livefx-campaignAchieve your FX Goals with LiveFX

We know how precious your time is. Now with LiveFX, you can easily access real-time FX rates, gain market insights, place limit orders and more.

For more information on LiveFX, click here.

https://www.sc.com/my/investments/livefx/Terms and Conditions

1. The Standard Chartered Bank Malaysia Berhad (“SCBMB”) and Standard Chartered Saadiq Berhad (“SCSB”) (collectively/singly, “Bank”) 2020 LiveFX Campaign (“Campaign”) commences from 16 November 2020 to 30 June 2021, inclusive of both dates (“Campaign Period”).

2. This Campaign is open to the Bank’s clients who fulfil all of the following conditions:

• Individuals aged 18 years old and above;

• Have maintained all their accounts with the Bank in good standing, without any breach of the terms and conditions or agreements;

• All clients of the Personal, Premium and/or Priority segments; and

• NOT a staff of either any of the following entities: Standard Chartered Bank Malaysia Berhad, Standard Chartered Saadiq Berhad, Global Business Services (M) Sdn Bhd; Price Solutions Sdn Bhd and Standard Chartered (SC) of other countries.

3. Only FX transactions booked by Clients through the LiveFX platform are qualified for calculating the total cumulative transacted amount but shall EXCLUDE the following transactions:

• booked by Bank’s staff on behalf of Clients; and/or

• booked by Clients but subsequently requested to be cancelled;

• limit orders that were placed but expired/cancelled.

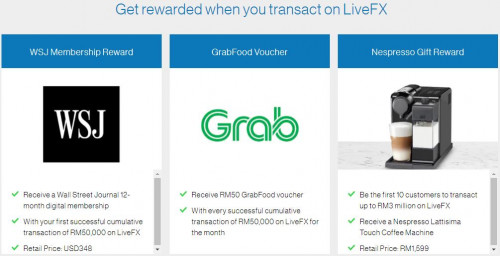

4. Clients are eligible to all 3 Rewards listed (not mutually exclusive).

5. Reward – Wall Street Journal Publication Membership:

• First 1,000 Clients to transact their first cumulative transacted amount of RM50,000 or equivalent in other currency (determined by the transacted timestamp in the Bank’s system) will receive a 12-month (1 year) Membership.

• Clients who have already received the Membership via other Bank’s promotions/campaigns as at the time of fulfilment will not be entitled for this Reward.

6. Reward – RM50 GrabFood Voucher:

• Clients with a cumulative RM50,000 or equivalent in other currency successfully transacted in LiveFX for the calendar month (determined by the transacted time stamp in the Bank’s system) will be eligible for the Voucher.

• The cumulative transacted amount will be observed on a calendar monthly basis.

7. Reward – Nespresso Coffee Machine Lattisima Touch Facelift:

• First 10 Clients who transact their first cumulative transacted amount of RM3,000,000 or equivalent in other currency (determined by the transacted time stamp in the Bank’s system) will be entitled to receive a Machine.

Click here for full LiveFX Campaign Terms and Conditions.

https://av.sc.com/my/content/docs/my-livefx-tcs.pdf

Feb 9 2021, 10:26 AM

Feb 9 2021, 10:26 AM

Quote

Quote

0.0325sec

0.0325sec

0.14

0.14

6 queries

6 queries

GZIP Disabled

GZIP Disabled