Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

GrumpyNooby

|

Mar 10 2020, 08:40 AM Mar 10 2020, 08:40 AM

|

|

QUOTE(BacktoBasics @ Mar 10 2020, 08:31 AM) Just another question.... FI wont be affected ?? such as bond funds? IR going down, bond prices goes up? When all hell breaks loose, nothing is safe except for gold, USD and Yen. US treasure and Deutsch bunds are considered safe haven too. |

|

|

|

|

|

GrumpyNooby

|

Mar 10 2020, 08:49 AM Mar 10 2020, 08:49 AM

|

|

QUOTE(xcxa23 @ Mar 10 2020, 08:48 AM) I also want to know which FI too. This post has been edited by GrumpyNooby: Mar 10 2020, 08:49 AM |

|

|

|

|

|

GrumpyNooby

|

Mar 10 2020, 08:54 AM Mar 10 2020, 08:54 AM

|

|

QUOTE(-CoupeFanatic- @ Mar 10 2020, 08:52 AM) manyak manyak sifu here market drop = take less risk? or market drop = buy more? answer: no answer, depends on u It depends on your heart strength and your warchest. |

|

|

|

|

|

GrumpyNooby

|

Mar 10 2020, 09:06 AM Mar 10 2020, 09:06 AM

|

|

QUOTE(zstan @ Mar 10 2020, 09:03 AM) US treasury bonds rates are horrible nowadays. Institutional investors don't care the rates. You can see that Deutsch bunds are giving negative yields. This post has been edited by GrumpyNooby: Mar 10 2020, 09:06 AM |

|

|

|

|

|

GrumpyNooby

|

Mar 10 2020, 09:10 AM Mar 10 2020, 09:10 AM

|

|

QUOTE(BacktoBasics @ Mar 10 2020, 09:08 AM) alright thanks for the insight...so you top up on HG? hahahaha Tempted but I have no balls to go in. Plus I have no faith in gold. |

|

|

|

|

|

GrumpyNooby

|

Mar 10 2020, 09:14 AM Mar 10 2020, 09:14 AM

|

|

QUOTE(BacktoBasics @ Mar 10 2020, 09:13 AM) hahaha i finally decided to do FD temporarily first. PBB 4-months fresh funds at 3.18% p.a. I rather put money into under-performing fund(s) rather putting money into FD with pathetic rate. Things tend to bounce back upward and it is a matter of time. |

|

|

|

|

|

GrumpyNooby

|

Mar 10 2020, 09:18 AM Mar 10 2020, 09:18 AM

|

|

QUOTE(BacktoBasics @ Mar 10 2020, 09:17 AM) hmm, a bit no balls to top-up now. haha how long do you think this will pan out? another 4 months? xD With oil price war, I don't know. This is a new variable which just set off last weekend. |

|

|

|

|

|

GrumpyNooby

|

Mar 10 2020, 02:42 PM Mar 10 2020, 02:42 PM

|

|

QUOTE(hamster9 @ Mar 10 2020, 02:41 PM) Eh, no more free withdrawal? So how t calculation like.. If I withdraw RM200 means 0.1% of the 200 or 0.1% of my initial 1k? 0.1% is forex conversion fee. |

|

|

|

|

|

GrumpyNooby

|

Mar 11 2020, 10:13 PM Mar 11 2020, 10:13 PM

|

|

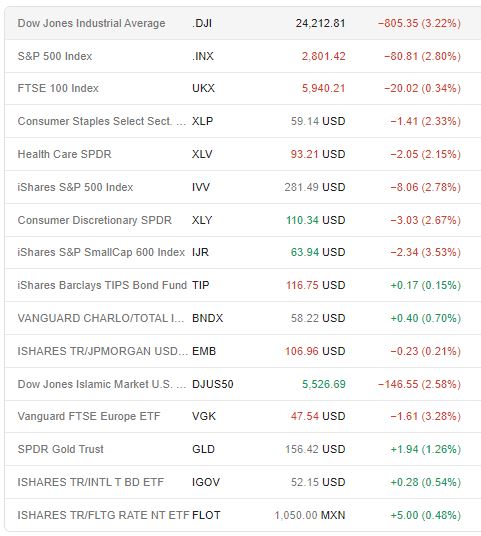

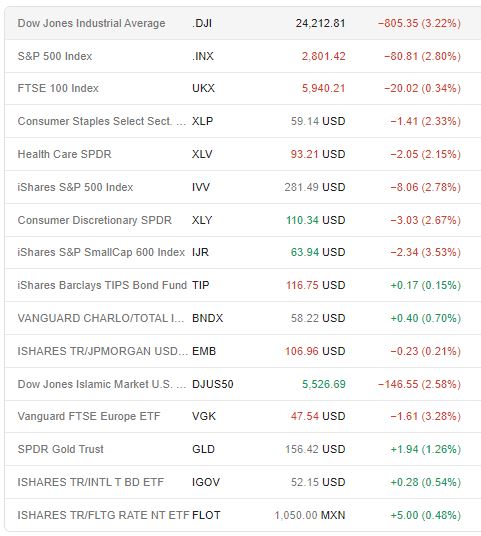

QUOTE(palm05wince @ Mar 11 2020, 10:12 PM)  I believe this is majority of the ETF selected by Stashaway. Ratio will be dependent on your risk profile Where's the famous XLK for Technology Select Sector SPDR Fund ETF? And also the under the sea XLE for Energy Select Sector SPDR Fund ETF? IJR for iShares Core S&P Small-Cap ETF? XLC for Communication Services Select Sector SPDR ETF? This post has been edited by GrumpyNooby: Mar 11 2020, 10:21 PM |

|

|

|

|

|

GrumpyNooby

|

Mar 12 2020, 05:46 PM Mar 12 2020, 05:46 PM

|

|

QUOTE(taiping... @ Mar 12 2020, 05:41 PM) Always positive. The lowest I saw or remembered was +4.xx% |

|

|

|

|

|

GrumpyNooby

|

Mar 12 2020, 05:51 PM Mar 12 2020, 05:51 PM

|

|

QUOTE(taiping... @ Mar 12 2020, 05:49 PM) Damn what am i doing in this thread  That's the scary part ... I don't know it's a MLM thingy or scam. I tried to find the correlation in the past weeks but being shot blatantly in that thread for doing such efforts. I couldn't see any correlation to the US market and USD-MYR forex at all. This post has been edited by GrumpyNooby: Mar 12 2020, 05:52 PM |

|

|

|

|

|

GrumpyNooby

|

Mar 12 2020, 06:16 PM Mar 12 2020, 06:16 PM

|

|

QUOTE(seiluen @ Mar 12 2020, 06:13 PM) was thinking the same thing too. wondering why still earning 5%+  Despite 2 top ups, my portfolio gain is still earning 10%+ But yesterday US market dropped > 4% This post has been edited by GrumpyNooby: Mar 12 2020, 06:16 PM |

|

|

|

|

|

GrumpyNooby

|

Mar 12 2020, 07:15 PM Mar 12 2020, 07:15 PM

|

|

S&P 500 futures for June hit limit-down again amid global rout https://www.theedgemarkets.com/article/sp-5...mid-global-rout |

|

|

|

|

|

GrumpyNooby

|

Mar 13 2020, 07:48 AM Mar 13 2020, 07:48 AM

|

|

Waiting for salary in ... ammo is not enough.

Have been DCA for the past 2 to 3 weeks!

|

|

|

|

|

|

GrumpyNooby

|

Mar 13 2020, 09:00 AM Mar 13 2020, 09:00 AM

|

|

QUOTE(coolguy99 @ Mar 13 2020, 08:57 AM) SA really called to ask us to continue hold? I think SA will rebalance if you topup. SA will re-optimize when certain drastic market condition triggers such as inversion yield curve. |

|

|

|

|

|

GrumpyNooby

|

Mar 13 2020, 04:18 PM Mar 13 2020, 04:18 PM

|

|

The difference is the forex gain which had been removed.

|

|

|

|

|

|

GrumpyNooby

|

Mar 13 2020, 10:06 PM Mar 13 2020, 10:06 PM

|

|

QUOTE(stormseeker92 @ Mar 13 2020, 10:05 PM) just deposit a bit extra yesterday to buy when its cheap. lol It's not really cheap when your MYR to USD like shit ... |

|

|

|

|

|

GrumpyNooby

|

Mar 16 2020, 05:16 AM Mar 16 2020, 05:16 AM

|

|

Federal Reserve cuts rate to zero. In a bold, emergency action to support the economy during the coronavirus pandemic, the Federal Reserve on Sunday announced it would cut its target interest rate to zero. The last time the Fed cut rates to zero was during the global financial crisis just over a decade ago. In addition to rate cuts, the Fed also said it would purchase another $700 billion worth of Treasury bonds and mortgage-backed securities. https://edition.cnn.com/2020/03/15/economy/...erve/index.htmlThis post has been edited by GrumpyNooby: Mar 16 2020, 05:39 AM |

|

|

|

|

|

GrumpyNooby

|

Mar 16 2020, 07:16 AM Mar 16 2020, 07:16 AM

|

|

Trump wants low interest rate.

He has it now!

|

|

|

|

|

|

GrumpyNooby

|

Mar 18 2020, 05:45 PM Mar 18 2020, 05:45 PM

|

|

QUOTE(neverfap @ Mar 18 2020, 05:44 PM) MCA said it was the effort of the new government that MYR is so strong. |

|

|

|

|

Mar 10 2020, 08:40 AM

Mar 10 2020, 08:40 AM

Quote

Quote

0.0368sec

0.0368sec

0.75

0.75

7 queries

7 queries

GZIP Disabled

GZIP Disabled