Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Mar 12 2022, 12:19 AM Mar 12 2022, 12:19 AM

Return to original view | Post

#101

|

Junior Member

269 posts Joined: Sep 2019 |

|

|

|

|

|

|

Mar 14 2022, 12:33 PM Mar 14 2022, 12:33 PM

Return to original view | Post

#102

|

Junior Member

269 posts Joined: Sep 2019 |

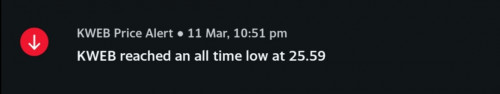

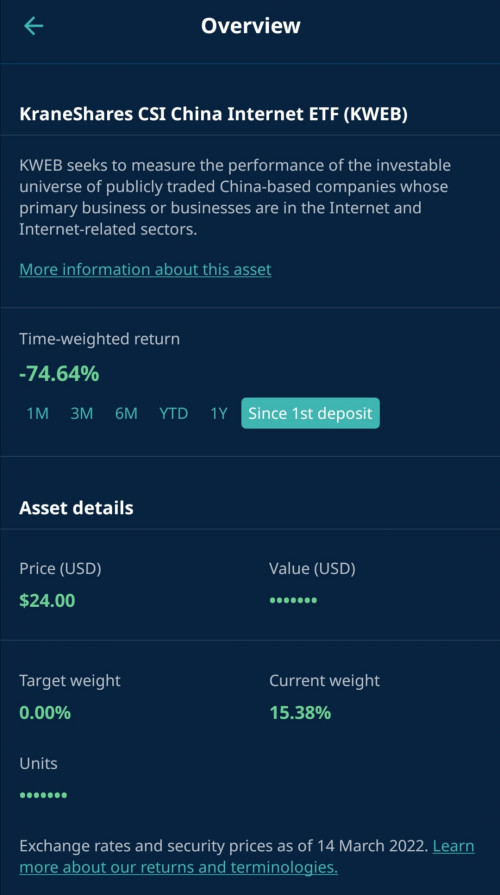

Thanks SA for the bloody lesson.

personal opinion: i will only give SA a chance till end of this year. If there's no growth (now is -18%, hope to get -10% by end of the year), I will quit and put my money somewhere else. Staying in negative return consistently for the whole year isn't a investment at all, it's simply just a gamble game by SA but using our money. Me being just 1 year+ user but experiencing 3 times reopt, so called long term investment by SA, they definitely failed my trust. Good luck guys!   |

|

|

Mar 14 2022, 01:09 PM Mar 14 2022, 01:09 PM

Return to original view | Post

#103

|

Junior Member

269 posts Joined: Sep 2019 |

QUOTE(DJFoo000 @ Mar 14 2022, 12:59 PM) To be fair, the "36% SRI" should be interpreted to mean that the portfolio may experience drawdowns as large as 36%. Well within margins...? please, it's not about 36% or not... so it's okay for you that SA having commentary keep telling you "DCA mindset" and "put trust in KWEB" then now they want cut lost quietly just like that? |

|

|

Mar 14 2022, 05:12 PM Mar 14 2022, 05:12 PM

Return to original view | Post

#104

|

Junior Member

269 posts Joined: Sep 2019 |

Buy high sell low, like what SA advertised in HK 😉😉 Medufsaid liked this post

|

|

|

Mar 14 2022, 10:52 PM Mar 14 2022, 10:52 PM

Return to original view | Post

#105

|

Junior Member

269 posts Joined: Sep 2019 |

|

|

|

Mar 15 2022, 10:53 AM Mar 15 2022, 10:53 AM

Return to original view | Post

#106

|

Junior Member

269 posts Joined: Sep 2019 |

QUOTE(zstan @ Mar 15 2022, 10:10 AM) simply gambling. if they get to sell at higher price tonight, they can brag they did a right choice not to sell in a shot, thus average down some loss. if they sell at lower price tonight, then they will say the amount of KWEB whole SA hold is huge, not so many buyer thus forced them cannot sell one shot. why not right? everyone can made up some reason at one point. |

|

|

|

|

|

Mar 16 2022, 02:57 PM Mar 16 2022, 02:57 PM

Return to original view | Post

#107

|

Junior Member

269 posts Joined: Sep 2019 |

Again, typical SA Buy high sell low 😉😉 They did exactly what they advertised in HK, no wrong what raptor_cZn, langstrasse, and 2 others liked this post

|

|

|

Mar 16 2022, 10:19 PM Mar 16 2022, 10:19 PM

Return to original view | IPv6 | Post

#108

|

Junior Member

269 posts Joined: Sep 2019 |

|

|

|

Apr 30 2022, 02:05 PM Apr 30 2022, 02:05 PM

Return to original view | IPv6 | Post

#109

|

Junior Member

269 posts Joined: Sep 2019 |

Let's have a bold guess: SA portfolio continue downtrend, then somewhere during September, SA gonna tell you they gonna re-optimising again. Sell at lost again and buy something else at high, just as what SA pro at.

|

|

|

Apr 30 2022, 07:50 PM Apr 30 2022, 07:50 PM

Return to original view | IPv6 | Post

#110

|

Junior Member

269 posts Joined: Sep 2019 |

|

|

|

Jun 14 2022, 09:23 PM Jun 14 2022, 09:23 PM

Return to original view | Post

#111

|

Junior Member

269 posts Joined: Sep 2019 |

|

|

|

Jun 21 2022, 06:14 PM Jun 21 2022, 06:14 PM

Return to original view | Post

#112

|

Junior Member

269 posts Joined: Sep 2019 |

QUOTE(Davidtcf @ Jun 21 2022, 05:21 PM) Agree. There is no rebalancing so why charge 0.8% still for those under RM50k? Doesn’t make sense. There will be rebalancing.. example if you set 10% cash, 90% KWEB.. somehow KWEB drop 50% share price, means your portfolio became 55% cash, 45% KWEB, so SA will trigger cont buying KWEB, isn't it?They already earn from exchange rate etc. could charge some other fees such as one off platform trade fee is good enough. |

|

|

Jun 21 2022, 06:53 PM Jun 21 2022, 06:53 PM

Return to original view | Post

#113

|

Junior Member

269 posts Joined: Sep 2019 |

QUOTE(Davidtcf @ Jun 21 2022, 06:36 PM) No la no such thing. The cash is set aside to pay Stashaway for their fees. Not sure about that, but their UI shows "will always maintain your asset allocation", which I believed should be the same like before, SA auto buy/sell to meet the percentage.It is stated at flex portfolio when you create, that there is no rebalancing for this. You have to ownself manage.  |

|

|

|

|

|

Jun 21 2022, 07:00 PM Jun 21 2022, 07:00 PM

Return to original view | Post

#114

|

Junior Member

269 posts Joined: Sep 2019 |

QUOTE(Davidtcf @ Jun 21 2022, 06:56 PM) Yes that means no rebalancing. Rebalancing means SA help you sell etf and buy new ones if they feel it’s the right thing to do. This flex portfolio have to ownself manage. Hence why the management fee is too high for such a product. Wasn't that called "re-optimization" in SA? Confusing term it is, haha... honsiong liked this post

|

|

|

Sep 26 2022, 05:22 PM Sep 26 2022, 05:22 PM

Return to original view | Post

#115

|

Junior Member

269 posts Joined: Sep 2019 |

langstrasse, StDCent, and 3 others liked this post

|

|

|

Dec 21 2022, 04:18 PM Dec 21 2022, 04:18 PM

Return to original view | Post

#116

|

Junior Member

269 posts Joined: Sep 2019 |

|

| Change to: |  0.0511sec 0.0511sec

0.61 0.61

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 27th November 2025 - 02:20 PM |