QUOTE(glitz2z @ Aug 3 2020, 10:01 AM)

Hi everyone,

Happy Monday!

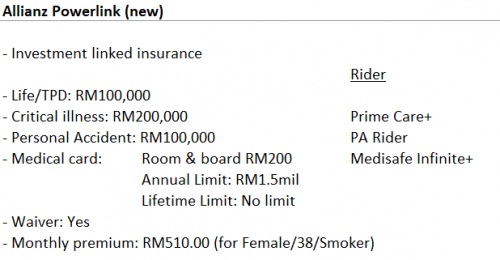

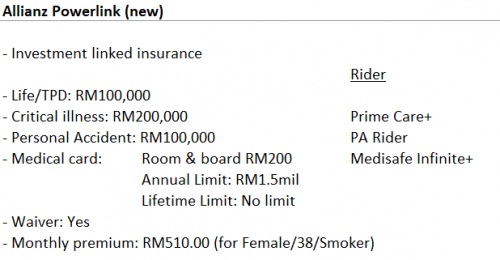

Would need advise on the insurance plan quoted by an agent last week to me.

First concern:

First concern: Was wondering if the monthly premium if too high for this ILP (anyone has similar package?) I know that standalone medical card and critical illness policies are definitely cheaper but I have done so much reading/checking and most independent websites recommend that Allianz Medisafe Infinite+ as one of the best choices for medical card but it's a rider type.

My focus right now is only to have better coverage for medical card and critical illness. I already have a few insurance that have higher payout for Life/TPD.

Another insurance agent from GE (a friend) mentioned that nowadays most insurance will always focus on selling ILP to customers for all-in-one package (since it's the trend) and of course, at the end of the day, it's the most commissions agents can get when selling ILP.

He did quote me a similar package for GE to match the coverage by Allianz but the monthly premium is higher at RM575 and I need to top up / pay extra since I wanted early payout for critical care, whereas Allianz already have payout at all stages.

Second concern: Allianz definitely have the holistic package but unsure how fast they process guarantee letters and claims.

Thank you!

Good morning,

You will need to check how long is the sustainability of the policy compared to GE.

Allianz does provide a much more comprehensive coverage compared to GE in terms of overall benefits.

However the Cost of Insurance will be much more higher in comparison. GE will on a high side as well since they’ve done a repricing recently and have experience up to 40% increase in cost.

Again I am not able to comment much until I know you myself better in terms of existing policies, risk that you may need to cover & your other plannings.

As for reliability in claims, I believe most of the life insurance company follows the same protocol to ensure the policy holder gets their payout on time. When it comes to admission of hospitalization, it will depend sometimes on the hospital’s side to file in the claim request to the insurance company as soon as possible for the insurance company to respond and check a few things with the policy holder

I.e

is the policy holder covered for such procedure / illness ?

Is the policy still active?

Is the policy holder excluded of such claims

Before they can proceed to issue any guarantee letter.

This post has been edited by lifebalance: Aug 3 2020, 11:20 AM

Aug 1 2020, 08:37 PM

Aug 1 2020, 08:37 PM

Quote

Quote

0.0154sec

0.0154sec

0.74

0.74

6 queries

6 queries

GZIP Disabled

GZIP Disabled