QUOTE

China Is Planning a Bigger Ant Crackdown With Bank Funding Curbs

NOVEMBER 04, 2020

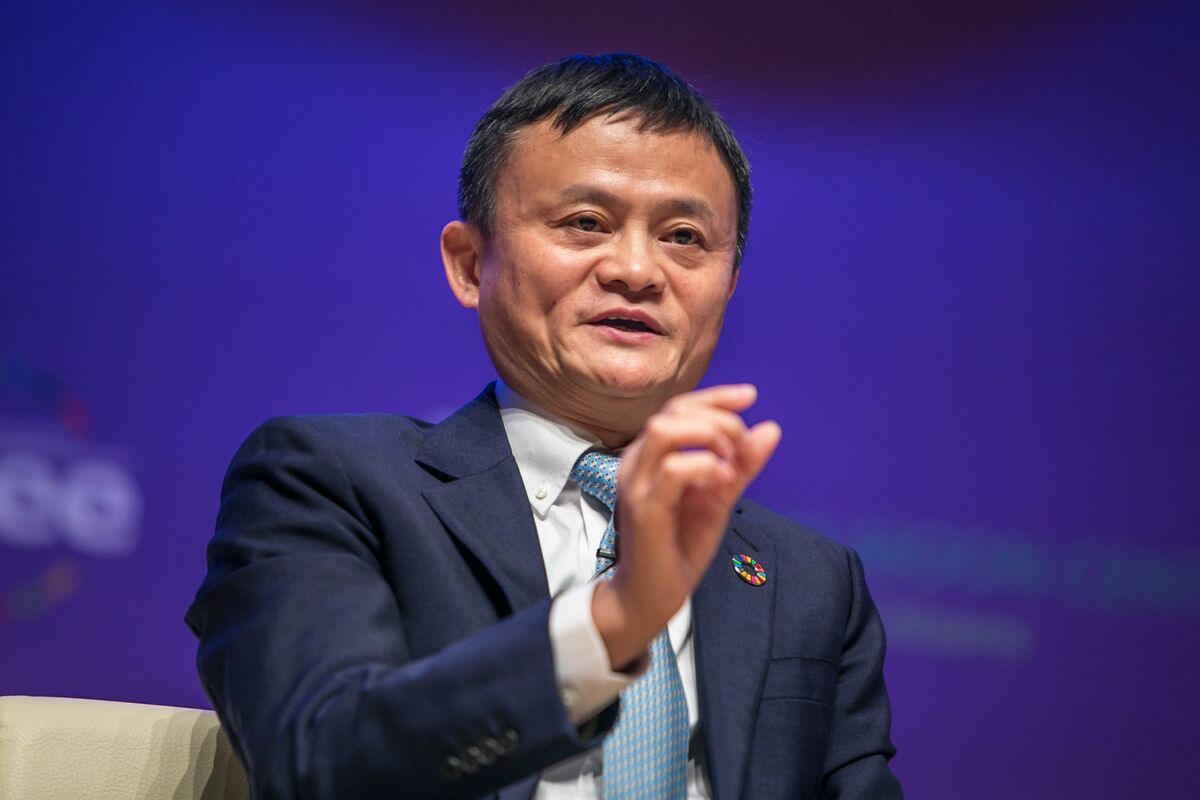

The shock suspension of Ant Group Co.’s $35 billion initial public offering is just the beginning of a renewed campaign by China to rein in the fintech empire controlled by Jack Ma.

Authorities are now setting their sights on Ant’s biggest source of revenue: its credit platforms that funnel loans from banks and other financial institutions to millions of consumers across China, according to people familiar with the matter.

The China Banking and Insurance Regulatory Commission plans to discourage lenders from using Ant’s platforms and has already asked some to ensure their portfolios are compliant with stringent draft regulations announced on Monday, said the people, who asked not to be identified discussing private information.

The proposed measures, which call for platform operators to provide at least 30% of the funding for loans, would render many of Ant’s existing transactions non-compliant. The company currently keeps about 2% of loans on its own balance sheet, with the rest funded by third parties or packaged as securities and sold on.

The full scope of China’s plans for Ant are unclear, and it’s possible that lenders will continue to work with the company once it complies with regulators’ requests. Any suggestion that banks would stop using its platforms is “unsubstantiated,” Ant said in a response to questions from Bloomberg. “Ant will continue to support bank partners to make independent credit decisions and leverage Ant’s technology platforms to serve consumers and small businesses.”

https://www.bloomberg.com/news/articles/202...nd=premium-asia

NOVEMBER 04, 2020

The shock suspension of Ant Group Co.’s $35 billion initial public offering is just the beginning of a renewed campaign by China to rein in the fintech empire controlled by Jack Ma.

Authorities are now setting their sights on Ant’s biggest source of revenue: its credit platforms that funnel loans from banks and other financial institutions to millions of consumers across China, according to people familiar with the matter.

The China Banking and Insurance Regulatory Commission plans to discourage lenders from using Ant’s platforms and has already asked some to ensure their portfolios are compliant with stringent draft regulations announced on Monday, said the people, who asked not to be identified discussing private information.

The proposed measures, which call for platform operators to provide at least 30% of the funding for loans, would render many of Ant’s existing transactions non-compliant. The company currently keeps about 2% of loans on its own balance sheet, with the rest funded by third parties or packaged as securities and sold on.

The full scope of China’s plans for Ant are unclear, and it’s possible that lenders will continue to work with the company once it complies with regulators’ requests. Any suggestion that banks would stop using its platforms is “unsubstantiated,” Ant said in a response to questions from Bloomberg. “Ant will continue to support bank partners to make independent credit decisions and leverage Ant’s technology platforms to serve consumers and small businesses.”

https://www.bloomberg.com/news/articles/202...nd=premium-asia

Nov 4 2020, 11:21 PM

Nov 4 2020, 11:21 PM

Quote

Quote

0.0302sec

0.0302sec

0.61

0.61

6 queries

6 queries

GZIP Disabled

GZIP Disabled