QUOTE(JackMao @ Dec 3 2020, 08:28 PM)

Hey everyone, I need some opinion, if you can give any.

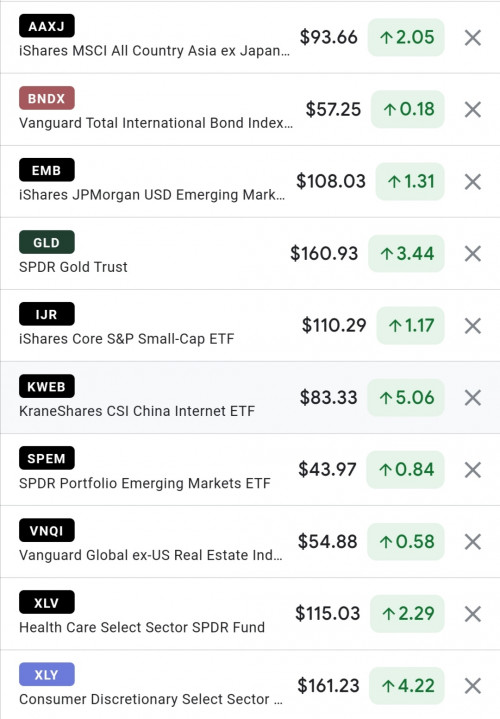

I'm thinking of opening another portfolio (max RI 36%).

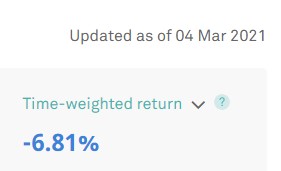

My current portfolio is 22 % (invested 1 year, 11.36% TWR and 18.40 MWR)

Is it a good choice to open another portfolio? Having 2 separate to portfolio (easier to track the performance)?

Or should I just change the risk index on my current portfolio to the highest one and not having 2 portfolio?

As I recalled, if I change my index at this moment, it's like selling or buying some asset classes on a little bit high prices (correct me if I'm wrong).

Thank you.

Sorry for OT but I couldn't resist...I'm thinking of opening another portfolio (max RI 36%).

My current portfolio is 22 % (invested 1 year, 11.36% TWR and 18.40 MWR)

Is it a good choice to open another portfolio? Having 2 separate to portfolio (easier to track the performance)?

Or should I just change the risk index on my current portfolio to the highest one and not having 2 portfolio?

As I recalled, if I change my index at this moment, it's like selling or buying some asset classes on a little bit high prices (correct me if I'm wrong).

Thank you.

Your name is Jack Mao already, you still need invest through SA meh? Hahaha

Dec 3 2020, 11:17 PM

Dec 3 2020, 11:17 PM

Quote

Quote

0.0495sec

0.0495sec

0.71

0.71

7 queries

7 queries

GZIP Disabled

GZIP Disabled