Link REIT seems to be climbing up for the past few days. Today up about 1% The worst is over?

Hong Kong Exchange & HK Stocks, Per title post-Extradition Bill W/drawal

Hong Kong Exchange & HK Stocks, Per title post-Extradition Bill W/drawal

|

|

Jan 16 2020, 01:18 PM Jan 16 2020, 01:18 PM

Return to original view | Post

#1

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Link REIT seems to be climbing up for the past few days. Today up about 1% The worst is over?

|

|

|

|

|

|

Jan 16 2020, 09:36 PM Jan 16 2020, 09:36 PM

Return to original view | Post

#2

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(moosset @ Jan 16 2020, 05:03 PM) Their portfolio tends to be more resilient during though times as they mainly service public housing community. And they show good move in diversifying their portfolio into developed markets like Australia (with the purchase of 100 Market Street) recently. I am aware of Fortune REIT but didn't have much holdings in it. Link is more established than Fortune and has been a favourite stock for dividend-hungry investors for years. I love its low gearing in particular, probably the lowest among all high quality REITs in SG and HK. That said, Link has a very bad reputation in treating the underprivileged tenants in the past. A very immoral company. Too bad I have too little shares to voice out for them... So, you prefer Fortune over Link? Why? |

|

|

Jan 17 2020, 02:04 PM Jan 17 2020, 02:04 PM

Return to original view | Post

#3

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Link REIT up another 1% today! Shanghai and Hang Seng index a little red.

|

|

|

Jan 29 2020, 02:38 PM Jan 29 2020, 02:38 PM

Return to original view | IPv6 | Post

#4

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(moosset @ Jan 29 2020, 10:31 AM) Who knows if it can dip below 75 HKD? Everyone is afraid of virus. Nonsense. Viruses are everywhere. It's not like people don't need to eat or drink when SARS hit in 2003. Markets are too efficient at digesting information! It seems. |

|

|

Jan 29 2020, 08:07 PM Jan 29 2020, 08:07 PM

Return to original view | IPv6 | Post

#5

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(moosset @ Jan 29 2020, 05:10 PM) As said earlier, I am currently purchasing through mutual funds, which as some members claimed, are expensive. No plan to open a brokerage account yet, as I am too poor to even pay for the deposit for opening an IBKR whitelabel account. if I were to purchase through Manulife AP REIT, I need to wait for BOTH HK and S-REITS to go red, then only before 3pm on that day, I will purchase the units. That's what I did for the past few months. For me personally, I will go long on S-REITs as Singapore is politically stable and most S-REITs are now in active acquisition (most of which are DPU accretive) in the midst of low interest rate. I would expect the benefits to be reaped in the future, so AP REIT quite suits my taste. That said, HK-REITs like Link REIT should be pretty resilient in time to come though the risk of privatization is high (if they keep squeezing money out of the underprivileged public housing community). Yuexiu REIT has quite a number of properties in mainland China, which would add to some growth aspects if included in one's portfolio. This post has been edited by TOS: Jan 29 2020, 08:12 PM |

|

|

Jan 30 2020, 04:26 PM Jan 30 2020, 04:26 PM

Return to original view | IPv6 | Post

#6

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Hansel @ Jan 30 2020, 12:25 PM) Wahh, bro,.. to your first paragraph in the above,.. you need to 'jaga' everyday,... but I respected your initiative in wanting to invest. Haha. Thanks. Mostly checking the monthly fund reports to make sure the manager's investment outlook is the same as mine.To yr second paragraph, yeah,... I am of the same opinion. I can't bring myself to investing into HK REITs because of :- 1) all payout only twice per year. 2) yields are not so good compared to SG REITs, especially the popular Link REIT. 3) forex risks when I wished to take back my funds in SGD. Link REIT is more of a growth stock to me, as most of its ROE comes from increase in share price, aka capital gains and not dividend. The dividend yield is just a mediocre 3%. Most local HK investors (excluding the traders) go for HSBC for its yield. Others aim for rental shares like Wharf, Swire Properties and SHK. Or pick utilities stocks like towngas, CLP etc. These blue chips are the to-go for most HK investors, especially those dividend chasers. For me though, I am positive that the HK-REIT managers will slowly diversify their portfolio in time to come after they learnt their lessons. Link is aiming for at least 10-15% in developed markets, for example. Their recent 100 Market Street acquisition in Australia marks a milestone. Agreed on the forex part. Need to check SGD against USD (since HKD pegged to USD) This post has been edited by TOS: Jan 30 2020, 04:26 PM |

|

|

|

|

|

Feb 3 2020, 10:13 AM Feb 3 2020, 10:13 AM

Return to original view | IPv6 | Post

#7

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(kart @ Jan 31 2020, 08:10 PM) Sorry, off topic a bit. Thanks for the info. But I am not based in Singapore, can open an account there? I asked about opening a bank account in Singapore when I was an intern back there in the open SG bank account thread and was already recommended by members there not to open an account. Have you considered opening a prefunded trading account in Maybank Kim Eng, at least for trading in S-REIT? No deposit is required. You are only needed to top up an amount, based on the amount of shares you intend to buy. If opening a bank account as an intern is already so hard, I can't imagine how it is possible to open a stock trade account as a foreigner. Maybe have to wait till I work there? |

|

|

Feb 3 2020, 11:27 AM Feb 3 2020, 11:27 AM

Return to original view | IPv6 | Post

#8

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(moosset @ Feb 3 2020, 10:29 AM) by the way, what's the reason LINK and Fortune keep going down since July 2019? Is it just the protest? can definitely open lah .... MY & SG are like brothers! try to read the other thread about opening a bank account in SG. QUOTE(Ramjade @ Feb 3 2020, 10:34 AM) Go open. If you are working as intern you are paid right? Easier to open. If you have no connection to SG, not working or studying there basically all banks will turn you down. Still can open. Not impossible. Problem is, I only have cousins staying in SG (work and stay there), and me myself not working or studying there. My internship is over and basically I have to pay for my internship instead of the company paying me. I am back at Malaysia now, anyway. I do have a HK bank account, since I am studying there. But I invest in HK & SG REITs and shares through unit trusts rather than directly in the exchange as I don't have sufficient cash to open a brokerage account at IBKR's whitelabels. 1000 USD is a lot for me (Tradestation Global). Need to wait till I work. No choice, have to contend with 2-3% off my investment return due to tonnes of charges. This post has been edited by TOS: Feb 3 2020, 11:27 AM |

|

|

Feb 4 2020, 09:19 PM Feb 4 2020, 09:19 PM

Return to original view | IPv6 | Post

#9

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(apathen @ Feb 4 2020, 05:29 PM) Thanks for introducing this broker. I remain doubtful on the zero-commission business model.Not sure how true is this: https://apenquotes.wordpress.com/2017/10/10...e-8-securities/ I don't like to trade HK shares as the regulations there are slightly loser compared to Singapore, will prefer US S&P 500 ETF, but then there is 30% WHT. So, have to go for UCITS instead. I will not work in HK upon graduation as I prefer to stay and work in Singapore after I graduate. So, a HK brokerage account may not be a good option, more so given the bleak future of HK. Tradestation global may be a suitable one for me, I think. |

|

|

Feb 5 2020, 01:20 PM Feb 5 2020, 01:20 PM

Return to original view | Post

#10

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(apathen @ Feb 4 2020, 10:18 PM) reason why i said 8 securities suit you now because you have hk bank account and remittance fee is not an issue and you are there now to sign the document best to open account now even later you work in SG also still can use, and you are still beginner with little capital, free fee can help you save a lot while learning. You don't have to buy hk share if no confident, but this is one of the few ways that you can buy china-h share direct. If you cannot trust hk securities commission then nothing to say, none of their licensed brokerage are safe then. No right or wrong, the choice is yours. QUOTE(markedestiny @ Feb 5 2020, 09:42 AM) 8Sec now is free of fees effective 1st Feb 2020 based on the email which I received recently. Understood. I will apply to Singapore uni soon as a backup. So, HK bank account may close anytime. I have opened this some time back but have not fund this account due to its strict requirement of having to use bank to transfer and receive funds and I don't have a local HK bank. Therefore unless you have a local HK based bank, using a Msia bank for this account will incur higher transfer cost on top of unfavorable exchange rate by the bank. Moreover, even if I have a HK account, I don't have much choice as a single lot for HK shares can be a few thousands HKD. I prefer blue chip dividend stocks and utility stocks, but then 8securities have dividend charges. I agree that H-shares are attractive, especially the HSI constituents. Will have a look at this, anyway. Thanks for the info. |

|

|

Feb 5 2020, 03:18 PM Feb 5 2020, 03:18 PM

Return to original view | Post

#11

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

May 22 2020, 02:37 PM May 22 2020, 02:37 PM

Return to original view | IPv6 | Post

#12

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Link REIT... -9%

|

|

|

May 22 2020, 09:45 PM May 22 2020, 09:45 PM

Return to original view | IPv6 | Post

#13

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(moosset @ May 22 2020, 03:12 PM) I am afraid the return to normality might take far longer than expected. Bankers there already anticipate more exodus of talents and capital outflow (to be observed from HKMA data in the next few months). H-shares should be safer than local HK-oriented counters in the long run, as evident from the degree of sell-down today between the two. |

|

|

|

|

|

Jul 26 2020, 08:28 PM Jul 26 2020, 08:28 PM

Return to original view | IPv6 | Post

#14

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

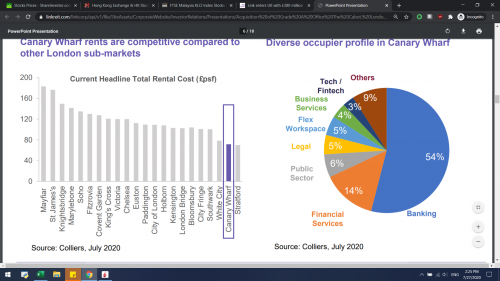

Link enters Europe!

Hooray. https://www.linkreit.com/en/media/news/110 Regulatory Announcement: https://www1.hkexnews.hk/listedco/listconew...20072600037.pdf Presentation Slides: https://www.linkreit.com/linkcorp/api/v1/fi...nal_Website.pdf Their major tenants are Morgan Stanley (Investment Bank) and the UK Competition and Markets Authority (CMA). Background news: https://www.mingtiandi.com/real-estate/outb...ys-european-hq/ This post has been edited by TOS: Jul 26 2020, 09:25 PM |

|

|

Jul 27 2020, 02:24 PM Jul 27 2020, 02:24 PM

Return to original view | IPv6 | Post

#15

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Hansel @ Jul 27 2020, 11:31 AM) Isn't there a risk that if the UK economy continues to deteriorate, the UK Govt may decide to be more prudent and cut down on number of premises rented ? After all,... usage of net today for govt matters is surfacing everywhere,... There is such risk, as stated in the regulatory announcement. But Canary Wharf's rent is actually cheaper than major London areas. And the fact that CMA is a finance-related tenant which has to "serve the markets and check for competitions" means it's a stable tenant as it needs to operate all year long. (M&As happen all the time, plus Morgan Stanley, just below CMA's office, is always on the looks for M&A fees to earn). Both looks like stable, anchor tenant to me.  I would worry more about the retail tenants at the ground floor, but that does not account for a significant portion of rent collected. This post has been edited by TOS: Jul 27 2020, 02:26 PM Hansel liked this post

|

|

|

Aug 3 2020, 02:08 PM Aug 3 2020, 02:08 PM

Return to original view | IPv6 | Post

#16

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Hang Seng Bank performance: https://www.hangseng.com/en-hk/about-us/inv...s-announcement/

|

|

|

Aug 7 2020, 05:28 PM Aug 7 2020, 05:28 PM

Return to original view | IPv6 | Post

#17

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Top-up my Chindia fund today. Anyone top-up Tencent and the likes?

|

|

|

Aug 12 2020, 04:38 PM Aug 12 2020, 04:38 PM

Return to original view | IPv6 | Post

#18

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(markedestiny @ Aug 11 2020, 04:21 PM) IMO you'll get more mileage with your investment if you purchase Tencent after the end of the deadline (45days from directive issued); just in case the situation gets worst... Ni problem. Just plugged in 100 MYR last week, armour still have a few "k"s... Ready to top-up anytime. But my Chidia fund just dropped 0.4-0.5% from the previous day (the day when tencent dropped sharply). So, perhaps the fund manager pulled out a lot during the sell-down. I expected a drop of 1% ++ in NAV. Never mind. Next time. |

|

|

Aug 28 2020, 01:19 PM Aug 28 2020, 01:19 PM

Return to original view | IPv6 | Post

#19

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

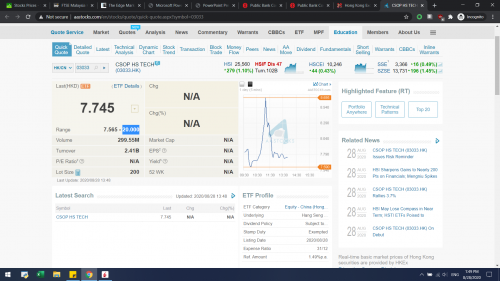

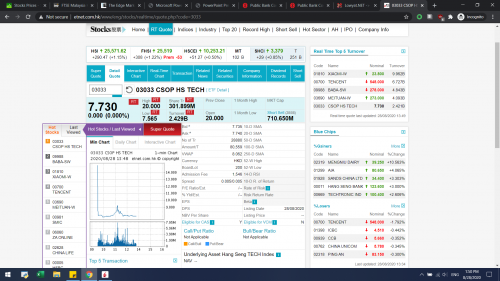

Just a reminder for those CSOP ETF investor:

https://www.mpfinance.com/fin/instantf2.php...&issue=20200828 (Sorry, it's in traditional Chinese as it is published in Ming Pao, a HK newspaper, can use Google Translate or seek help from investors here who can read in traditional Chinese.) A short summary: The ETF traded far above its NAV during the early trading session. CSOP would like to remind investors to understand the product (the ETF) and check if the pricing is correct and justified. At one point, the ETF traded at 20 HKD when the NAV is only around 7.5 HKD. Meanwhile, Hang Seng will offer its own Hang Seng Tech ETF next Friday to meet the huge demand from investors. This post has been edited by TOS: Aug 28 2020, 01:22 PM |

|

|

Aug 28 2020, 01:51 PM Aug 28 2020, 01:51 PM

Return to original view | IPv6 | Post

#20

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(AVFAN @ Aug 28 2020, 01:44 PM) the hkd20 price wasn't real, i think... some market maker indication only. The range clearly shows 20 at the other end.but it did go to a high of 9.10. it is now 7.745. http://www.aastocks.com/en/stocks/quote/qu...px?symbol=03033 like our bursa kaki's... goreng anything under the sun.   http://www.etnet.com.hk/www/eng/stocks/rea...e.php?code=3033 True, everything just goreng. |

| Change to: |  0.0646sec 0.0646sec

0.64 0.64

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 08:07 PM |