QUOTE(darkueki @ May 17 2020, 12:49 AM)

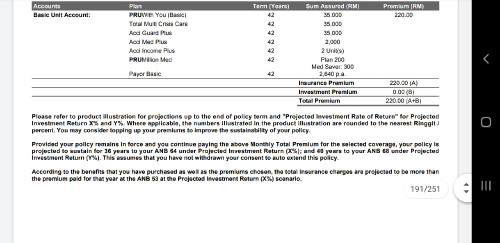

Hi , I would like to seek answer what my agent said is true or not.About one week ago, my agent contacted me and said the insurance company doing offer by let me change the current policy from prulife ready to pruwithyou with medical no waiting period.As my existing policy was only 1 million for life time, then I agreed to shift to new policy.

Currently there are 2 policy , one old and one new, the old policy premium revised to lower.

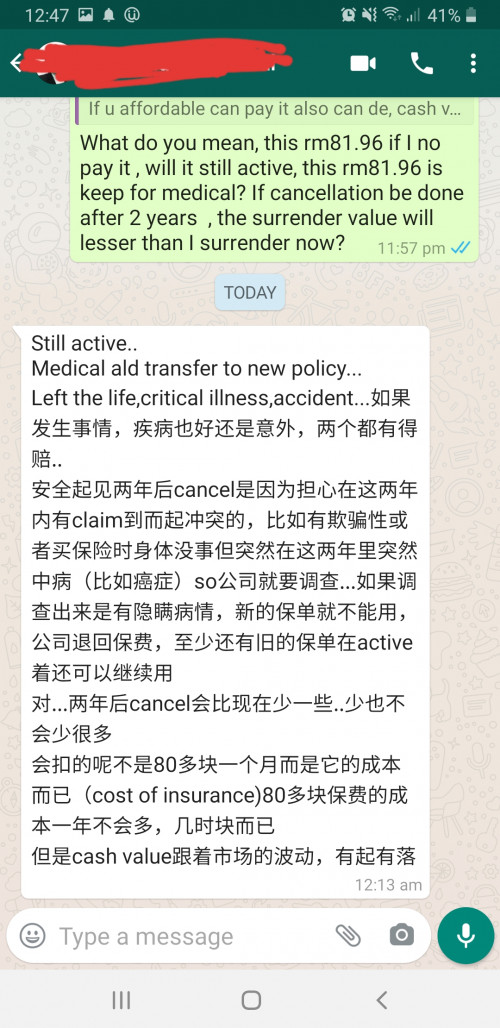

Then I asked my agent , do I still need to pay for old policy, she said no need but I afforable , I can pay it and the cash value will be more.

I felt weird why to keep the old policy as she mentioned my medical benefit transfer to new .

She answered me it is better to keep and the surrender value will just reduce a bit when I surrender 2 years later.

Can I have advise if I dont pay the old policy premium , will it really be like what my agent said, the surrender value will just reduce a little as only cost of insurance charges.

I attached screenshot but as she replied in Chinese so hope got people can help.

Halo friend, from what i see your agent really taking care of you.

1st, for me 1 Million lifetime quite a risk for young people. Technology and medical fees keep on raising. Certain treatment is long terms process. Easily use up large amount from lifetime limit.

2nd, telling to keep the exiting and explain is a must. May be from phone whatsapp text can't elaborate clearly. Suggest you give a call and try meet your agent in future. I'm sure he/she can give further explaination.

What I can try .. give example. Your old medical plan inforce long time ago. new one inforce by MAY2020.

If one year later you got serious stomach issue and consult doctor, if doctor diagnose saying that your illness started at least 1 year ago .. in this case most likely your new medical plan can't cover you. Then your old medical will save you.

So .. ask your agent explain further

Usually we will advise user to keep exiting old medical card at least 6 months to 1 year depending their condition. Advise to keep more than 1 year if affordable and got significant illness record among family members. All this by own risk, agent can only explain and advise.

QUOTE(rebornyama @ May 17 2020, 07:18 AM)

Hey guys,

I got laid off a while back and my extended medical coverage benefit will soon expires. Looking at the options available online, it seems like most medical card only covers hospital visits?

Are there takaful/insurance plan that covers GP/private clinic visit? Not really concerned about hospital visit tbh since worse case scenario still got govt hospital, but visiting govt clinic for the occasional flu/ailments is too much of a hassle.

tldr: need coverage for GP/clinic visits

Good day friend,

Believe your exiting is standalone medical plan right?

It seems like you have different view and objective taking medical plan

is ok no right or wrong.

Just sharing, normally reason people need medical card to cover unexpected high medical cost need out of sudden. Also to enjoy free medical coverage if serious issue occur and waiver benefit opt in.

Illness / Injured case can handle by clinic usually cost can be handle as well.

Even govt hospital not all cost free. Yes it look like free for small matter and senior citizen check up.

Try refer to GH website for ward charge

http://www.hkl.gov.my/index.php/advanced-s...ospital-chargesand medical cost reference compare by Ringgitplus 2 years ago

https://ringgitplus.com/en/blog/insurance/g...eally-cost.htmlYou can't use medical card in govt hospital, anyhow can still claim under paid and claim basis.

Any medical plan that cover clinic visit, have to look detail into the product policy terms. It won't be any visit any time can be claim.

For your need. looking for medical plan cover ONLY GP/CLINIC Visit .... May be general insurance / commercial group policy got

This post has been edited by tyenfei: May 17 2020, 09:17 AM

This post has been edited by tyenfei: May 17 2020, 09:17 AM

May 15 2020, 09:35 AM

May 15 2020, 09:35 AM

Quote

Quote

0.0326sec

0.0326sec

1.24

1.24

6 queries

6 queries

GZIP Disabled

GZIP Disabled