QUOTE(cytyler @ Mar 10 2021, 07:23 PM)

I used to have mutual funds investment with monthly deposit for few years. But stopped deposit now. Just leaving it there for 4years already.

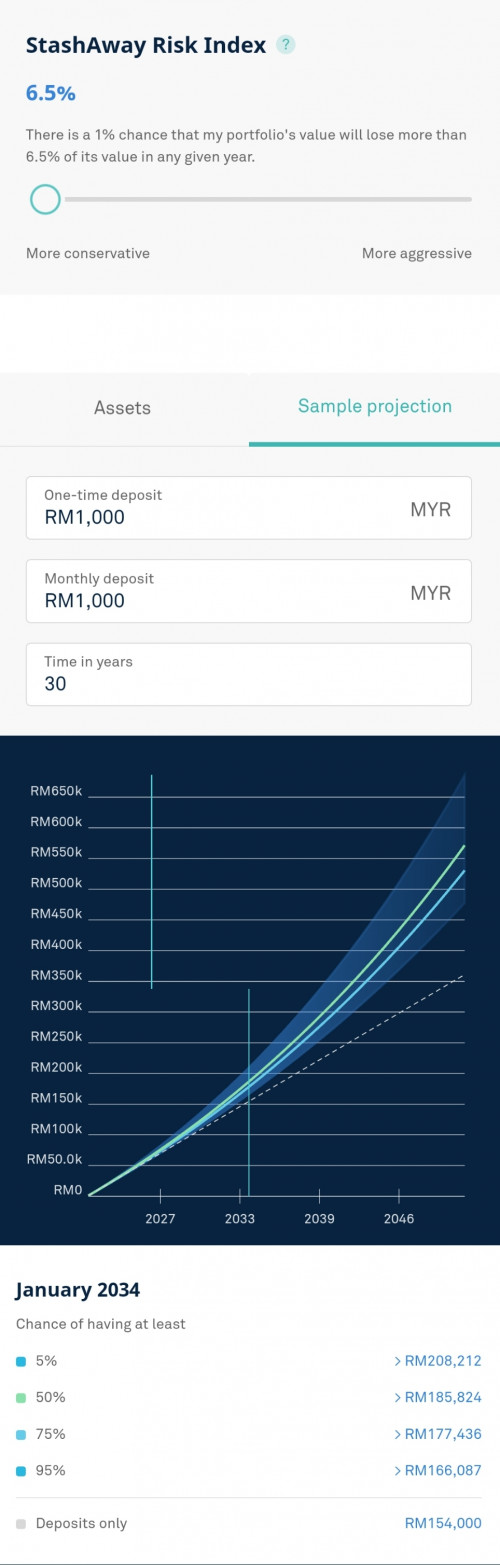

I'm planning to invest for a minimal amount in StashAway to see how it perform and see whether can invest for long-term.

And yes I'm young But not really afraid of losing since i know investment is a long time one. Have some extra cash from salary planning to invest in something that can earn.

10K with 22% sounds good to start. Or i should start lower.

Young ppl good. I'm planning to invest for a minimal amount in StashAway to see how it perform and see whether can invest for long-term.

And yes I'm young But not really afraid of losing since i know investment is a long time one. Have some extra cash from salary planning to invest in something that can earn.

10K with 22% sounds good to start. Or i should start lower.

Why dun open 2 portfolio, one is 22%, one is 36%.

Dca 100 weekly to both or 50 weekly to both.

After 6 month to 1 year come back n verify it.

Pls dun stop in between.

Suggest only.

Mar 10 2021, 08:05 PM

Mar 10 2021, 08:05 PM

Quote

Quote

0.4368sec

0.4368sec

0.28

0.28

7 queries

7 queries

GZIP Disabled

GZIP Disabled