QUOTE(jacksonpang @ Jun 14 2022, 09:23 PM)

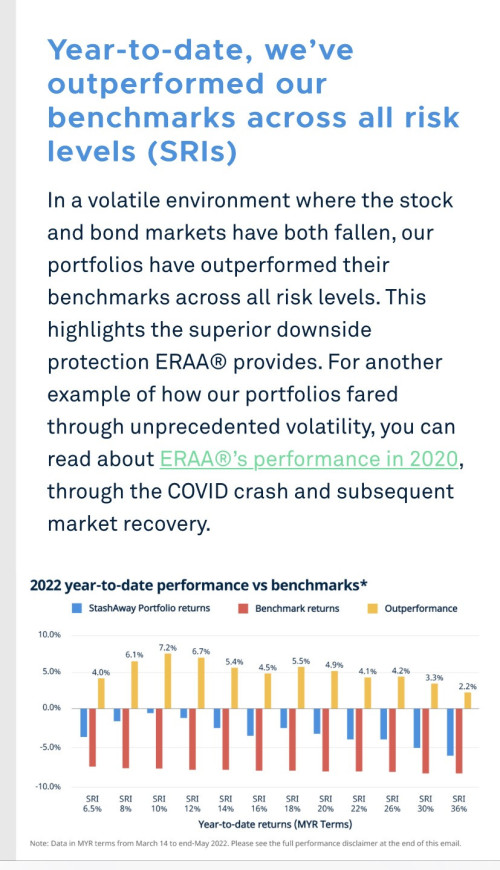

yes. SA is doing very well all this while…

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Jun 14 2022, 09:36 PM Jun 14 2022, 09:36 PM

Return to original view | IPv6 | Post

#41

|

Junior Member

998 posts Joined: May 2014 |

|

|

|

|

|

|

Jun 15 2022, 12:19 AM Jun 15 2022, 12:19 AM

Return to original view | IPv6 | Post

#42

|

Junior Member

998 posts Joined: May 2014 |

|

|

|

Jun 15 2022, 11:15 AM Jun 15 2022, 11:15 AM

Return to original view | IPv6 | Post

#43

|

Junior Member

998 posts Joined: May 2014 |

QUOTE(MUM @ Jun 15 2022, 01:55 AM) No wonder, the FD, sspn and ASNB fp funds threads are still so active and has a lots of posts contributors... If some investor argued that SA poor investment decision in kweb is acceptable to them. What can I said further?Nobody is mentioning on the China secondary sanction except that Mr. Freddy Lim. This post has been edited by bcombat: Jun 15 2022, 11:22 AM |

|

|

Jun 15 2022, 11:56 AM Jun 15 2022, 11:56 AM

Return to original view | IPv6 | Post

#44

|

Junior Member

998 posts Joined: May 2014 |

QUOTE(yklooi @ Jun 15 2022, 07:31 AM) "Rule Number One: Never Lose Money. Rule Number Two: Never Forget Rule Number One" But but but most of the Buffett portfolio assets eventually did recover its value and move upwards and make decent profit. That’s why he is one of the richest man in the world and not one of us.Buffett personally lost about $23 billion in the financial crisis of 2008, and his company, Berkshire Hathaway, lost its revered AAA rating. So how can he tell us to never lose money? Rules That Warren Buffett Lives By https://www.investopedia.com/financial-edge...t-lives-by.aspx Buffett No like someone on SA who so confident in his invested assets despite received many complaints the price of his assets kept dropping. Eventually one day he suddenly cut off with reasons such as “Unknown Unknowns” , “ know unknown”, “unknown know” etc. |

|

|

Jun 18 2022, 12:45 AM Jun 18 2022, 12:45 AM

Return to original view | IPv6 | Post

#45

|

Junior Member

998 posts Joined: May 2014 |

QUOTE(cl.t08 @ Jun 17 2022, 08:12 PM) So what is SA strategy now, just wait for the portfolio to continue sinking? All my portfolios combined has gone from positive 20k to now negative 30k. Great job SA! If uncertain, some of the “in between” partial solutions I can think of if you don’t want to pull out 100% from SA- change your risk appetites to the lower risk portfolio (May be 6%, 8% etc) in which most of the assets are bonds. The portfolio asset value may still drop further but at least not so dramatic. When the snp500 index trend has change, you may want to switch back to higher risk portfolio later. - sold off 50/40/30/20% of your SA holding;and - stop DCA until right time has come. No perfect solution but you need to make decision. |

|

|

Jun 18 2022, 12:56 PM Jun 18 2022, 12:56 PM

Return to original view | Post

#46

|

Junior Member

998 posts Joined: May 2014 |

Just illustrate with simple example why we shouldn't loss our money. I believe this is what Warren Buffett trying to say:

Assumption here: This is all the money that A and B have. They don't have extra money to top up the investment. B loss money in his investment in Y2 RM2,000 and he cut lost (realised loss) A breakeven in his investment in Y2. Y3 -Y6 both A and B make same return of 10% consistently. B only breakeven in between Y4- Y5 (his investment back to RM10,000 level) whereas A already make profit of RM3,310 in Y5. (Please see attach due to alignment issue) Most of the Warren Buffet is in the equity assets which carried certain degree of risks. How can he make a fortune by investing in Fixed Deposit or any low risk/ low return money market funds/ bonds? Yes. His portfolio is up and down just like us and it is impossible not to have any asset dropping below the entry prices. But for sure most of his assets price were recover later and he make decent profits from these assets subsequently. He invest in the long terms and not short term or medium terms. I think when he said "Don't lost your money" means here is don't invest in the wrong assets that don't generate good returns in both shorts and long terms and don't enter at the wrong timing when the value of the assets are already on high side. This post has been edited by bcombat: Jun 18 2022, 01:00 PM Attached thumbnail(s)

|

|

|

|

|

|

Jun 20 2022, 08:58 PM Jun 20 2022, 08:58 PM

Return to original view | IPv6 | Post

#47

|

Junior Member

998 posts Joined: May 2014 |

Ishare hang Seng tech etf…..assets are quite similar to kweb. History price trend also quite identical.

|

|

|

Jun 20 2022, 11:50 PM Jun 20 2022, 11:50 PM

Return to original view | IPv6 | Post

#48

|

Junior Member

998 posts Joined: May 2014 |

admin can close or delete the thread…without letting us know

|

|

|

Jun 21 2022, 09:52 AM Jun 21 2022, 09:52 AM

Return to original view | IPv6 | Post

#49

|

Junior Member

998 posts Joined: May 2014 |

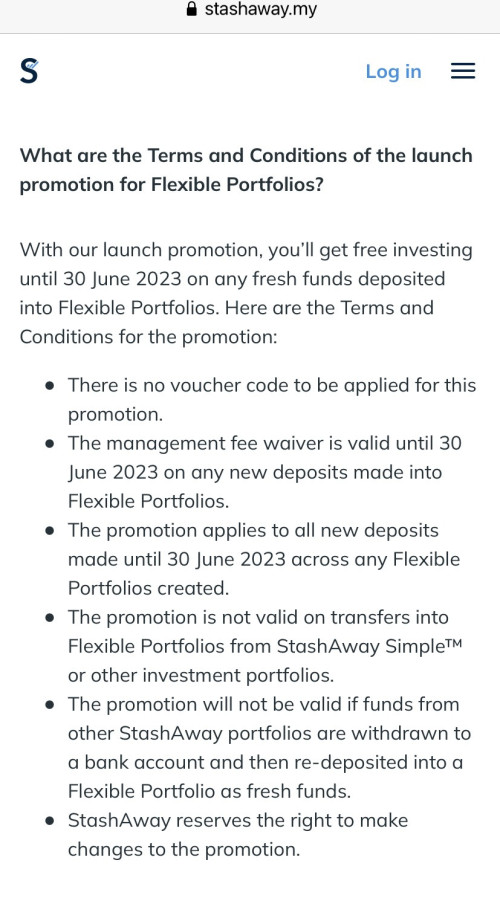

Flexible portfolio have fewer choices of ETF…..compare to IBKR, FSM etc.

Anyway promotion is worth considering if they do offer in SA Malaysia This post has been edited by bcombat: Jun 21 2022, 09:53 AM |

|

|

Jun 22 2022, 05:34 PM Jun 22 2022, 05:34 PM

Return to original view | IPv6 | Post

#50

|

Junior Member

998 posts Joined: May 2014 |

https://www.stashaway.my/help-center/643051...ible-portfolios

key word: fresh fund This post has been edited by bcombat: Jun 22 2022, 05:45 PM |

|

|

Jun 24 2022, 12:15 AM Jun 24 2022, 12:15 AM

Return to original view | IPv6 | Post

#51

|

Junior Member

998 posts Joined: May 2014 |

|

|

|

Jun 24 2022, 12:01 PM Jun 24 2022, 12:01 PM

Return to original view | IPv6 | Post

#52

|

Junior Member

998 posts Joined: May 2014 |

|

|

|

Jun 24 2022, 12:30 PM Jun 24 2022, 12:30 PM

Return to original view | IPv6 | Post

#53

|

Junior Member

998 posts Joined: May 2014 |

QUOTE(george_dave91 @ Jun 24 2022, 12:10 PM) So for those of you opting for the flexible portfolio, what do your portfolio allocations look like. I was thinking of just the s&p500 and the apac ETFs for my equity side 75% and 24% in bonds (1% cash mandatory). Not too sure how to allocate the bond side tho. Not sure what’s good/balanced to begin with. my 10% risk portfolio bond performance so far….even KDI also invested in BNDX, no sure why they like it so much…recently in video hear our Freedie Lim said some indication that bond market could be bottom but need another few more months data in future to confirm it….hope he know what he was talking about this time. Attached thumbnail(s)

|

|

|

|

|

|

Jun 24 2022, 02:04 PM Jun 24 2022, 02:04 PM

Return to original view | IPv6 | Post

#54

|

Junior Member

998 posts Joined: May 2014 |

|

|

|

Jun 27 2022, 11:14 AM Jun 27 2022, 11:14 AM

Return to original view | IPv6 | Post

#55

|

Junior Member

998 posts Joined: May 2014 |

if we update ourself with finance and economy news frequently…..should have come across the new that US is high probable will enter recession next year….

Leave it to the investor here to judge whether they should be so aggressive like 1-2 year ago or leave some of our bullets to the later stage. This post has been edited by bcombat: Jun 27 2022, 11:17 AM |

|

|

Jun 28 2022, 12:36 PM Jun 28 2022, 12:36 PM

Return to original view | IPv6 | Post

#56

|

Junior Member

998 posts Joined: May 2014 |

|

|

|

Jun 28 2022, 12:37 PM Jun 28 2022, 12:37 PM

Return to original view | IPv6 | Post

#57

|

Junior Member

998 posts Joined: May 2014 |

|

|

|

Jun 28 2022, 12:42 PM Jun 28 2022, 12:42 PM

Return to original view | IPv6 | Post

#58

|

Junior Member

998 posts Joined: May 2014 |

|

|

|

Jul 1 2022, 08:34 PM Jul 1 2022, 08:34 PM

Return to original view | IPv6 | Post

#59

|

Junior Member

998 posts Joined: May 2014 |

QUOTE(engyr @ Jul 1 2022, 08:26 PM) Invested 30% from April to July 2021, now - 16%😒 market is very uncertain atmInvested 36% in March to June 2020, sold out in April 2022 after kweb event, earn 10% Started to invest flexible portfolio with us equity 50%, international equity 30%. Hope will earn from this portfolio. Timing is important too invest prudently….. just now receive email from verve invest…their current strategy has change to manage mkt volatility instead of investing aggressive as it is not a right timing to challenge broader mkt This post has been edited by bcombat: Jul 1 2022, 08:37 PM |

|

|

Jul 1 2022, 11:40 PM Jul 1 2022, 11:40 PM

Return to original view | IPv6 | Post

#60

|

Junior Member

998 posts Joined: May 2014 |

|

| Change to: |  0.4678sec 0.4678sec

0.37 0.37

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 28th November 2025 - 01:04 AM |