QUOTE(honsiong @ Mar 23 2021, 11:08 PM)

Hahaha, if really happened again i might throw all my emergency fund in XDD just sayingInvestment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Mar 23 2021, 11:11 PM Mar 23 2021, 11:11 PM

Return to original view | Post

#41

|

Junior Member

270 posts Joined: Sep 2019 |

QUOTE(honsiong @ Mar 23 2021, 11:08 PM) Hahaha, if really happened again i might throw all my emergency fund in XDD just saying littlegamer and honsiong liked this post

|

|

|

|

|

|

Mar 24 2021, 11:08 PM Mar 24 2021, 11:08 PM

Return to original view | Post

#42

|

Junior Member

270 posts Joined: Sep 2019 |

KWEB all way south.. from ATH 103-ish, now falls below 80, lol...

|

|

|

Mar 25 2021, 04:39 PM Mar 25 2021, 04:39 PM

Return to original view | IPv6 | Post

#43

|

Junior Member

270 posts Joined: Sep 2019 |

QUOTE(DragonReine @ Mar 25 2021, 02:50 PM) Bear in mind that 22% and below (core portfolios) actually existed longer than the higher risk (26/30/36) portfolios. So the returns are a bit skewed because core portfolios have been on the market longer. https://www.stashaway.my/r/our-returns-2020 This post has been edited by jacksonpang: Mar 25 2021, 04:41 PM DragonReine liked this post

|

|

|

Apr 9 2021, 10:02 PM Apr 9 2021, 10:02 PM

Return to original view | IPv6 | Post

#44

|

Junior Member

270 posts Joined: Sep 2019 |

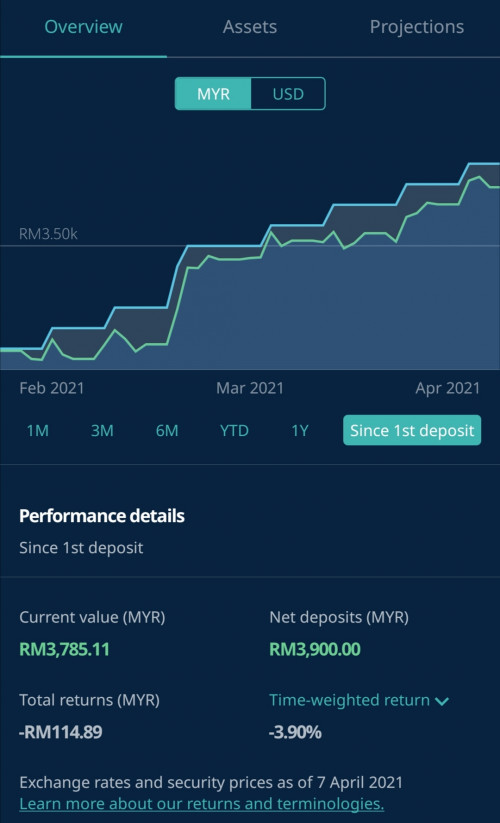

QUOTE(limmmkb @ Apr 9 2021, 06:58 PM) Would it be a good idea to cash out your returns bit by bit and leave the principal amount? Go negative the next day? Bxxxh pls, been negative for 2 months, lolololololOr just leave it eventhough there is a risk it might go negative the next day?  Quazacolt liked this post

|

|

|

Apr 9 2021, 10:20 PM Apr 9 2021, 10:20 PM

Return to original view | IPv6 | Post

#45

|

Junior Member

270 posts Joined: Sep 2019 |

|

|

|

Apr 9 2021, 10:29 PM Apr 9 2021, 10:29 PM

Return to original view | IPv6 | Post

#46

|

Junior Member

270 posts Joined: Sep 2019 |

QUOTE(e-lite @ Apr 9 2021, 10:27 PM) You may also share your risk percentage for your portfolio. This should be a low-risk bond-heavy portfolio 36%  This post has been edited by jacksonpang: Apr 9 2021, 10:33 PM Quazacolt liked this post

|

|

|

|

|

|

Apr 16 2021, 05:30 PM Apr 16 2021, 05:30 PM

Return to original view | IPv6 | Post

#47

|

Junior Member

270 posts Joined: Sep 2019 |

Citigroup exits from Malaysia. Wonder how it will affect SA. Maybe not at all also if the transition is done nicely.

|

|

|

Apr 17 2021, 11:22 AM Apr 17 2021, 11:22 AM

Return to original view | Post

#48

|

Junior Member

270 posts Joined: Sep 2019 |

QUOTE(prophetjul @ Apr 17 2021, 08:53 AM) After 1.5 month of fortnightly DCA, my 20% portfolio remains green with a Good for you! 2 months old user still in negative, cause "accidentally" started investing journey when ATH. Bought KWEB at 103-ish, now is about 74-ish.. DCA every week (variable amount), avg still at about 90-ish, far from green, lol.TWR of 5.45% and MWR of 3.94%. Looks Good so far! |

|

|

Apr 18 2021, 10:42 PM Apr 18 2021, 10:42 PM

Return to original view | IPv6 | Post

#49

|

Junior Member

270 posts Joined: Sep 2019 |

|

|

|

Apr 30 2021, 12:03 AM Apr 30 2021, 12:03 AM

Return to original view | IPv6 | Post

#50

|

Junior Member

270 posts Joined: Sep 2019 |

|

|

|

May 10 2021, 10:39 PM May 10 2021, 10:39 PM

Return to original view | Post

#51

|

Junior Member

270 posts Joined: Sep 2019 |

Really wth this KWEB. Bought all the way starting from 10X, 9X, 8X, 7X, all the ranges.. Still not enough, right now 6X 🙄🙄 47100 liked this post

|

|

|

Jun 1 2021, 01:48 PM Jun 1 2021, 01:48 PM

Return to original view | Post

#52

|

Junior Member

270 posts Joined: Sep 2019 |

QUOTE(owum @ May 31 2021, 10:19 PM) Today marks my 45 days with SA - RSI 26% in UK pound denominator with 1 time lumpsum RM10k (monthly contribution got reversed by bank, don't know why?). The time-weighted return is 4.6%, with most of the return gained by the Gold (32%) while the equities (48%) performance is lackluster. Still far from the projected double-digit return (13-16%), will continue to DCA and report back in 6 month, 1 year. Has anyone getting above 8%? you should be glad you're in positive TWR.. lol.. mine is SRI 36%. |

|

|

Jun 15 2021, 10:14 PM Jun 15 2021, 10:14 PM

Return to original view | IPv6 | Post

#53

|

Junior Member

270 posts Joined: Sep 2019 |

|

|

|

|

|

|

Jun 26 2021, 09:57 AM Jun 26 2021, 09:57 AM

Return to original view | IPv6 | Post

#54

|

Junior Member

270 posts Joined: Sep 2019 |

QUOTE(Barricade @ Jun 26 2021, 09:39 AM) Save you 300++ for 3 months(?).. means you roughly got RM150k inside SA 😮 if you mean 300 per month, lagi terrifying 🤣 Quazacolt liked this post

|

|

|

Jun 26 2021, 11:25 AM Jun 26 2021, 11:25 AM

Return to original view | IPv6 | Post

#55

|

Junior Member

270 posts Joined: Sep 2019 |

|

|

|

Jun 26 2021, 12:02 PM Jun 26 2021, 12:02 PM

Return to original view | IPv6 | Post

#56

|

Junior Member

270 posts Joined: Sep 2019 |

I re-read what Dr Jason written in fb and i think this promo code is for waiver for your next fresh fund, not existing fund. We might have wrong understanding XD

"Use the promo code DRJASON when you inject new funds into StashAway and you get 3 months of management fees waived off :-D" https://m.facebook.com/story.php?story_fbid...100044201511171 |

|

|

Jun 26 2021, 02:09 PM Jun 26 2021, 02:09 PM

Return to original view | IPv6 | Post

#57

|

Junior Member

270 posts Joined: Sep 2019 |

|

|

|

Jun 26 2021, 02:58 PM Jun 26 2021, 02:58 PM

Return to original view | IPv6 | Post

#58

|

Junior Member

270 posts Joined: Sep 2019 |

QUOTE(honsiong @ Jun 26 2021, 02:46 PM) If it's so easily misinterpreted, of course the copy is wrong! What do you mean by "not wrong, just not accurate enough". Offer showing "100% management fee for 3 months"While hidden clause is "only for fresh fund" Just like typical offer/sales advertisement you can found on the market you know? Something like "buy smartphone from us, BUY 1 FREE 1", while actually is buy 1 phone free 1 phone case, not free another phone. 😅 |

|

|

Jun 26 2021, 03:18 PM Jun 26 2021, 03:18 PM

Return to original view | IPv6 | Post

#59

|

Junior Member

270 posts Joined: Sep 2019 |

QUOTE(honsiong @ Jun 26 2021, 03:07 PM) Not sure why you so easily triggered.That's exactly why we need to look for the T&C before doing something, which I did, look for Dr Jason fb post and found its more specific T&C, and shared back here. So, what you did? Applied promo code given by others w/o further checking T&C then said other people defended scam? Nice mindset bro. thediablo liked this post

|

|

|

Jul 21 2021, 12:58 PM Jul 21 2021, 12:58 PM

Return to original view | IPv6 | Post

#60

|

Junior Member

270 posts Joined: Sep 2019 |

|

| Change to: |  0.0523sec 0.0523sec

0.42 0.42

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 20th December 2025 - 10:43 PM |