QUOTE(ajin999 @ May 16 2020, 06:42 PM)

Hi, i never take any insurance before.

Been quote this from AIA(life link). Is it ok?

Pampasan kematian - 500k

Pampsan TPD - 500k

Pampasan penyakit kritikal accelerated 250k

Age limit 70

Cash value at 70 : 16k

Waiver and save : inclusive

Monthly : 300

What’s your age ?

What liabilities are you covering for yourself?

What is your objective ?

QUOTE(rebornyama @ May 17 2020, 07:18 AM)

Hey guys,

I got laid off a while back and my extended medical coverage benefit will soon expires. Looking at the options available online, it seems like most medical card only covers hospital visits?

Are there takaful/insurance plan that covers GP/private clinic visit? Not really concerned about hospital visit tbh since worse case scenario still got govt hospital, but visiting govt clinic for the occasional flu/ailments is too much of a hassle.

tldr: need coverage for GP/clinic visits

You only get gp coverage if it’s a company medical card, personal medical card only covers for hospitalization

QUOTE(darkueki @ May 17 2020, 09:40 AM)

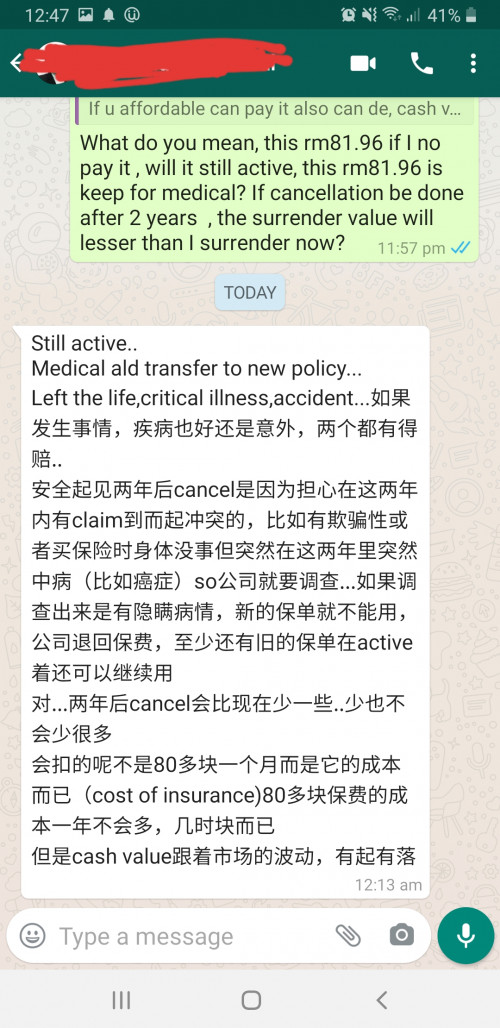

Hi Tyenfei,, thank for your explanation, I understood the importance of keeping existing medical policy, but I have doubt on no need to pay the premium , if dont pay the premium, really the policy will still active as what my agent said, only deduct cost of insurance?

What it means is that your policy goes into premium Holiday whereby it deducts your account value to pay for the cost of insurance

This is not free as it mean it deducts your money that you have In your investing account.

May 17 2020, 08:23 PM

May 17 2020, 08:23 PM

Quote

Quote

0.0238sec

0.0238sec

0.31

0.31

6 queries

6 queries

GZIP Disabled

GZIP Disabled