QUOTE(gooroojee @ Jan 30 2023, 11:43 PM)

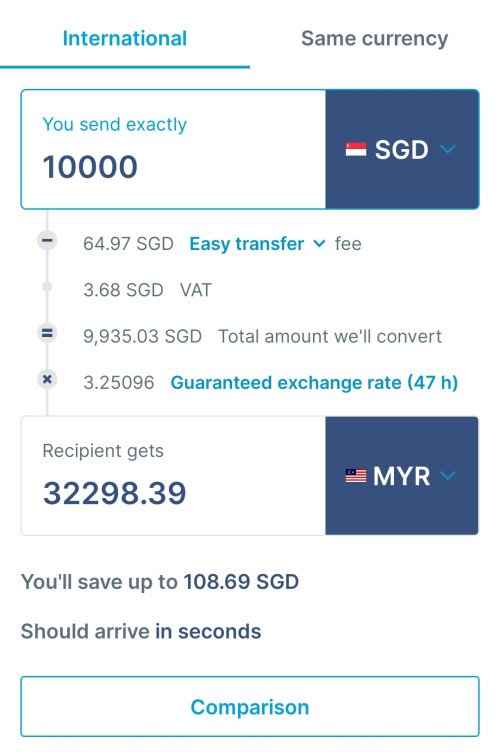

you can use your Visa debit as long as there are sufficient funds in your Wise account across all currencies . You don't even need to convert it yourself. I mentioned Wise will auto convert to THB for you. The exchange rate after including conversion fee is typically still better than a money changer or credit card.

Thank you for your reply. So I just need to deposit some MYR and let wise operate for me when I need to use THB at Bangkok

Jan 31 2023, 05:53 PM

Jan 31 2023, 05:53 PM

Quote

Quote

0.0274sec

0.0274sec

0.38

0.38

6 queries

6 queries

GZIP Disabled

GZIP Disabled