QUOTE(johnnyenglish123 @ Feb 9 2023, 04:38 PM)

Hi

I called cs yesterday, but still kinda blur. Any tips to get the quarterly 2%?

Eg:

every month put in 3k for 1 quarter. Can I withdraw that initial 9k at the beginning of 2nd quarter?

Thank youu

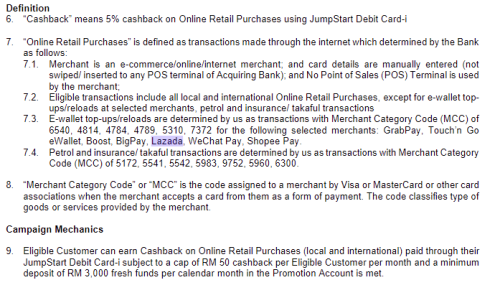

Let's say first quarter is Feb/Mar/April. On 1st Feb you have 10k inside. Your monthly balance must be 13k on average for February. I guess if you add 3k on 1st Feb then that should work. Maybe for safety you add a bit more.

Then March you need Feb monthly average balance +3k. Note that if you added a bit more for February this would affect your target amount here.

Then April you need Mar monthly average balance +3k.

This is doable if you treat this account as FD, no in/out money. For those of us who actively using the account, you will have a headache calculating monthly average balance.

Anyway after April, you still need to do the same in May/June and so on. But the workaround if you want... May you take out your money (put elsewhere). That means the Q2 (April to June) you don't get the bonus 2%.

If you have two individuals, both with SCB Privilege Savers, SCB credit card, and SCB debit card (for all the categories) you can cycle your money, one quarter in person A account, one quarter in person B account.

If you have only yourself, you can do one quarter here, another quarter put in RHB Smart-i/OCBC 360 or whatever.

And at the end.... you get AT MAX 4.15% which you could have gotten without hassle (and no spending requirements) from some promo FD. Am sure some will do it though.

Feb 1 2023, 12:31 PM

Feb 1 2023, 12:31 PM

Quote

Quote

0.0295sec

0.0295sec

0.62

0.62

6 queries

6 queries

GZIP Disabled

GZIP Disabled