QUOTE(MGM @ Sep 29 2022, 12:22 PM)

For quite a while di RHB has been better than those two, why not that one?Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

|

|

Sep 29 2022, 03:51 PM Sep 29 2022, 03:51 PM

|

Senior Member

6,265 posts Joined: Jul 2005 From: UEP Subang Jaya |

|

|

|

|

|

|

Sep 29 2022, 04:17 PM Sep 29 2022, 04:17 PM

|

All Stars

18,416 posts Joined: Oct 2010 |

|

|

|

Sep 30 2022, 01:31 PM Sep 30 2022, 01:31 PM

|

Junior Member

47 posts Joined: Mar 2020 |

|

|

|

Oct 1 2022, 09:53 AM Oct 1 2022, 09:53 AM

|

Junior Member

429 posts Joined: Jan 2003 |

Hi All

Am so sorry for my noobness. Hope you can guide me. I dont know what i did wrong tat i did not get my full interest I’ve transferred 5 times bigpay rm1 from My Savings account to bigpay And Spent rm600 from my SC Credit card to big pay. And ive spent about rm1k from other merchants using JustOne I feel i should be getting more interest or should i wait for a few more days?  |

|

|

Oct 1 2022, 09:45 PM Oct 1 2022, 09:45 PM

Show posts by this member only | IPv6 | Post

#1545

|

Junior Member

110 posts Joined: Nov 2016 |

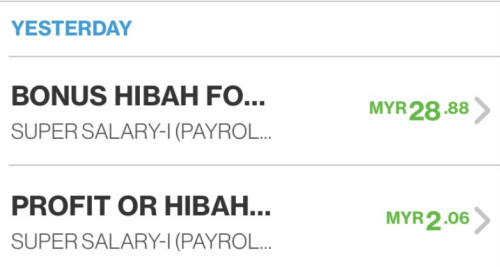

QUOTE(keewah @ Oct 1 2022, 09:53 AM) Hi All 30 sept posted are savings and deposit interestAm so sorry for my noobness. Hope you can guide me. I dont know what i did wrong tat i did not get my full interest I’ve transferred 5 times bigpay rm1 from My Savings account to bigpay And Spent rm600 from my SC Credit card to big pay. And ive spent about rm1k from other merchants using JustOne I feel i should be getting more interest or should i wait for a few more days?  If not mistaken, debit card usage interest will only be posted after 20+days, credit card usage interest just posted this morning Hinote liked this post

|

|

|

Oct 1 2022, 10:22 PM Oct 1 2022, 10:22 PM

|

Junior Member

429 posts Joined: Jan 2003 |

|

|

|

|

|

|

Oct 2 2022, 06:23 AM Oct 2 2022, 06:23 AM

|

Senior Member

6,265 posts Joined: Jul 2005 From: UEP Subang Jaya |

QUOTE(Hinote @ Sep 30 2022, 01:31 PM) Depends on your usage of course. RHB need 3x bill payment (no minimum amount), transfer in RM2000 (I think, can't remember exact amount but around there), and spend RM1000 on CC.The good thing about RHB is that in their webpage, where you viewing the savings account summary, there is a table showing which of the criteria you have already met for the month. No need to sendiri keep track in some excel sheet. It even shows degree to which you've achieved (so e.g. for the CC spend might show "you have spent RM500" and the target is RM1000. For me I see no issue to achieve. I think most difficult is CC RM1000 (bill payment just pay RM1 x 3 to TNB or something), that one really depend your spending pattern/habit. I will say their Shell Visa can use to reload ewallet though. Hinote liked this post

|

|

|

Oct 13 2022, 03:12 PM Oct 13 2022, 03:12 PM

|

Junior Member

47 posts Joined: Mar 2020 |

QUOTE(LostAndFound @ Oct 2 2022, 06:23 AM) Depends on your usage of course. RHB need 3x bill payment (no minimum amount), transfer in RM2000 (I think, can't remember exact amount but around there), and spend RM1000 on CC. Cool, will look into getting RHB Smart then. Perhaps will ditch PSA instead of 360 The good thing about RHB is that in their webpage, where you viewing the savings account summary, there is a table showing which of the criteria you have already met for the month. No need to sendiri keep track in some excel sheet. It even shows degree to which you've achieved (so e.g. for the CC spend might show "you have spent RM500" and the target is RM1000. For me I see no issue to achieve. I think most difficult is CC RM1000 (bill payment just pay RM1 x 3 to TNB or something), that one really depend your spending pattern/habit. I will say their Shell Visa can use to reload ewallet though. |

|

|

Oct 14 2022, 09:15 AM Oct 14 2022, 09:15 AM

|

Senior Member

6,265 posts Joined: Jul 2005 From: UEP Subang Jaya |

QUOTE(Hinote @ Oct 13 2022, 03:12 PM) Cool, will look into getting RHB Smart then. Perhaps will ditch PSA instead of 360 Thing is, which is the best rate can change over time as the banks readjust their offerings. For me, between me and wife we have all 3, just hold and use whichever is the best at that point in time. Both RHB and SCB got at least one useful CC to link with it anyway which we would use, only OCBC CC seem a bit lousy (still remember the Titanium days...). |

|

|

Oct 14 2022, 09:23 AM Oct 14 2022, 09:23 AM

|

All Stars

18,416 posts Joined: Oct 2010 |

QUOTE(LostAndFound @ Oct 14 2022, 09:15 AM) Thing is, which is the best rate can change over time as the banks readjust their offerings. For me, between me and wife we have all 3, just hold and use whichever is the best at that point in time. Both RHB and SCB got at least one useful CC to link with it anyway which we would use, only OCBC CC seem a bit lousy (still remember the Titanium days...). I find titanium very useful with its unlimited 1% cb for most ewallet. |

|

|

Oct 14 2022, 10:52 AM Oct 14 2022, 10:52 AM

|

Senior Member

6,265 posts Joined: Jul 2005 From: UEP Subang Jaya |

QUOTE(MGM @ Oct 14 2022, 09:23 AM) The 5% years back was so much better though. yap1992 liked this post

|

|

|

Oct 14 2022, 12:15 PM Oct 14 2022, 12:15 PM

Show posts by this member only | IPv6 | Post

#1552

|

Senior Member

5,551 posts Joined: Aug 2011 |

QUOTE(LostAndFound @ Oct 14 2022, 09:15 AM) Thing is, which is the best rate can change over time as the banks readjust their offerings. For me, between me and wife we have all 3, just hold and use whichever is the best at that point in time. Both RHB and SCB got at least one useful CC to link with it anyway which we would use, only OCBC CC seem a bit lousy (still remember the Titanium days...). Still waiting for RHB Smart % revision, not sure what they're waiting for though. |

|

|

Jan 31 2023, 10:30 AM Jan 31 2023, 10:30 AM

|

All Stars

65,306 posts Joined: Jan 2003 |

Revision to Privilege$aver Campaign Terms and Conditions effective 1 February 2023

https://www.sc.com/my/important-information...r-campaign-tcs/ |

|

|

|

|

|

Jan 31 2023, 01:47 PM Jan 31 2023, 01:47 PM

|

All Stars

17,500 posts Joined: Feb 2006 From: KL |

QUOTE(cybpsych @ Jan 31 2023, 10:30 AM) Revision to Privilege$aver Campaign Terms and Conditions effective 1 February 2023 any good?https://www.sc.com/my/important-information...r-campaign-tcs/ |

|

|

Feb 1 2023, 05:51 AM Feb 1 2023, 05:51 AM

|

Junior Member

654 posts Joined: May 2020 |

|

|

|

Feb 1 2023, 06:27 AM Feb 1 2023, 06:27 AM

|

All Stars

18,416 posts Joined: Oct 2010 |

Will stop using this cos find the bonus loyalty not attainable for my usage. Luckily got ocbc360 n will explore rhb smart account.

|

|

|

Feb 1 2023, 06:53 AM Feb 1 2023, 06:53 AM

|

Junior Member

654 posts Joined: May 2020 |

|

|

|

Feb 1 2023, 06:59 AM Feb 1 2023, 06:59 AM

|

Senior Member

889 posts Joined: Jun 2008 |

It looks more work to do for bonus loyalty. When OPR went down, SC quickly revise interest rates down. But now when OPR gone up, they don't bother increase interest rate. Instead they add another stupid requirement. Looks like I have to move my deposit to FD or somewhere else, much more easy.

|

|

|

Feb 1 2023, 08:16 AM Feb 1 2023, 08:16 AM

|

All Stars

18,416 posts Joined: Oct 2010 |

QUOTE(datolee32 @ Feb 1 2023, 06:53 AM) If cashflow less than RM50k and RM30k, can try KDI 3.5% and Versa 4%, withdrawal within 1-2 days, interest calculate daily. For these 2, withdrawal needs planning so I will stick to those high interest CASA with instant withdrawal for my 20+ cc payment. datolee32 liked this post

|

|

|

Feb 1 2023, 09:14 AM Feb 1 2023, 09:14 AM

Show posts by this member only | IPv6 | Post

#1560

|

Junior Member

313 posts Joined: Mar 2010 From: Kuala Lumpur |

QUOTE(LostAndFound @ Oct 2 2022, 06:23 AM) Depends on your usage of course. RHB need 3x bill payment (no minimum amount), transfer in RM2000 (I think, can't remember exact amount but around there), and spend RM1000 on CC. Just deposit RM2k and pay 6 times bill you can get the entire 3.3%. Dont need to spend RM1k to fulfill the requirement.The good thing about RHB is that in their webpage, where you viewing the savings account summary, there is a table showing which of the criteria you have already met for the month. No need to sendiri keep track in some excel sheet. It even shows degree to which you've achieved (so e.g. for the CC spend might show "you have spent RM500" and the target is RM1000. For me I see no issue to achieve. I think most difficult is CC RM1000 (bill payment just pay RM1 x 3 to TNB or something), that one really depend your spending pattern/habit. I will say their Shell Visa can use to reload ewallet though. |

| Change to: |  0.0930sec 0.0930sec

0.40 0.40

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 07:38 AM |