid QR" error on your TnG ewallet app. QUOTE(CommodoreAmiga @ Oct 3 2024, 12:15 PM) OMG...then i have to prepare cash. But VISA card still can be used right, especially for Hotel. I have booked Hotel via Agoda using VISA. In China, unfortunately, you need to manage your expectation that card terminal machines are not found in every places, unlike in Malaysia here. Even if that merchant/shop in China has a card terminal machine, VISA and Mastercard may or may not be supported, and it may only accepts if it's under UnionPay (银联), so better that you ask the merchant staff whether it accepts VISA or Mastercard or not. If it doesn't, then your Wise card or whatever Malaysian bank cards also won't work. Can i use Maybank App while in China? Because in case not enough money, i still want to transfer from Maybank to WISE, like what i did in Japan. Will Maybank app be blocked by the Great Firewall of China? 😅 China don't block banking apps one, so it's fine. You said you booked a hotel via Agoda, you've paid it or you'll pay it at the hotel physically? If you'll pay there physically, assuming the hotel room fee definitely exceeds 200 CNY, or whatever stuff that you want to pay that exceeds 200 CNY, then the sequence of the preferred payment method if one fails, shall be: Card payment (Wise Card, GX Bank, BigPay,...) > TnG ewallet > Alipay (bcuz of the 3% fee) > Cash Alipay or WeChat Pay is accepted pretty much everywhere there, so making sure that your Alipay app is linked with bank cards (Wise) will be very helpful. If you don't have enough cash, you can use China's ATM to withdraw cash using your Wise card. Make sure don't exceed 2 ATM withdrawals in a calendar month, or cumulative equivalent amount to RM1000 in a calendar month. Else, there will be additional fee from Wise from 3rd withdrawals onwards or exceed RM1000. CommodoreAmiga liked this post

|

|

|

Oct 3 2024, 09:00 PM Oct 3 2024, 09:00 PM

Return to original view | IPv6 | Post

#9

|

Senior Member

7,798 posts Joined: Dec 2014 From: Malaysia |

QUOTE(CommodoreAmiga @ Oct 3 2024, 04:01 PM) I see. Understood. So looks like need cash for these worst case scenario. China-issued UnionPay card would work well, provided if it is issued in China. I see...wondering should i apply for a UnionPay card now.... My Agoda booking is currently just a booking, no charge yet. It says the payment will be charged to my card 1 month beore my arrival date. So this means the Hotel bill was settled with my VISA card, correct? What is this Alipay 3% charge? Every transaction i made in China with Alipay will have 3% charge? Even if you apply UnionPay card from Malaysia banks, it may still be treated as an international bank card in China also. Open a China bank account and get a China-issued UnionPay card would make better sense if you intend to stay in China for long time, like for study or work. Otherwise, you can forget about the option of getting a UnionPay card. What is this Alipay 3% charge? Every transaction i made in China with Alipay will have 3% charge? If you link a non-China issued bank cards (such as Wise card) and make payment of more than 200 CNY in a single transaction, Alipay/WeChat Pay themselves will charge you 3% foreign transaction fee of the entire amount. To avoid this fee, make sure the amount doesn't exceed 200 CNY, or you split your payments, provided if the merchant is okay with that. Meaning, if the payment costs 280 CNY, so you pay 200 CNY first, and then pay 80 CNY. CommodoreAmiga liked this post

|

|

|

Oct 4 2024, 01:53 PM Oct 4 2024, 01:53 PM

Return to original view | Post

#10

|

Senior Member

7,798 posts Joined: Dec 2014 From: Malaysia |

QUOTE(CommodoreAmiga @ Oct 4 2024, 07:47 AM) I will only be there for short trip, looks like UnionPay is not worth the hassle as there is no guarantee it will work either. Looks like sufficient amount of cash is a must. What about if i pay direct with QRCode from my Maybank? Does it have 3% charge also? 3% foreign transaction fee is coming from Alipay and WeChat Pay only (when it is linked with international bank cards). This rule isn't applicable for payments made by other methods, such as Maybank MAE app and TnG ewallet. CommodoreAmiga liked this post

|

| Change to: |  0.0847sec 0.0847sec

0.39 0.39

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 06:09 AM |