Outline ·

[ Standard ] ·

Linear+

Interactive Brokers (IBKR), IBKR users, welcome!

|

lee82gx

|

Sep 6 2024, 10:35 AM Sep 6 2024, 10:35 AM

|

|

QUOTE(TOS @ Sep 6 2024, 10:29 AM) I have the same question too. But Moomoo charges it anyway: https://www.moomoo.com/my/pricingI checked FSM Malaysia's charges for buying US shares, stamp duties are imposed as well: https://www.fsmone.com.my/pricing/stocksSo looks like you can't run away with it. thanks for the enlightenment. Looks like Anwar is hungry for tax, and I can't blame him. But he won't blame me if I legally evade it too. Doubling the fees for their customers without any added value is a good way to make oneself poor and competitors rich. |

|

|

|

|

|

Medufsaid

|

Sep 6 2024, 10:44 AM Sep 6 2024, 10:44 AM

|

|

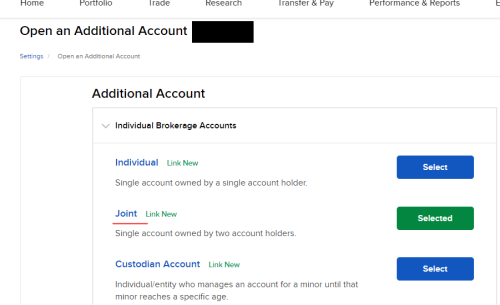

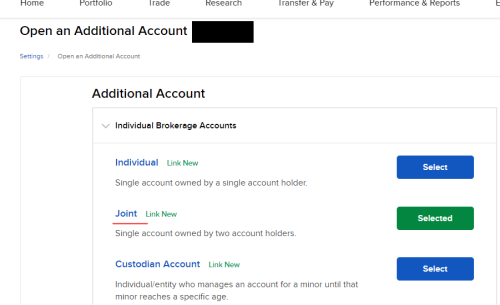

QUOTE(lee82gx @ Sep 6 2024, 10:21 AM) I'm also very much looking forward to re-opening a joint account with rights of survivorship with my wife. As of today if you already have an individual account they treat you like a terrorist / money launderer if you try to do this kind of changes via "chat" or phone call. did you close your individual account already? can try to open joint acct here  QUOTE(TOS @ Sep 6 2024, 10:29 AM) I have the same question too. But Moomoo charges it anyway: rakuten / webull etc all have to charge it This post has been edited by Medufsaid: Sep 16 2024, 07:58 AM |

|

|

|

|

|

sp3d2

|

Sep 6 2024, 10:59 AM Sep 6 2024, 10:59 AM

|

|

QUOTE(lee82gx @ Sep 6 2024, 10:21 AM) the most important thing IF IB comes to malaysia is survivorship / estate planning. You die as individual account holder, hopefully your heir can directly go to their office, present your will and death cert and they transfer the account to the heir. As of today, you send a pdf to HK office. Imagine the security and possible pitfalls. I'm also very much looking forward to re-opening a joint account with rights of survivorship with my wife. As of today if you already have an individual account they treat you like a terrorist / money launderer if you try to do this kind of changes via "chat" or phone call. im 100% agree with you. nowadays im very worried what will happened to all my investment in IBKR should i suddenly die. my family dont know a thing about how IBKR works. This post has been edited by sp3d2: Sep 6 2024, 11:00 AM |

|

|

|

|

|

SUSTOS

|

Sep 6 2024, 11:14 AM Sep 6 2024, 11:14 AM

|

|

QUOTE(sp3d2 @ Sep 6 2024, 10:59 AM) im 100% agree with you. nowadays im very worried what will happened to all my investment in IBKR should i suddenly die. my family dont know a thing about how IBKR works. Include your assets in a will, that would need to be drafted separately from your Malaysia's will (and that of other Commonwealth countries, if any) If your IBKR account is based in the UK, Australia or Singapore, then no worries, can include them in your will. If you have kids, expose them to investment world when they start to grow up... at least that's what I plan to do. This post has been edited by TOS: Sep 6 2024, 11:16 AM |

|

|

|

|

|

sp3d2

|

Sep 6 2024, 11:39 AM Sep 6 2024, 11:39 AM

|

|

QUOTE(TOS @ Sep 6 2024, 11:14 AM) Include your assets in a will, that would need to be drafted separately from your Malaysia's will (and that of other Commonwealth countries, if any) If your IBKR account is based in the UK, Australia or Singapore, then no worries, can include them in your will. If you have kids, expose them to investment world when they start to grow up... at least that's what I plan to do. thanks for your detailed response. my ibkr is US based, should i transfer it to singapore (as it is the nearest and easiest)? also what does it mean by 'separate will from Malaysia'? does it mean if let say my IBKR in US, i need to have will approved by US government using US lawyer? and If based in Singapore, i need to have a will using singapore goverment using Singapore lawyer? |

|

|

|

|

|

SUSTOS

|

Sep 6 2024, 11:47 AM Sep 6 2024, 11:47 AM

|

|

QUOTE(sp3d2 @ Sep 6 2024, 11:39 AM) thanks for your detailed response. my ibkr is US based, should i transfer it to singapore (as it is the nearest and easiest)? also what does it mean by 'separate will from Malaysia'? does it mean if let say my IBKR in US, i need to have will approved by US government using US lawyer? and If based in Singapore, i need to have a will using singapore goverment using Singapore lawyer? IBKR SG can only be opened by those with SG address (and SG FIN/NRIC number), so unlikely you can transfer over to SG unless you are SG resident. As for will for assets in foreign countries, this is one good advice: https://www.sinchew.com.my/news/20240603/finance/5650482https://www.kuekong.com/?p=22054https://www.yeolaw.my/%E5%A4%96%E5%9B%BD%E9...AE%A4%E5%90%97/There are lawyers in Malaysia who understand US estate laws which can help you in drafting will for your will for your IBKR assets. I don't expect the charges to come cheap nevertheless.  One of my old female classmate is now a lawyer in Penang (practising), but she's busy reading cases... too bad can't ask her much lol My asset (and foreign asset) is still too small to worth seeing a lawyer for will preparation... some years later when it grows into the millions I will update you guys here again on IBKR US estate issue... This post has been edited by TOS: Sep 6 2024, 11:48 AM |

|

|

|

|

|

lee82gx

|

Sep 6 2024, 12:03 PM Sep 6 2024, 12:03 PM

|

|

QUOTE(sp3d2 @ Sep 6 2024, 10:59 AM) im 100% agree with you. nowadays im very worried what will happened to all my investment in IBKR should i suddenly die. my family dont know a thing about how IBKR works. I thought I opened an SG account, but I believe mine is handled via Hong Kong. This was what the chat customer service told me. |

|

|

|

|

|

Medufsaid

|

Sep 6 2024, 01:02 PM Sep 6 2024, 01:02 PM

|

|

QUOTE(sp3d2 @ Sep 6 2024, 11:39 AM) my ibkr is US based, should i transfer it to singapore (as it is the nearest and easiest)? just open joint ibkr acct with your partner. if cannot, can consider to move to Moomoo Singapore QUOTE(lee82gx @ Sep 6 2024, 12:03 PM) I thought I opened an SG account, but I believe mine is handled via Hong Kong. This was what the chat customer service told me. just generate your report statement, if it's IBKR HK it'll show as such. mine is IBKR LLC  if TOS generates, his will be IBKR UK (since he opened it via tradestation) This post has been edited by Medufsaid: Sep 6 2024, 01:03 PM |

|

|

|

|

|

SUSTOS

|

Sep 6 2024, 01:05 PM Sep 6 2024, 01:05 PM

|

|

QUOTE(Medufsaid @ Sep 6 2024, 01:02 PM) just open joint ibkr acct with your partner. if cannot, can consider to move to Moomoo Singaporejust generate your report statement, if it's IBKR HK it'll show as such. mine is IBKR LLC  if TOS generates, his will be IBKR UK (since he opened it via tradestation) No, mine changed to IBKR LLC liao. I switched to LLC (US side) at the end of 2022 (account transfer finalized April last year with the closure of IBKR UK account).  |

|

|

|

|

|

kelvinfixx

|

Sep 6 2024, 01:06 PM Sep 6 2024, 01:06 PM

|

|

QUOTE(sp3d2 @ Sep 6 2024, 10:59 AM) im 100% agree with you. nowadays im very worried what will happened to all my investment in IBKR should i suddenly die. my family dont know a thing about how IBKR works. Yes, my will cover all asset and broker that is register in Malaysia. If your family dunno you have IBKR account, it may be gone just like that. This post has been edited by kelvinfixx: Sep 6 2024, 01:07 PM |

|

|

|

|

|

Ziet Inv

|

Sep 6 2024, 03:40 PM Sep 6 2024, 03:40 PM

|

|

QUOTE(lee82gx @ Sep 6 2024, 10:21 AM) the most important thing IF IB comes to malaysia is survivorship / estate planning. You die as individual account holder, hopefully your heir can directly go to their office, present your will and death cert and they transfer the account to the heir. As of today, you send a pdf to HK office. Imagine the security and possible pitfalls. I'm also very much looking forward to re-opening a joint account with rights of survivorship with my wife. As of today if you already have an individual account they treat you like a terrorist / money launderer if you try to do this kind of changes via "chat" or phone call. great point, and i totally agree with this! plus, the "transparency" of holding an account with movements tracked/linked to the BNM's system - really just helps with users from not having to worry about moving their funds (esp big amount) offshore/back to malaysia down the road |

|

|

|

|

|

Medufsaid

|

Sep 6 2024, 09:27 PM Sep 6 2024, 09:27 PM

|

|

BMDB did a webinar for IBKR last month... let's see what takeaway i'll have after watching the recording https://www.interactivebrokers.com/campus/w...vatives-market/--update-- ok nothing relevant. will just email the speaker This post has been edited by Medufsaid: Sep 6 2024, 09:36 PM |

|

|

|

|

|

SUSTOS

|

Sep 7 2024, 12:54 AM Sep 7 2024, 12:54 AM

|

|

QUOTE(TOS @ Sep 5 2024, 08:13 PM) Sold iFAST, bought Hermes today... Catching the falling knife requires lots of guts, especially when it's a heavy one!  Shit. Lost 90 EUR in 24 hours!  Gonna average down my EPA: RMS position soon...  I notice IBKR will deduct the 0.3% Financial Transaction Tax (FFT) one day after your purchase of French stock*. I paid nearly 6 EUR of tax to the French government for my purchase of Hermes shares 2 days ago... *My Hermes stock trade was executed on SBF (EPA, Euronext Paris) with 1.61 EUR commissions. I used SMART routing after noticing that the reported stock price dropped below my BATS and CHI-X ETNs' limit order price but the orders still had not been filled. This post has been edited by TOS: Sep 7 2024, 01:04 AM |

|

|

|

|

|

SUSTOS

|

Sep 9 2024, 12:40 AM Sep 9 2024, 12:40 AM

|

|

After parking USD at DBS for nearly 2 years, it's time to reverse the flow of money back to IBKR. USD 2 month yields 4.67% p.a. for DBS but 2-month T-bills still yields 5.14% p.a. (50 basis points spread!  ) and given the 30% WHT refund will come next February which is not too far from now, it makes more sense to go back to BIL ETF. First time doing it in reverse and first time using DBS Remit. Anyone send USD to IBKR via DBS Remit before? Are there any incoming charges from Citibank for the IBKR side (receiving bank side)? I know it's free on DBS (sender side) using DBS Remit, but receiver side not so sure.  |

|

|

|

|

|

Medufsaid

|

Sep 9 2024, 03:29 AM Sep 9 2024, 03:29 AM

|

|

TOS online says that IBKR USD (in singapore) is using DBS?

This post has been edited by Medufsaid: Sep 9 2024, 03:36 AM

|

|

|

|

|

|

SUSTOS

|

Sep 9 2024, 10:29 AM Sep 9 2024, 10:29 AM

|

|

QUOTE(Medufsaid @ Sep 9 2024, 03:29 AM) TOS online says that IBKR USD (in singapore) is using DBS? Oh that's probably for IBKR SG users. Mine is IBKR LLC, money sent directly to CITIBANK N.A (CITIUS33XXX). Make sure you guys fill up the ABA Routing Number in the Clearing Code section during your transfer: https://www.dbs.com.sg/ibanking/help/faq/clearing-code.html |

|

|

|

|

|

Medufsaid

|

Sep 9 2024, 10:39 AM Sep 9 2024, 10:39 AM

|

|

TOS wow if that's the case, I wonder if more cost effective to open moomoo sg acct (directly or via moomoo my) and buy $BIL there

|

|

|

|

|

|

SUSTOS

|

Sep 9 2024, 10:39 AM Sep 9 2024, 10:39 AM

|

|

QUOTE(TOS @ Sep 9 2024, 10:29 AM) Oh that's probably for IBKR SG users. Mine is IBKR LLC, money sent directly to CITIBANK N.A (CITIUS33XXX). Make sure you guys fill up the ABA Routing Number in the Clearing Code section during your transfer: https://www.dbs.com.sg/ibanking/help/faq/clearing-code.htmlSent liao sent liao. Money is out!  |

|

|

|

|

|

SUSTOS

|

Sep 9 2024, 08:34 PM Sep 9 2024, 08:34 PM

|

|

Citibank received money at 8 pm, confirmed by DBS via email and notification on phone.  And money is available for trading within the same day!  DBS Remit is fast! No money deducted from IBKR side or Citibank's side!  |

|

|

|

|

|

SUSTOS

|

Sep 12 2024, 11:41 PM Sep 12 2024, 11:41 PM

|

|

https://robbreport.com/style/menswear/herme...ian-1235821303/Didn't know Hermes ban consultants... that's good for the company. Had they followed Gucci they would suffer horribly now.

|

|

|

|

|

Sep 6 2024, 10:35 AM

Sep 6 2024, 10:35 AM

Quote

Quote

0.1538sec

0.1538sec

0.68

0.68

6 queries

6 queries

GZIP Disabled

GZIP Disabled