Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

jacksonpang

|

Jul 22 2021, 08:40 AM Jul 22 2021, 08:40 AM

|

Getting Started

|

QUOTE(Kadaj @ Jul 22 2021, 07:23 AM) Very interesting SA reduce 12% of GLD significantly from 30% RSI and allocate it to IJR in 36% RSI. If you think GLD is better, you should hold 30% RSI. If you think IJR is better, then you should hold 36% RSI. **SRI (Stashaway Risk Index) |

|

|

|

|

|

jacksonpang

|

Jul 24 2021, 12:32 PM Jul 24 2021, 12:32 PM

|

Getting Started

|

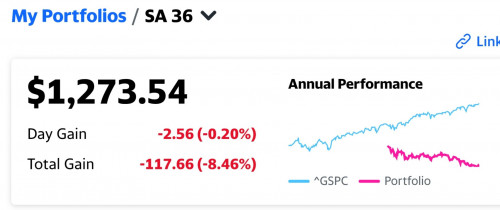

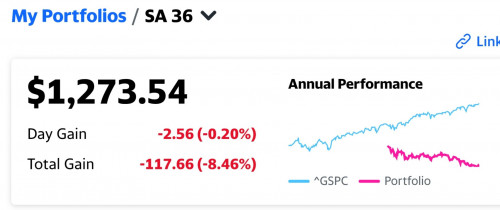

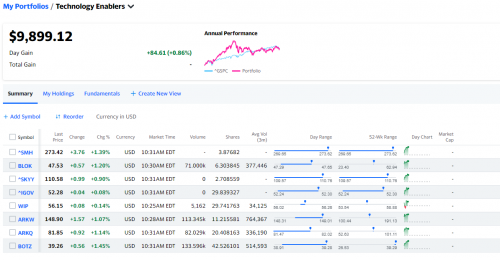

QUOTE(GymBoi @ Jul 24 2021, 12:30 AM) Anyone track with yahoo finance? How to set selling? Bro you quite special eh ... that's practically my question .. i don't know how u get selling on SA from ... i asking a innocent question suddenly i get blamed for not asking properly? lol Just ignore those toxic person, quite a few in this thread, act like they are the "one-above-all" pattern. I also faced some 🤢 Btw, i also realised that key in negative number of share and the selling price will helpa bit, your portfolio total value will matched, but the total gain/loss will went crazy.. mine supposedly shall be -60, but showing -73 instead. Haven't found a way to overcome this bug. |

|

|

|

|

|

jacksonpang

|

Aug 5 2021, 02:22 PM Aug 5 2021, 02:22 PM

|

Getting Started

|

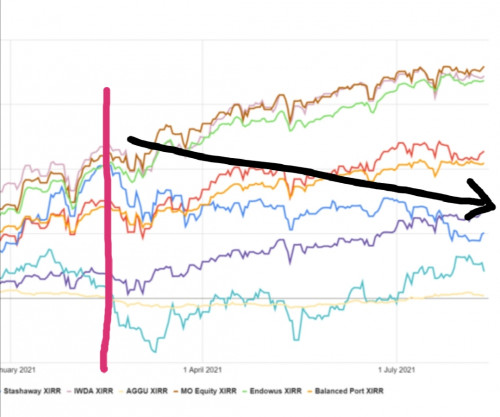

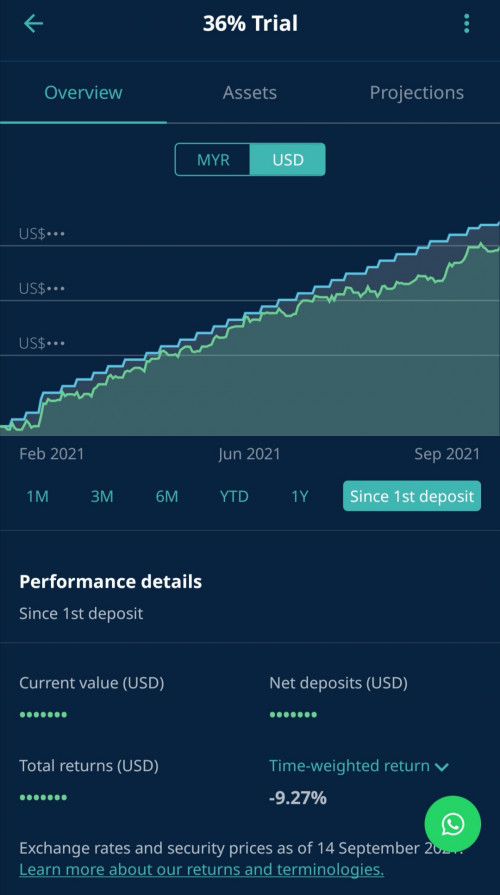

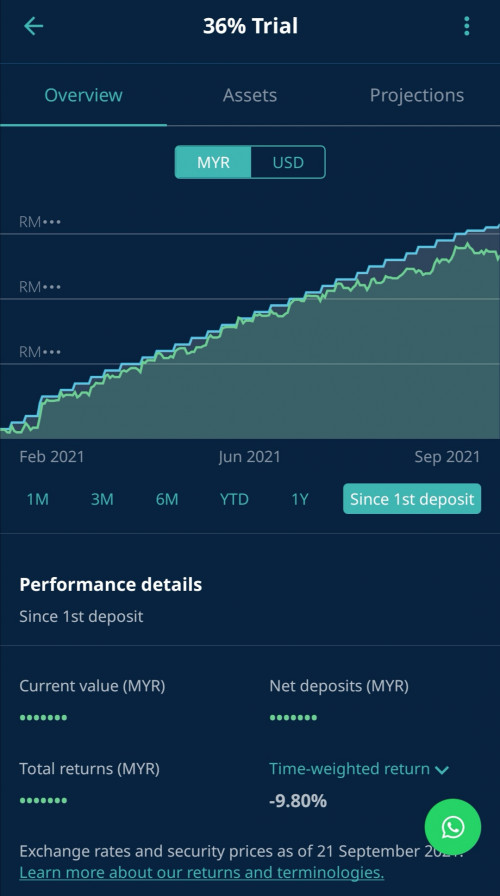

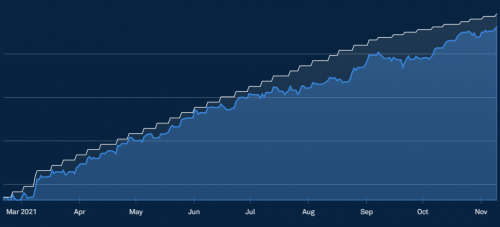

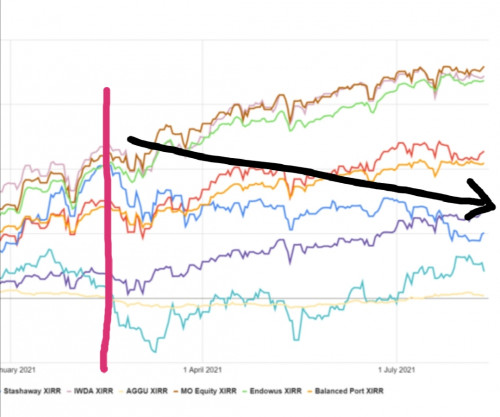

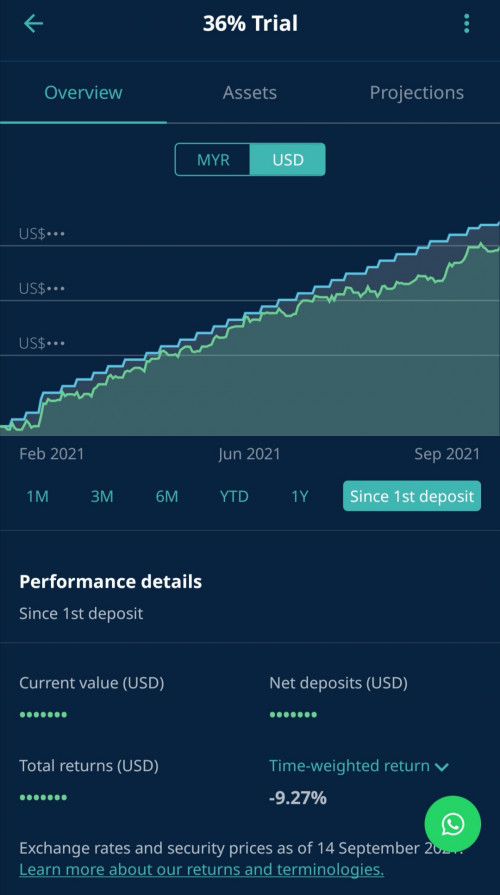

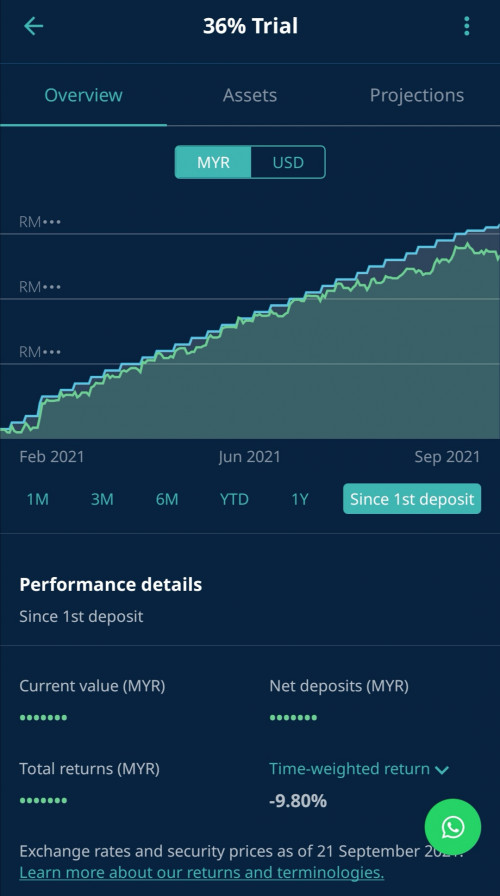

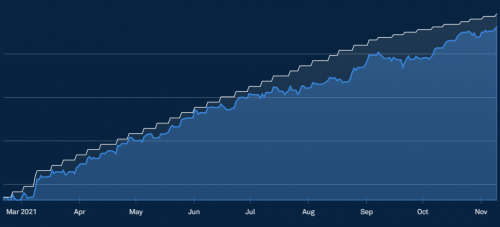

QUOTE(gooroojee @ Aug 4 2021, 06:42 PM) Feb this year, too early to assess... and lump sum has a risk of poor returns if timing is bad... I know QUOTE(Hoshiyuu @ Aug 5 2021, 12:11 PM) Howdy frendo! Welcome to the ATH loss gang, we have about 4 members I think so far.  This is the tracking portfolio I made, as you can see, we haven't really went up since February's ATH. For my main portfolio which I have consistently DCA'd daily, I am hovering around only ~2% loss up to last week, which is pretty good considering the China turmoil mess and me recovering the drop from ATH. Last week did drop me down to -7% all of a sudden, I don't really follow the news that much so I am not sure what happened. Keep in mind, everything I've said about is like within 5% - its basically nothing in terms of investing. Anyone that DIY on KWEB/ARK around the same period have suffered at least a 20% drop at the same time. Hi there matesss, lol    |

|

|

|

|

|

jacksonpang

|

Aug 14 2021, 02:52 PM Aug 14 2021, 02:52 PM

|

Getting Started

|

QUOTE(jacksonpang @ Aug 14 2021, 09:19 AM) Yeah, i know definitely will got people saying "judging based on 1 year is blah3", but it does not cover the fact that SA is the only(?) robo-adviser that is getting negative return since the so-called "ATH of kweb", hence ATH of 36% portfolio too(?) during around mid-feb period, which is when i started my 36% portfolio too. Just stating the fact. Sad me is sad, dca every week for half year already, portfolio still going south... Move KWEB, move! Lol   |

|

|

|

|

|

jacksonpang

|

Aug 15 2021, 11:54 PM Aug 15 2021, 11:54 PM

|

Getting Started

|

Lol.. i thought here is "forum", but why macam more like "praising hall" ah? Since always got certain people nagging about other people post their negative return/complaints.. maybe they got position inside SA like "defender of SA" or something.. hmmm...

|

|

|

|

|

|

jacksonpang

|

Aug 16 2021, 12:17 AM Aug 16 2021, 12:17 AM

|

Getting Started

|

QUOTE(honsiong @ Aug 16 2021, 12:04 AM) Because as someone who has been using stashaway for 4 years, experienced -23% MRR in 2018, a huge drop in MCO1, staying invested has helped me got very good results with Stashaway.  I hope more people do the same as I did, because short term comparison, naughty2 switch portfolios and risk etc don't pay. Stashaway isnt perfect, but I doubt other robo-advisors can do better than Stashaway. Unless you buy pure equities ETFs like VWRA, VTI, VXUS. That's good that you're willing to share and guide for those who just joined and feeling uncomfortable about their negative return. This kind of reply definitely will give them much more confidence and information. Unlike those just saying "lol, just xxx months then complaint" type.. |

|

|

|

|

|

jacksonpang

|

Aug 16 2021, 12:33 AM Aug 16 2021, 12:33 AM

|

Getting Started

|

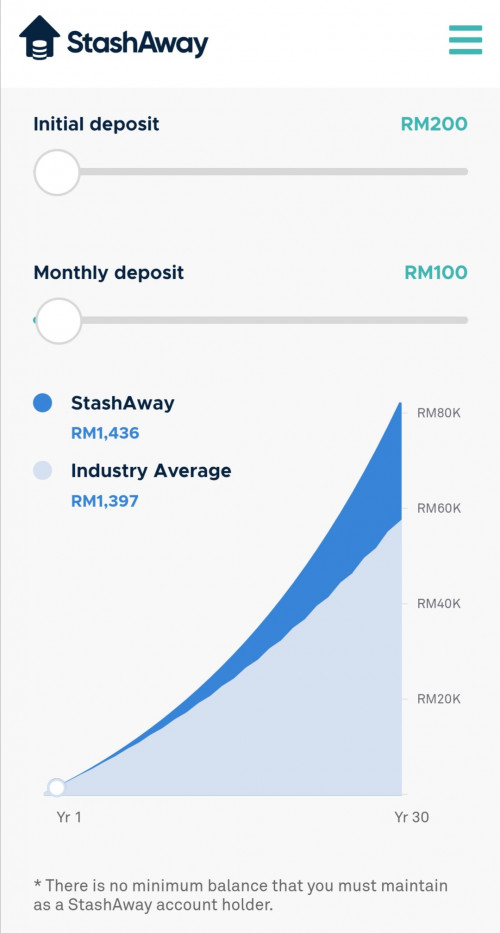

QUOTE(pendekartauhu @ Aug 16 2021, 12:20 AM) yes most of those ppl investing peanuts and nagging like a kid. If they want only profit and fast return should not invest in RA. Look elsewhere like stock trading, forex or crypto but they can't stomach the volatility and not willing to study on how to trade themselves relying RA and goyang kaki wait for profits. I have different view with you.. you stated that: -If they want only profit and fast return should not invest in RA. -relying RA and goyang kaki wait for profits. But then, that's exactly what SA advertising themselves for the newbies om the sign up page, lol.  |

|

|

|

|

|

jacksonpang

|

Aug 16 2021, 12:40 AM Aug 16 2021, 12:40 AM

|

Getting Started

|

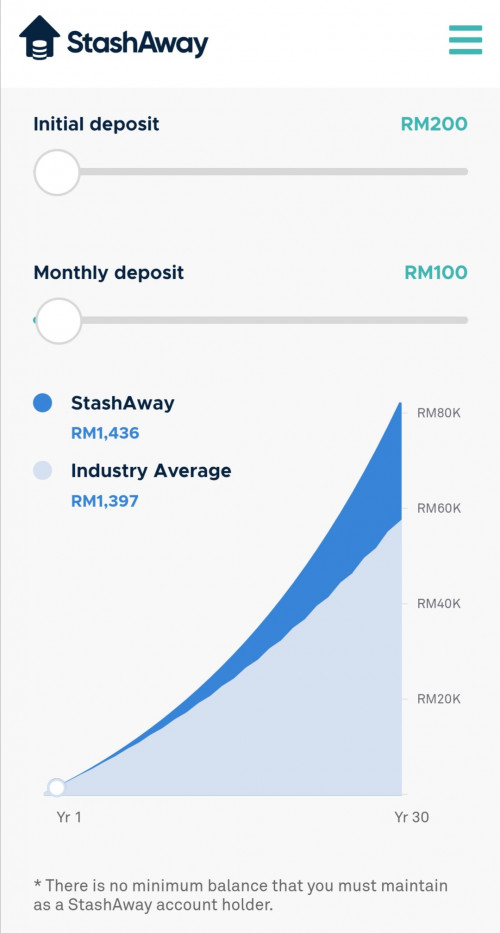

QUOTE(honsiong @ Aug 16 2021, 12:34 AM) 30 years on x-axis don't sound like fast return to me LOL. Goyang kaki wait for profits is correct leh, stashaway is memang for us to goyang kaki one. Nah, i intentionally pull the data to year 1 only. That's the part many newbies that really has no knowledge about investing "fall into" SA kot.. since nothing about negative return is mentioned at first. 200 initial, 100 monthly, then year 1 end showing 1436 (profit of 36).. |

|

|

|

|

|

jacksonpang

|

Aug 18 2021, 09:05 AM Aug 18 2021, 09:05 AM

|

Getting Started

|

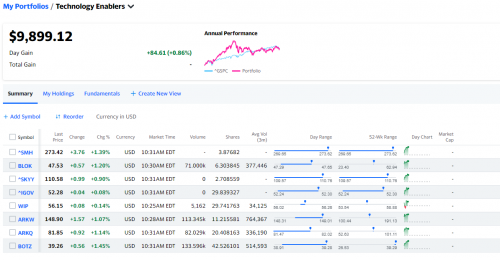

QUOTE(necrox77 @ Aug 18 2021, 08:58 AM) Thank you for reply. It is useless to predict the market. Do you guys check the total average price Kweb etf price vs current price? Stashaway only show TWR for individual etf performance. Really good if they can show MWR for individual etf performance. Need 3rd party software to trace, example Yahoo Finance, by key in all your buy order. |

|

|

|

|

|

jacksonpang

|

Aug 20 2021, 11:41 AM Aug 20 2021, 11:41 AM

|

Getting Started

|

QUOTE(yklooi @ Aug 20 2021, 11:00 AM) QUOTE(buffa @ Aug 20 2021, 11:16 AM) Mine is currently -51.4% I am champion  QUOTE(rc2x @ Aug 20 2021, 11:37 AM) *cough cough*  |

|

|

|

|

|

jacksonpang

|

Aug 20 2021, 02:30 PM Aug 20 2021, 02:30 PM

|

Getting Started

|

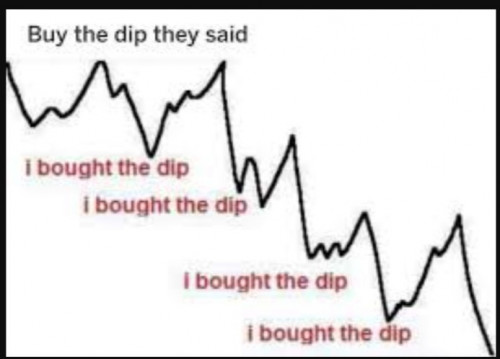

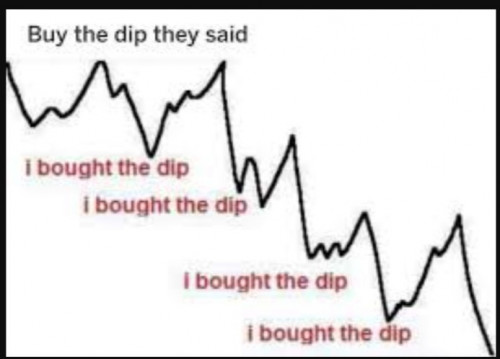

QUOTE(xander83 @ Aug 20 2021, 02:20 PM) Pity you buying at least at 100 in KWEB Started from 102-ish till now, literally this meme, haha  |

|

|

|

|

|

jacksonpang

|

Sep 15 2021, 12:38 PM Sep 15 2021, 12:38 PM

|

Getting Started

|

QUOTE(diversity @ Sep 15 2021, 12:46 AM) I've been crediting RM500 on a monthly basis to highest risk setting but to date only profit RM50 lol, better channel to FSM managed funds So goooood you got positive return 😉  Yet to see any good sign, continue buying dips after dips 😄 |

|

|

|

|

|

jacksonpang

|

Sep 20 2021, 09:48 PM Sep 20 2021, 09:48 PM

|

Getting Started

|

What a red opening tonight..

|

|

|

|

|

|

jacksonpang

|

Sep 21 2021, 10:05 PM Sep 21 2021, 10:05 PM

|

Getting Started

|

QUOTE(smallcrab @ Sep 21 2021, 09:50 PM) started SA on March this year, 22% risk invested about 10k in it, regular DCA every 2 weeks all this while have profit, but since yesterday it turned negative  Come, let me comfort you, I don't know what is positive since my starting.   |

|

|

|

|

|

jacksonpang

|

Sep 23 2021, 10:59 PM Sep 23 2021, 10:59 PM

|

Getting Started

|

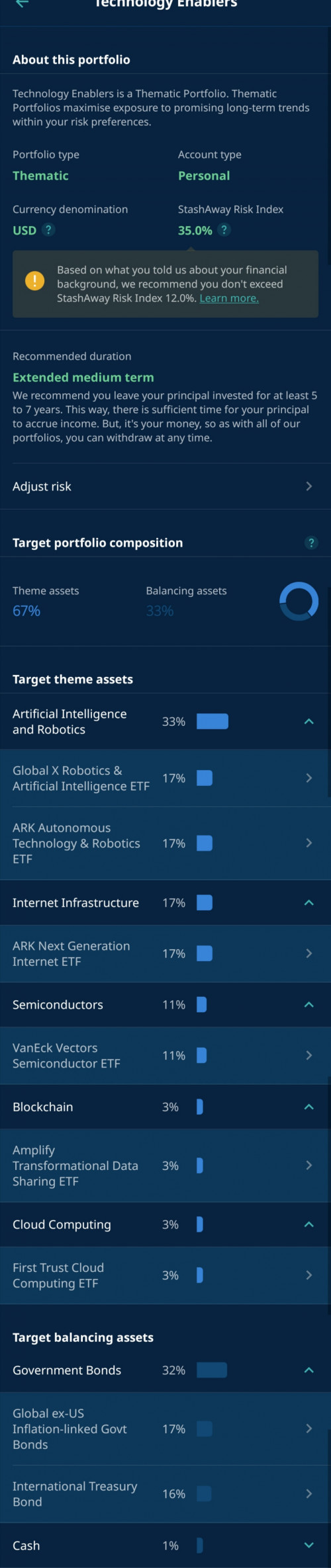

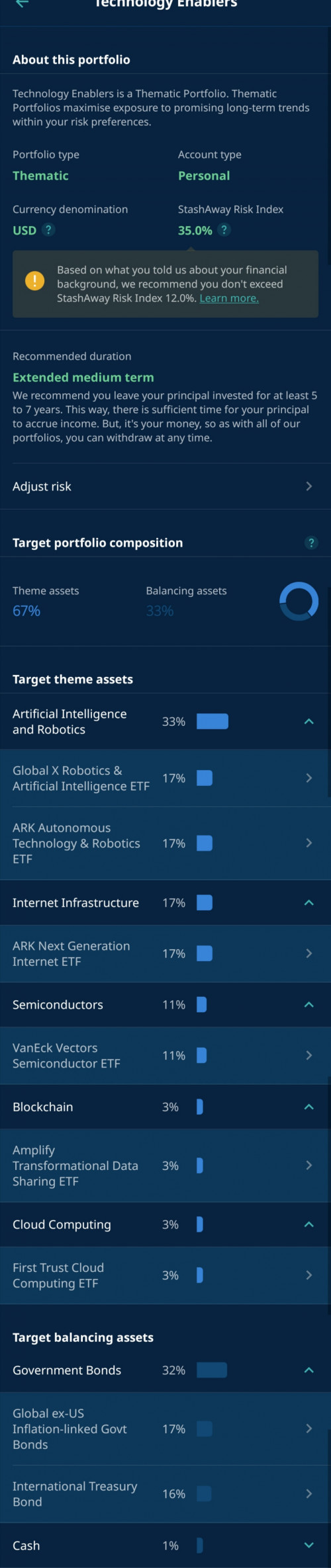

QUOTE(Medufsaid @ Sep 23 2021, 10:33 PM) here's the backdated performance of Technology Enablers @ 35% risk index. the other 2 i might add back into this post or a new one. blue is the benchmark to compare against  will/did SA publish the new ETFs and their weightage anywhere? Nah, yet to publish their weightage, now can only see by creating portfolio can review back.  |

|

|

|

|

|

jacksonpang

|

Oct 7 2021, 12:41 PM Oct 7 2021, 12:41 PM

|

Getting Started

|

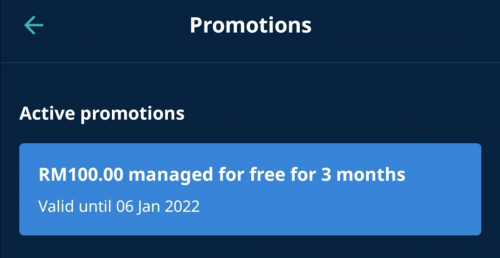

Ehh fxxx.. this time promo code DOUGLASLIM really just the one-time fresh fund count only ah? Should have stop my scheduled jompay and pump in higher amount, lol..  This post has been edited by jacksonpang: Oct 7 2021, 12:41 PM This post has been edited by jacksonpang: Oct 7 2021, 12:41 PM |

|

|

|

|

|

jacksonpang

|

Oct 7 2021, 01:19 PM Oct 7 2021, 01:19 PM

|

Getting Started

|

QUOTE(tehoice @ Oct 7 2021, 12:52 PM) LOL, only one-time. not for the entire duration of 3 months.... Yalor, thought its similar with DRJASON. 3 months of fresh fund no charge fee, mana tau it looks like just one-off. QUOTE(yklooi @ Oct 7 2021, 01:00 PM) RM1000 x 0.8% annual mgmt fees = RM8 pa = 1 month = abt 0.666 sen = 3 months FREE = abt RM 2 Thanks for the input, i laughed very hard XDDD |

|

|

|

|

|

jacksonpang

|

Nov 9 2021, 10:10 PM Nov 9 2021, 10:10 PM

|

Getting Started

|

QUOTE(Hoshiyuu @ Nov 9 2021, 04:42 PM) Sorry, terribly slow week. No one even bother to come out complain about KWEB rollercoaster or cash out on thematic during the dip. Gotta keep that SA thread on frontpage somehow 🙈 hahaha, let me take the lead then! "SA is a scammm, no positive return yet dare to charge us management fee!" "never got any positive return since beginning!" apa lagi? hahaha  |

|

|

|

|

Jul 22 2021, 08:40 AM

Jul 22 2021, 08:40 AM

Quote

Quote

0.0565sec

0.0565sec

0.80

0.80

7 queries

7 queries

GZIP Disabled

GZIP Disabled