QUOTE(yklooi @ Mar 21 2021, 11:47 AM)

Initial lump sum, then DCA.Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Mar 21 2021, 04:01 PM Mar 21 2021, 04:01 PM

Return to original view | IPv6 | Post

#41

|

Senior Member

1,264 posts Joined: Aug 2009 |

|

|

|

|

|

|

Mar 21 2021, 11:43 PM Mar 21 2021, 11:43 PM

Return to original view | IPv6 | Post

#42

|

Senior Member

1,264 posts Joined: Aug 2009 |

|

|

|

Mar 22 2021, 01:30 AM Mar 22 2021, 01:30 AM

Return to original view | IPv6 | Post

#43

|

Senior Member

1,264 posts Joined: Aug 2009 |

|

|

|

Mar 25 2021, 12:25 AM Mar 25 2021, 12:25 AM

Return to original view | IPv6 | Post

#44

|

Senior Member

1,264 posts Joined: Aug 2009 |

QUOTE(honsiong @ Mar 25 2021, 12:16 AM) How do you do that? Sorry, newbie question.Btw, I have been away from this thread for a couple of days and I must say, you guys are a very patient and helpful lot! I see posts from newcomers being answered thoroughly, step by step, eventhough the answers can be found within and have been repeated many times. You guys are just amazing. |

|

|

Mar 25 2021, 12:34 AM Mar 25 2021, 12:34 AM

Return to original view | IPv6 | Post

#45

|

Senior Member

1,264 posts Joined: Aug 2009 |

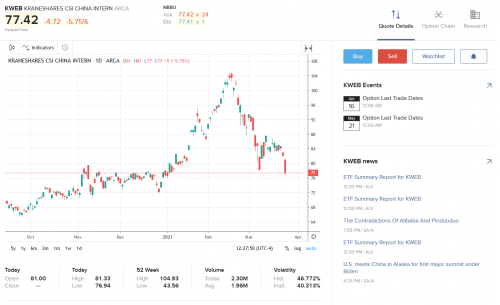

QUOTE(Hoshiyuu @ Mar 25 2021, 12:28 AM) KWEB is KraneShares CSI China Internet ETF, which is listed on NYSE and other places, it can be bought directly to overweight it in your portfolio via a broker that have access to NYSE. Thanks for this, Hoshiyuu. I don't normally follow the funds within SA, I see lots of hype with KWEB. What happened? It dipped so much when I got curious and looked at it, lol |

|

|

Mar 27 2021, 03:38 PM Mar 27 2021, 03:38 PM

Return to original view | IPv6 | Post

#46

|

Senior Member

1,264 posts Joined: Aug 2009 |

BFM code is valid until when yea? Cuz I have existing promotion going from friend's referral, so by right I should use BFM only after my friend's promo is over, yes?

|

|

|

|

|

|

Mar 27 2021, 08:26 PM Mar 27 2021, 08:26 PM

Return to original view | IPv6 | Post

#47

|

Senior Member

1,264 posts Joined: Aug 2009 |

QUOTE(cucumber @ Mar 27 2021, 04:59 PM) The BFM code doesn't work for me. I have a promotion that is active until July... I wonder if that's the reason? QUOTE(yklooi @ Mar 27 2021, 05:48 PM) just checked mine....see image,...both running concurrently... If our amount is within 30k, then I guess there's no point in entering two promo code same time? In case BFM code works, we should enter it after the first one expired, correct?thus maybe yours is as per below post, |

|

|

Mar 29 2021, 02:55 PM Mar 29 2021, 02:55 PM

Return to original view | IPv6 | Post

#48

|

Senior Member

1,264 posts Joined: Aug 2009 |

QUOTE(honsiong @ Mar 29 2021, 11:52 AM) The purpose of referral code is to bait new customers in, you already paying them money, why else would they waive your fees for next few months? For customer's satisfaction and loyalty, rave reviews, etc., lolI haven't tried BFM yet, but looks like from the responses here, it wouldn't work for mine either. |

|

|

Apr 3 2021, 08:57 PM Apr 3 2021, 08:57 PM

Return to original view | IPv6 | Post

#49

|

Senior Member

1,264 posts Joined: Aug 2009 |

QUOTE(ChessRook @ Apr 3 2021, 08:20 PM) Xander is correct. There is no robo involved in the buying and selling of funds. As for SA being successful before they introduced the China ETF, that is not my point. I am just saying SA has chosen to invest in the top two growth regions. If SA has chosen to invest in 20-30% in Japanese ETF or 100% in Malaysian ASN variable fund, then, I will sing a different tune. How are you liking SA since you're an early adopter? Has it been good for you, and may you share with us your goal investing into SA? Thanks in advance.Anyway, kudos to SA. It is my 2nd best (in terms of my personal XIRR) investment vehicle for me (starting 2018) |

|

|

Apr 5 2021, 12:41 AM Apr 5 2021, 12:41 AM

Return to original view | IPv6 | Post

#50

|

Senior Member

1,264 posts Joined: Aug 2009 |

QUOTE(ChessRook @ Apr 3 2021, 09:26 PM) I have two goals 26% and 36% with about each goal having about half of my SA investments. Thanks for sharing. Yes, I do intend to keep SA going for long term as well, an alternate investment vehicle. It feels alot easier to do recurring on this, probably cuz I've managed the expectations. Although, I do hope it doesn't do worse YoY in red. Even 5% also happy already, but certainly hope with the risks involved, it would do better.When I first invested in Nov 2018, I made an unrealised loss -4.6% as at 31 Dec 2018. At that time, I still keep DCA investing into SA and UT since all my other investment assets as at 31 Dec were all red except my fundsupermart bond funds, EPF, SSPN and P2P lending. I had faith to take risk and keep investing because of the historical record of stocks increasing in value long term and even if, stocks did not rebound I still have EPF, which forms the most of my portfolio. As I said earlier, SA is my 2nd best investment vehicle now. My personal XIRR as measured today is 18.5% for the entire SA. My advice to new investors of SA is to look at this vehicle as a long term say more than 5 year period and don't be too worried if your investment is making unrealised losses, now and then. |

|

|

Apr 5 2021, 09:46 PM Apr 5 2021, 09:46 PM

Return to original view | IPv6 | Post

#51

|

Senior Member

1,264 posts Joined: Aug 2009 |

QUOTE(tehoice @ Apr 5 2021, 10:02 AM) that's why it is important, just keep calm and keep investing. Not bad ah, 17%, every year like this, can retire well, lolI'm also very happy with my investment with SA, achieved an annualised 17% gain so far. QUOTE(ChessRook @ Apr 5 2021, 10:20 AM) I am just wondering when did you start investing in SA? I just started this year, lol...you're right about reading the news, I feel sometimes no read better than read. Caught myself panicking and then do more silly decisions, or cause restless nights. Good job in keeping it going through those down years. Sometimes I find it less stressful and emotional by moving away from all the investing news and coming back later. I stop reading financial news at end of 18 to 19 after my equities portion turn negative. I just keep my regular investing and at end of Dec 2019 boom almost all of my investment assets are in the black. BTW wishing you greatest of luck Thanks, wishing us the best in this~ |

|

|

Apr 6 2021, 01:12 AM Apr 6 2021, 01:12 AM

Return to original view | IPv6 | Post

#52

|

Senior Member

1,264 posts Joined: Aug 2009 |

QUOTE(honsiong @ Apr 5 2021, 10:25 PM) Definition of good returns to you above how many %? QUOTE(polarzbearz @ Apr 6 2021, 12:55 AM) 12% not ideal enough? Sincere question |

|

|

Apr 9 2021, 01:40 AM Apr 9 2021, 01:40 AM

Return to original view | IPv6 | Post

#53

|

Senior Member

1,264 posts Joined: Aug 2009 |

|

|

|

|

|

|

Apr 10 2021, 03:37 PM Apr 10 2021, 03:37 PM

Return to original view | IPv6 | Post

#54

|

Senior Member

1,264 posts Joined: Aug 2009 |

Does the fine Alibaba got slapped with affect this famous KWEB in our portfolio?

Anyway, still DCA-ing. Set bi-weekly from Simple. Must admit, it's very slow, but it's okie, don't wanna be bothered doing direct bank transfer each time. |

|

|

Apr 10 2021, 04:39 PM Apr 10 2021, 04:39 PM

Return to original view | IPv6 | Post

#55

|

Senior Member

1,264 posts Joined: Aug 2009 |

QUOTE(xander83 @ Apr 10 2021, 04:23 PM) Of course will get affected the only person who can answer on what they will do in KWEB would be Brendan Ahern from what happen to Alibaba Thanks for your response as I don't go too deep into the funds within SA. Just wanna understand what gives for current -20% performance of KWEB in my portfolio. Anyway, will keep adding bi-weekly, should be a good discipline to see how SA performs by year end.Hopefully KWEB will rotate some of the funds to Didi Chuxing once IPO is floated anytime coming soon from now As long as KWEB is holding up the support level of 72.50 nothing much to be worried because it is just waiting for another breakout this year honsiong liked this post

|

|

|

Apr 10 2021, 06:27 PM Apr 10 2021, 06:27 PM

Return to original view | IPv6 | Post

#56

|

Senior Member

1,264 posts Joined: Aug 2009 |

QUOTE(xander83 @ Apr 10 2021, 05:42 PM) KWEB underperforming it is very simple reason overvalued hence a lot of offloading recently even before Archegos scandal By the at the current moment anything 72.5 to 77 it is a good buy for its fundamentals if you’re a big China Tech fan QUOTE(honsiong @ Apr 10 2021, 05:50 PM) What does it mean for our SA who has this exposure then...it would still be up to SA to keep KWEB or do rebalancing, etc., yes? Meaning, for people like us...we just keep doing what we're doing, and be informed, that's it, correct? honsiong liked this post

|

|

|

Apr 11 2021, 05:57 PM Apr 11 2021, 05:57 PM

Return to original view | IPv6 | Post

#57

|

Senior Member

1,264 posts Joined: Aug 2009 |

QUOTE(backspace66 @ Apr 11 2021, 10:24 AM) Just to share the current performance of my oldest uninterrupted portfolio in SA,from June 2020, no redemption/withdrawal/transfer to another portolio. Although i am starting to feel annoyed with SA lag time. I will continue until a better competitor appear. Yes, the lag time can be quite irritating after a while. Not a deal breaker, but just wished it doesn't take so long. |

|

|

Apr 17 2021, 01:57 PM Apr 17 2021, 01:57 PM

Return to original view | IPv6 | Post

#58

|

Senior Member

1,264 posts Joined: Aug 2009 |

QUOTE(thecurious @ Apr 17 2021, 11:51 AM) To point out something that has been highlighted before...since the term DCA has been used rather loosely. Different people would be seeing returns that could be similar or wildly different. Does it mean Person A should do another lump sum now (since it's not ATH now) to make sure the impact is greater? And then continues with DCA thereafter.Person A lumpsum initial capital of 10k at ATH in February and DCA 100 each month since then would highly likely still be in negative. While Person B actually DCA from the start at ATH of 1k each month could have already breakeven. Because the impact of the subsequent "DCA" are wildly different. Scenario A is hardly impacted while scenario B each deposit impacted greater though with reducing impact with each deposit over time. |

|

|

Apr 17 2021, 02:01 PM Apr 17 2021, 02:01 PM

Return to original view | IPv6 | Post

#59

|

Senior Member

1,264 posts Joined: Aug 2009 |

QUOTE(Merubin @ Apr 17 2021, 12:56 PM) QUOTE(Takudan @ Apr 17 2021, 01:08 PM) I started from lump-sum then moved to bi weekly. And now wanna change to weekly cuz cannot tahan needing to wait for bi weekly transfer, feels like missing out on the market movement in the two weeks' space. Of course, just a feel, lolQUOTE(honsiong @ Apr 17 2021, 01:35 PM) This may have been asked to death, but how much do you put in for weekly, if you can share? Or else it's okie honsiong liked this post

|

|

|

Apr 17 2021, 02:34 PM Apr 17 2021, 02:34 PM

Return to original view | IPv6 | Post

#60

|

Senior Member

1,264 posts Joined: Aug 2009 |

|

| Change to: |  0.3329sec 0.3329sec

0.69 0.69

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 16th December 2025 - 07:11 PM |