QUOTE(furious and fast @ Apr 1 2020, 11:36 AM)

Good for you! Can cash out since you got handsome return and it's better than FD.

This post has been edited by GrumpyNooby: Apr 1 2020, 11:41 AM

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Apr 1 2020, 11:38 AM Apr 1 2020, 11:38 AM

Return to original view | IPv6 | Post

#81

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Apr 1 2020, 02:04 PM Apr 1 2020, 02:04 PM

Return to original view | IPv6 | Post

#82

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 1 2020, 02:09 PM Apr 1 2020, 02:09 PM

Return to original view | IPv6 | Post

#83

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 2 2020, 01:13 PM Apr 2 2020, 01:13 PM

Return to original view | IPv6 | Post

#84

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(cl.t @ Apr 2 2020, 01:12 PM) Which way is better to invest RM2,000 every month? -deleted-A) Invest RM2,000 at one time beginning of the month B) Split into RM500 and invest weekly for 4 times a month Please follow victorian advice, he said doesn't matter! Sorry, I'm stupid and not qualified to give any advices. This post has been edited by GrumpyNooby: Apr 2 2020, 01:52 PM |

|

|

Apr 2 2020, 01:18 PM Apr 2 2020, 01:18 PM

Return to original view | IPv6 | Post

#85

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(victorian @ Apr 2 2020, 01:17 PM) But then DCAing your DCA would not make more sense right? The purpose of DCA is to split the risk over the long run, which you have already did by investing monthly. By splitting that to weekly, you are not any better off in the long run. What you are trying to do is to time the market, and no one can do that. -deleted-This post has been edited by GrumpyNooby: Apr 2 2020, 01:50 PM |

|

|

Apr 2 2020, 01:50 PM Apr 2 2020, 01:50 PM

Return to original view | IPv6 | Post

#86

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(victorian @ Apr 2 2020, 01:49 PM) If he entered lump sum at the beginning of the month at a lower price, he would’ve ended up with more units than he would, if he split it into weekly. Vice versa, if the beginning of the month is expensive, he wouldve ended up with less unit. -deleted- So at the end of the day, are you trying to time the market? You win! OK! This post has been edited by GrumpyNooby: Apr 2 2020, 01:51 PM |

|

|

|

|

|

Apr 2 2020, 01:58 PM Apr 2 2020, 01:58 PM

Return to original view | IPv6 | Post

#87

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 2 2020, 03:35 PM Apr 2 2020, 03:35 PM

Return to original view | IPv6 | Post

#88

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Zdes @ Apr 2 2020, 03:32 PM) Hi, quick question. How to remove the risk index limiter? Based on the questions, my risk profile doesn't allow me to invest more than 22% risk index. Few weeks ago I saw someone shared there's a way to remove it. But kinda far to scroll back haha... How can I have access to all risk levels?If you would like access to all risk levels i.e our higher risk portfolios, there is a short, free online course (will take approximately 2 hours) by SGX that you can take. If you score above 90%, please forward the results from SGX to us, and we will be able to open up all risk levels for you. FAQ in SAMY: https://www.stashaway.my/faq/115001841974-h...all-risk-levels Definition of higher risk profiles at SASG: https://www.stashaway.sg/r/introducing-high...risk-portfolios Online Course by SGX: https://onlineeducation.sgx.com/specifiedinvestmentproducts/ This post has been edited by GrumpyNooby: Apr 2 2020, 03:47 PM |

|

|

Apr 2 2020, 03:45 PM Apr 2 2020, 03:45 PM

Return to original view | IPv6 | Post

#89

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Zdes @ Apr 2 2020, 03:44 PM) How can I have access to all risk levels?If you would like access to all risk levels i.e our higher risk portfolios, there is a short, free online course (will take approximately 2 hours) by SGX that you can take. If you score above 90%, please forward the results from SGX to us, and we will be able to open up all risk levels for you. FAQ in SAMY: https://www.stashaway.my/faq/115001841974-h...all-risk-levels This post has been edited by GrumpyNooby: Apr 2 2020, 03:47 PM |

|

|

Apr 3 2020, 09:21 AM Apr 3 2020, 09:21 AM

Return to original view | IPv6 | Post

#90

|

All Stars

12,387 posts Joined: Feb 2020 |

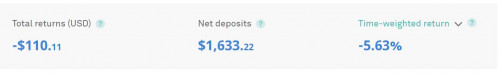

QUOTE(furious and fast @ Apr 3 2020, 09:20 AM) with the benefit of hindsight, anyone who had been doing DCA over the past few months or past few years would be in a LOSS position now. So you can time the market very well? let me give example of doing the opposite of DCA 1. i had been saving money in FD since 2019. guarantee 4% per annum. zero risk 2. i deposit 10k in stashaway on 18 march 3. i exit on 1 April. REALIZED quick n easy profit 6%.    |

|

|

Apr 3 2020, 09:24 AM Apr 3 2020, 09:24 AM

Return to original view | IPv6 | Post

#91

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 3 2020, 09:28 AM Apr 3 2020, 09:28 AM

Return to original view | IPv6 | Post

#92

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 3 2020, 09:33 AM Apr 3 2020, 09:33 AM

Return to original view | IPv6 | Post

#93

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Apr 4 2020, 06:49 PM Apr 4 2020, 06:49 PM

Return to original view | IPv6 | Post

#94

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(MasterConfucion @ Apr 4 2020, 06:16 PM) QUOTE(MasterConfucion @ Apr 4 2020, 06:16 PM) This is not bank account, FD nor Bursa Malaysia trading. I'm not sure if you know what SAMY is all about first. |

|

|

Apr 4 2020, 07:19 PM Apr 4 2020, 07:19 PM

Return to original view | IPv6 | Post

#95

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 4 2020, 07:35 PM Apr 4 2020, 07:35 PM

Return to original view | IPv6 | Post

#96

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 4 2020, 10:06 PM Apr 4 2020, 10:06 PM

Return to original view | IPv6 | Post

#97

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 5 2020, 04:04 PM Apr 5 2020, 04:04 PM

Return to original view | IPv6 | Post

#98

|

All Stars

12,387 posts Joined: Feb 2020 |

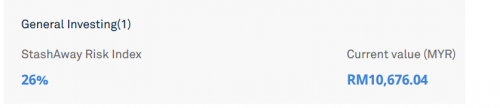

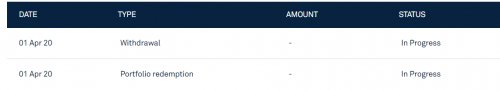

Then, I need to withdraw once it hits break even point since there's no transparency in this company and it's very concerning due to the undisclosed AUM.

Gosh, what had I gotten into! Dam ... This post has been edited by GrumpyNooby: Apr 5 2020, 04:04 PM |

|

|

Apr 5 2020, 04:47 PM Apr 5 2020, 04:47 PM

Return to original view | IPv6 | Post

#99

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Apr 6 2020, 11:10 AM Apr 6 2020, 11:10 AM

Return to original view | IPv6 | Post

#100

|

All Stars

12,387 posts Joined: Feb 2020 |

BNM said banks in MY are well capitalized.

|

| Change to: |  0.4022sec 0.4022sec

0.59 0.59

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 29th November 2025 - 02:58 AM |