Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia , Multi-Region ETF at your fingertips!

bcombat

deposit in StashAway simple earn 2.4% annual interest….after deducting the 0.5% of expense ratio…

bcombat

QUOTE(Hoshiyuu @ Mar 26 2022, 02:39 PM)

Just projected returns, but your math checks out if that is the case.

Can safely ignore, one of the worst MMF offerings on the market at the moment.

my own calculation is close to 1.9% return.

This post has been edited by bcombat : Mar 26 2022, 02:44 PM Attached thumbnail(s)

bcombat

QUOTE(MUM @ Mar 26 2022, 07:01 PM)

From that earlier image of his.... Mentioned "net" wor

I assume you have invested in StashAway since you are regular here? Have you put in money in SA simple? The dividend paid out tallied with 2.4%?

I reread this paragraph, “ your projected returns are net of this expense ratio”. That could means our returns would be further deducted by 0.5%. Depends on how we read. there are room for SA to argue if investor dispute it.

This post has been edited by bcombat : Mar 27 2022, 01:33 AM

bcombat

..

Attached thumbnail(s)

bcombat

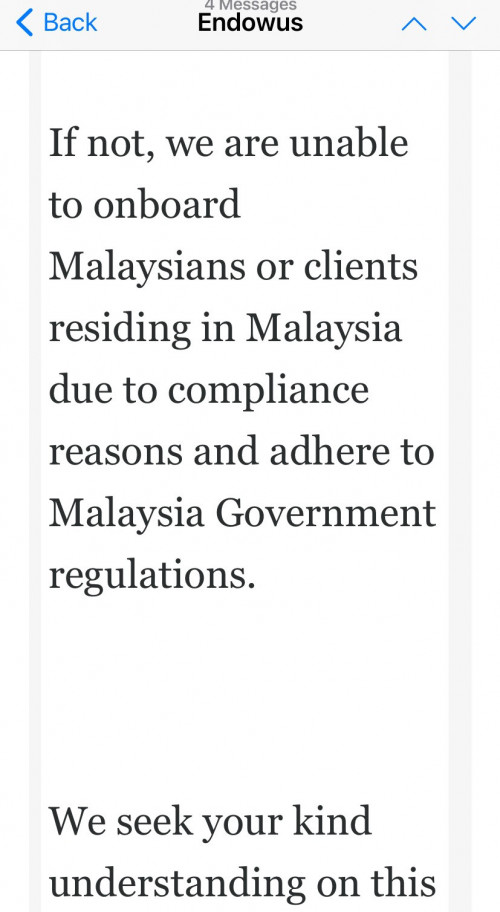

Malaysian who reside in Malaysia has successfully open endowus account?This post has been edited by bcombat : Mar 28 2022, 04:34 PM

bcombat

QUOTE(honsiong @ Mar 28 2022, 04:40 PM)

Me. Using it for almost 1 year. Also you are in the wrong thread.

Don’t know why their CS give me this nonsense…

bcombat

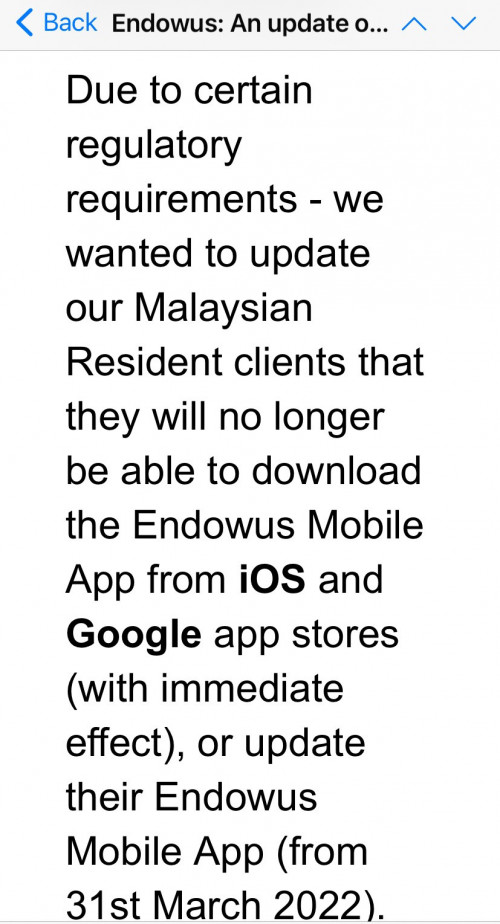

also this shit…

bcombat

at the moment BNDX and iGov are also so doing so well…just the negative margin are no as bad as kweb.

should see these two assets if u are in their 10% risk profiles.

This post has been edited by bcombat : Apr 12 2022, 12:43 PM

bcombat

QUOTE(Medufsaid @ Apr 12 2022, 12:46 PM)

refer to the stockcharts.com version whenever possible as they adjust for dividends

Both chart’s latest price are the same. they have adjusted for dividend?

bcombat

QUOTE(Medufsaid @ Apr 12 2022, 01:34 PM)

referring to this

Latest price still 51.37

bcombat

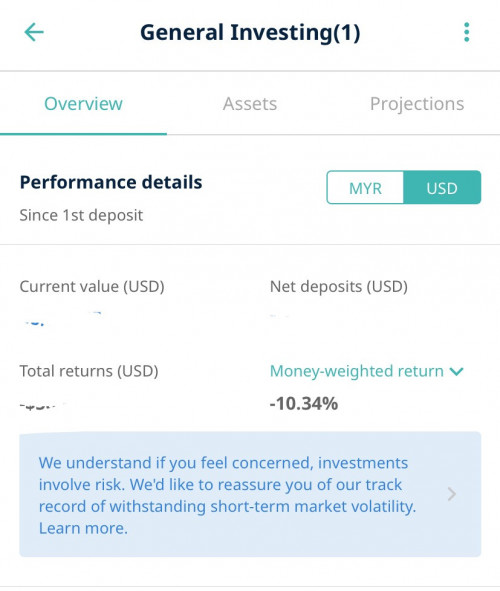

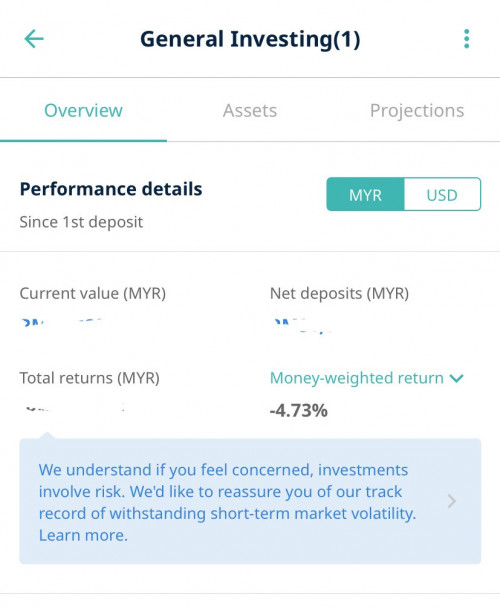

Different btw percentage of Money weighted return in US (-10.34 %) and in Ringgit (- 4.73%).

The currency exchange made so much difference

bcombat

The % they means likely is in MYR. subject to interpretation and arguments I guess

bcombat

FOMC meeting date to watch up

bcombat

Interest Rate revision may already factored into the price prior to the FOMC announcement…unless the announced rate is higher or lower than the mkt expectation.

bcombat

Still at lose position but hovering within certain range. should have break even if they didn’t invest in kweb earlier.

bcombat

my 10% risk portfolio loss is fluctuate btw ~ -1.3% to - 4.2%. Calculations based on absolute value (my own preferred calculation method)

bcombat

Kweb price close to its resistance point

bcombat

QUOTE(Cubalagi @ Jun 9 2022, 08:41 AM)

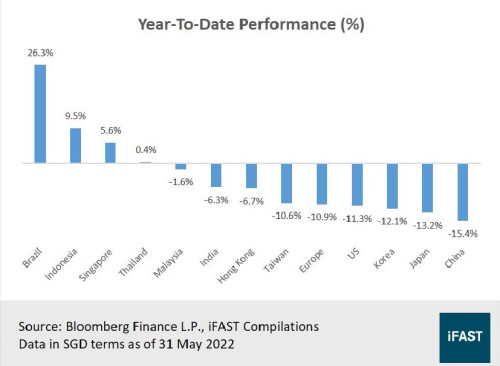

KWEB has been outperforming S&P500, YTD performance.

Basically the humans panicked and sold at the very bottom.

I felt that what happen to SA investment team mind when they suddenly want to cut losses. They sold it at the lowest points 20-21. Kudus to Freddy and Stephanie

bcombat

so many roboadvisor in Singapore…UOB and OCBC bank also enter this market….

VIDEO

VIDEO

This post has been edited by bcombat : Jun 11 2022, 03:38 PM

bcombat

KWEB was down together with whole China market…

Mar 26 2022, 02:36 PM

Mar 26 2022, 02:36 PM

Quote

Quote

0.0613sec

0.0613sec

0.27

0.27

7 queries

7 queries

GZIP Disabled

GZIP Disabled