QUOTE(lee82gx @ May 25 2021, 09:06 AM)

On the other hand I have no regret with my lump sums, if any the regret is I should've bought more.

After I consider personal investment records, including many which are actually loss making, I think lump sum is still better. But believe me I was a student of DCA. And even today, I still practice it.

Could it also be that lump sum was made at the right time too for those that eventually turned profit? I can understand what you mean, as I had those moments. Now, I'll tread according to the investment vehicle I'm subscribing too... without haste...and see if lump sum of DCA is a better approach. I'm inclined to think that both have its pros and cons, and plus a stroke of luck, it can change the outcomes. So one should not beat themselves up over it.After I consider personal investment records, including many which are actually loss making, I think lump sum is still better. But believe me I was a student of DCA. And even today, I still practice it.

QUOTE(flying_manatee @ May 26 2021, 11:28 AM)

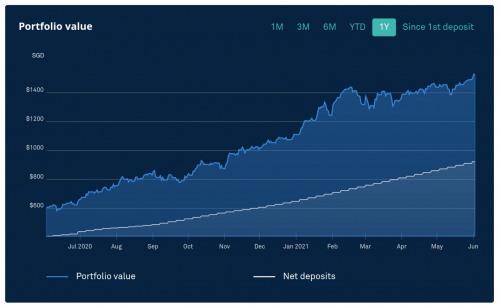

Market high

May 26 2021, 11:49 PM

May 26 2021, 11:49 PM

Quote

Quote

0.4347sec

0.4347sec

0.35

0.35

7 queries

7 queries

GZIP Disabled

GZIP Disabled