QUOTE(cklimm @ Apr 3 2020, 07:51 AM)

Before you go tekan the bank, do ensure the settlement date of your WMP that you bought falls in February and not on March.This post has been edited by GrumpyNooby: Apr 3 2020, 07:54 AM

Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

|

|

Apr 3 2020, 07:53 AM Apr 3 2020, 07:53 AM

Show posts by this member only | IPv6 | Post

#361

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Apr 3 2020, 11:45 AM Apr 3 2020, 11:45 AM

Show posts by this member only | IPv6 | Post

#362

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

Apr 4 2020, 09:21 PM Apr 4 2020, 09:21 PM

|

Senior Member

892 posts Joined: Oct 2007 From: Penang |

Hi sifu, I have a semi flexi Maybank Islamic housing loan with an interest rate of 3.75%, since there is this moratorium right now, should I just stop the monthly instalment for 6 months and put my money in SCB PrivilegeSaver to maximise the saving? After 6 months, one shot dump back the money back to my housing loan.

|

|

|

Apr 4 2020, 10:29 PM Apr 4 2020, 10:29 PM

|

Senior Member

2,552 posts Joined: Jan 2008 |

QUOTE(prescott2006 @ Apr 4 2020, 09:21 PM) Hi sifu, I have a semi flexi Maybank Islamic housing loan with an interest rate of 3.75%, since there is this moratorium right now, should I just stop the monthly instalment for 6 months and put my money in SCB PrivilegeSaver to maximise the saving? After 6 months, one shot dump back the money back to my housing loan. on paper it is a good idea as long you did not cap the 100k in PrivilegeSavers. I also noticed most banks refused to take the payment and opt to accumulate interest instead (though no compounding interest).I would suggest checking with Maybank - if you did bank in the installment, will it reduce the loan interest or will it just hold the payment as "advanced payment" which in most cases do not reduce the interest. |

|

|

Apr 4 2020, 11:52 PM Apr 4 2020, 11:52 PM

Show posts by this member only | IPv6 | Post

#365

|

All Stars

17,510 posts Joined: Feb 2006 From: KL |

QUOTE(prescott2006 @ Apr 4 2020, 09:21 PM) Hi sifu, I have a semi flexi Maybank Islamic housing loan with an interest rate of 3.75%, since there is this moratorium right now, should I just stop the monthly instalment for 6 months and put my money in SCB PrivilegeSaver to maximise the saving? After 6 months, one shot dump back the money back to my housing loan. do note you will still be charged interest on your housing loan balance for 6 months. |

|

|

Apr 5 2020, 09:44 AM Apr 5 2020, 09:44 AM

|

Junior Member

455 posts Joined: Jun 2012 |

|

|

|

|

|

|

Apr 5 2020, 09:47 AM Apr 5 2020, 09:47 AM

Show posts by this member only | IPv6 | Post

#367

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(bokbokchai @ Apr 5 2020, 09:44 AM) I heard the interest will still compound on your principal but not on top of your loan interest. Amount of principal is frozen from the start of moratorium. Don't know how true is that. Interest will be accrued based on the frozen amount. You have accumulated interest during the period. |

|

|

Apr 5 2020, 09:50 AM Apr 5 2020, 09:50 AM

Show posts by this member only | IPv6 | Post

#368

|

All Stars

17,510 posts Joined: Feb 2006 From: KL |

|

|

|

Apr 5 2020, 09:51 AM Apr 5 2020, 09:51 AM

Show posts by this member only | IPv6 | Post

#369

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 5 2020, 09:57 AM Apr 5 2020, 09:57 AM

Show posts by this member only | IPv6 | Post

#370

|

All Stars

17,510 posts Joined: Feb 2006 From: KL |

QUOTE(GrumpyNooby @ Apr 5 2020, 09:51 AM) That is so obvious and so many people are discussing on the other thread on how to take advantage of the moratorium. there is only one way to make money out of this, ie make sure ur investment is consistently higher than mortgage interest in the next 30 years or so.Come on, guys! There's no free lunch form the banks. |

|

|

Apr 5 2020, 10:00 AM Apr 5 2020, 10:00 AM

Show posts by this member only | IPv6 | Post

#371

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(!@#$%^ @ Apr 5 2020, 09:57 AM) there is only one way to make money out of this, ie make sure ur investment is consistently higher than mortgage interest in the next 30 years or so. That's true.For example, if your total monthly repayment is close to RM 20k and you're not capped to RM 100k for this PSA with current subscription to the highest tier at 6% pa. Even you're at 4% tier, you won't gain much. This post has been edited by GrumpyNooby: Apr 5 2020, 10:01 AM |

|

|

Apr 5 2020, 10:08 AM Apr 5 2020, 10:08 AM

Show posts by this member only | IPv6 | Post

#372

|

All Stars

17,510 posts Joined: Feb 2006 From: KL |

QUOTE(GrumpyNooby @ Apr 5 2020, 10:00 AM) That's true. also must remember mortgage interest will not forever be this low. anything can happen in the next 30 years.For example, if your total monthly repayment is close to RM 20k and you're not capped to RM 100k for this PSA with current subscription to the highest tier at 6% pa. Even you're at 4% tier, you won't gain much. |

|

|

Apr 5 2020, 11:31 AM Apr 5 2020, 11:31 AM

Show posts by this member only | IPv6 | Post

#373

|

Senior Member

2,722 posts Joined: May 2015 |

QUOTE(GrumpyNooby @ Apr 5 2020, 09:51 AM) That is so obvious and so many people are discussing on the other thread on how to take advantage of the moratorium. I guess ure referring to the asnb thread?Come on, guys! There's no free lunch form the banks. I guess the monthly interest accrued based on the frozen principal amount is lower than the ‘possible’ return in forms of dividend, hence, why those people are taking advantage of the moratorium. |

|

|

|

|

|

Apr 5 2020, 11:39 AM Apr 5 2020, 11:39 AM

Show posts by this member only | IPv6 | Post

#374

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(cucikaki @ Apr 5 2020, 11:31 AM) I guess ure referring to the asnb thread? Moratorium thread.I guess the monthly interest accrued based on the frozen principal amount is lower than the ‘possible’ return in forms of dividend, hence, why those people are taking advantage of the moratorium. I don't know there's heavy discussion in that too since I don't have those products in my hand. |

|

|

Apr 5 2020, 11:50 AM Apr 5 2020, 11:50 AM

Show posts by this member only | IPv6 | Post

#375

|

All Stars

17,510 posts Joined: Feb 2006 From: KL |

QUOTE(cucikaki @ Apr 5 2020, 11:31 AM) I guess the monthly interest accrued based on the frozen principal amount is lower than the ‘possible’ return in forms of dividend, hence, why those people are taking advantage of the moratorium. ultimately, the loan belongs to each individual. if they made the decision after fully understanding it then that's good. otherwise, if made decision with misconception, then it's their loss for not fully understanding the moratorium. many give advice and opinion, but always remember the one with the loan is you, not them. |

|

|

Apr 5 2020, 12:15 PM Apr 5 2020, 12:15 PM

|

Senior Member

892 posts Joined: Oct 2007 From: Penang |

|

|

|

Apr 5 2020, 12:22 PM Apr 5 2020, 12:22 PM

Show posts by this member only | IPv6 | Post

#377

|

|||||||||||||||||||||

All Stars

12,387 posts Joined: Feb 2020 |

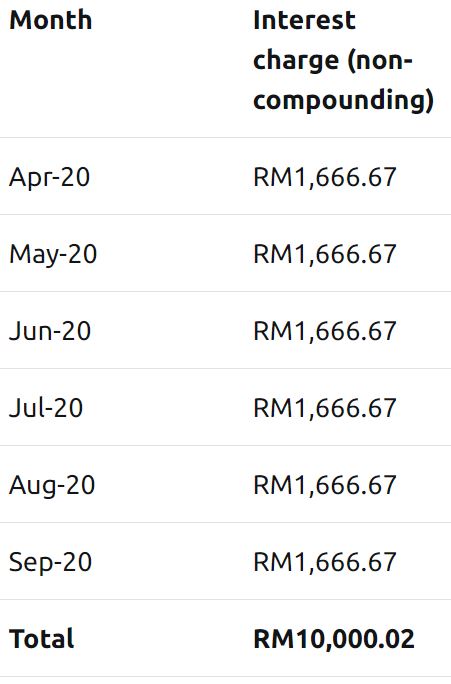

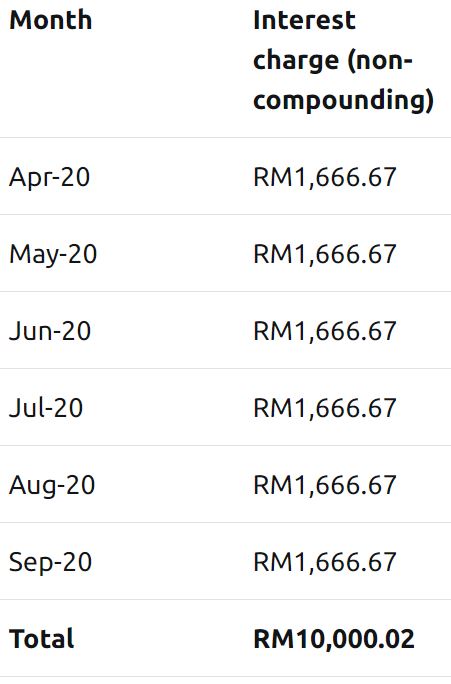

QUOTE(prescott2006 @ Apr 5 2020, 12:15 PM) Ya, I know that. But 4% PrivilegeSaver is > 3.75% interest. I know the saving might be little, but heh free money right. 😆 Using RP example of principal amount of RM 500k with loan interest of 4% and monthly repayment is RM 2390.52. At end of September, your accrued interest is RM 10,000.02. Let's say you're to divert the 6-month repayment into PSA, the total amount is RM 14343.12. The total interest earned at 4% is RM 167.92 for the period from 1/4/2020 to 30/9/2020.

And where is the free money comes from? Your housing loan is still accruing interest (not no interest at all). This post has been edited by GrumpyNooby: Apr 5 2020, 12:40 PM |

|||||||||||||||||||||

|

|

Apr 5 2020, 01:03 PM Apr 5 2020, 01:03 PM

Show posts by this member only | IPv6 | Post

#378

|

|||||||||||||||||||||

All Stars

17,510 posts Joined: Feb 2006 From: KL |

QUOTE(prescott2006 @ Apr 5 2020, 12:15 PM) Ya, I know that. But 4% PrivilegeSaver is > 3.75% interest. I know the saving might be little, but heh free money right. 😆 if u are very sure that PSA or similar investment/account can give u 4% per annum for 30 years and your mortgage loan interest will remain 3.75% for the next 30 years. then yes.QUOTE(GrumpyNooby @ Apr 5 2020, 12:22 PM) Using RP example of principal amount of RM 500k with loan interest of 4% and monthly repayment is RM 2390.52. extend this to 30 years At end of September, your accrued interest is RM 10,000.02. Let's say you're to divert the 6-month repayment into PSA, the total amount is RM 14343.12. The total interest earned at 4% is RM 167.92 for the period from 1/4/2020 to 30/9/2020.

And where is the free money comes from? Your housing loan is still accruing interest (not no interest at all). |

|||||||||||||||||||||

|

|

Apr 5 2020, 01:17 PM Apr 5 2020, 01:17 PM

Show posts by this member only | IPv6 | Post

#379

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(!@#$%^ @ Apr 5 2020, 01:03 PM) if u are very sure that PSA or similar investment/account can give u 4% per annum for 30 years and your mortgage loan interest will remain 3.75% for the next 30 years. then yes. This only valid if you do no need the money on 1/10/2020 and beyond. extend this to 30 years On 1/10/2020, I need to service the housing loan and the diverted amount needs to be withdrawn out to put back to the housing loan. |

|

|

Apr 5 2020, 01:24 PM Apr 5 2020, 01:24 PM

Show posts by this member only | IPv6 | Post

#380

|

All Stars

17,510 posts Joined: Feb 2006 From: KL |

QUOTE(GrumpyNooby @ Apr 5 2020, 01:17 PM) This only valid if you do no need the money on 1/10/2020 and beyond. oic, if u intend to put the money back into the housing loan by the end of 6 months moratorium then it's a more complicated calculation which i'm not good at. i know what u mean. but have to consider the interest saved if you continue paying your loan for the 6 months (since mortgage is reducing principal) thought i don't think it's significant.On 1/10/2020, I need to service the housing loan and the diverted amount needs to be withdrawn out to put back to the housing loan. This post has been edited by !@#$%^: Apr 5 2020, 01:30 PM |

| Change to: |  0.0255sec 0.0255sec

0.28 0.28

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 04:18 PM |