QUOTE(Cubalagi @ May 4 2020, 10:28 AM)

I don't like HSI. As you said, it's 70% China. The other 30% is HK. And I'm rather bearish of HK future.

I prefer HSCEI compared to HSI, that's pure 100% China HK stocks. Look at 2828 for HSCEI exposure.

2828 could be an even better choice, I am in the same line with you on HK's outlook.

Can I understand that 2828 is basically 2800 minus the HK companies (like HSBC).

QUOTE(Cubalagi @ May 4 2020, 10:28 AM)

Or you can even go for direct A shares exposure via 2822 or 2823. This is A50. Good thing about A share is that as foreign investor have limited access, the correlation is very weak with global markets. Low correlation is good for diversification purpose.

Low correlation is often understated, and diversification is key.

Right now all indexes globally are too correlated.

QUOTE(Cubalagi @ May 4 2020, 10:28 AM)

I have owned HSCEI and A50 etfs over the years, going in and out. The main problem with HSI, HSCEI and A50, are the high concentration of banks in the indices. Same like KLCI and STI. I think current recession will cause banks to underperform.

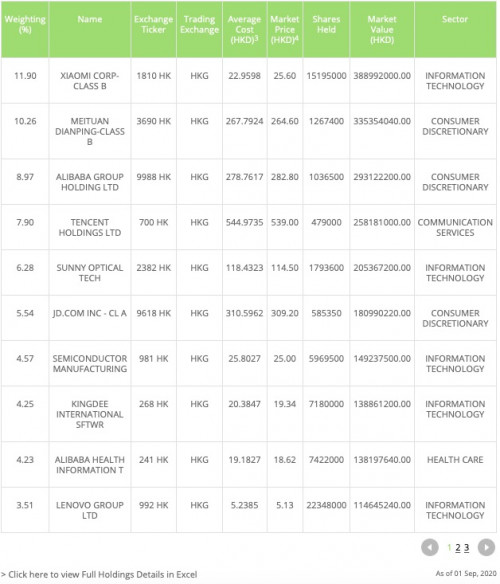

They also don't have enough exposure to the new companies, Iike the US listed Chinese giant tech stocks like Ali Baba, JD.com, Baidu. And even HK listed Meituan Dianping (grab food, food panda of China). How can one claim to invest in China without exposure to these companies?

I admit that the FAANGs of China have not monopolized China's index like what happened in the US. It bites both ways I guess, if tech stocks drops basically most US Indexes will go down.

Indeed KLCI and STI are heavy on banks, if US is any indication the banks' weightage will drop. But also then again, banks is a local business and tech is not. US tech companies are able to take the world, but the same cannot be said of Malaysia and Singapore tech companies. So it could be a decade before the regional banks being taken out from the indexes like what happened to US, if ever.

QUOTE(Cubalagi @ May 4 2020, 10:28 AM)

My view, to invest in China now, I rather go for the new economy types. My preference will be the smaller etfs eg:

2812: Global China new economy: US listed, HK listed and China mainland listed

3173: pure China mainland listed new economy. Lots of Chinese biotech and Healthcare exposure.

You maybe suprised to know that my main China exposure is via 0829EA on Bursa Malaysia. This is only US China stocks and HK China stocks, no A shares. So it's not like 2812 which has A shares, but it's wider in terms of industries. But important is cheaper transaction costs. But if I want to add my China exposure 3173 will be on my shopping list.

I sometimes have reservations about smaller company whose market cap is less than 1B USD, are 2812 and 3173 big companies in the new economy, or smaller ones?

Sep 4 2019, 08:59 PM, updated 2 months ago

Sep 4 2019, 08:59 PM, updated 2 months ago

Quote

Quote

0.2047sec

0.2047sec

0.41

0.41

6 queries

6 queries

GZIP Disabled

GZIP Disabled