This post has been edited by tadashi987: Jul 14 2021, 06:34 PM

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Jul 14 2021, 06:34 PM Jul 14 2021, 06:34 PM

|

Senior Member

2,106 posts Joined: Jul 2018 |

my bad, wrong SA

This post has been edited by tadashi987: Jul 14 2021, 06:34 PM |

|

|

|

|

|

Jul 14 2021, 08:35 PM Jul 14 2021, 08:35 PM

|

Senior Member

3,182 posts Joined: Nov 2008 From: KL |

Stashaway Simple in SG dont pay dividends one, actually not having dividends should not make a difference. Heck, paying dividends and having them not reinvested is worse.

|

|

|

Jul 15 2021, 12:11 AM Jul 15 2021, 12:11 AM

|

Senior Member

4,146 posts Joined: May 2005 |

|

|

|

Jul 15 2021, 04:24 AM Jul 15 2021, 04:24 AM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Jul 15 2021, 08:21 AM Jul 15 2021, 08:21 AM

Show posts by this member only | IPv6 | Post

#14925

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(MUM @ Jul 14 2021, 06:14 PM) Ah I see. SA might just lump them together with July.QUOTE(xander83 @ Jul 14 2021, 06:25 PM) Check back on the 1st as the payout it should be then Didn't have any update on the 1st though.Simple will calculate based on calendar month according to AmBank timeline |

|

|

Jul 15 2021, 11:58 PM Jul 15 2021, 11:58 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

|

|

|

Jul 16 2021, 08:20 AM Jul 16 2021, 08:20 AM

Show posts by this member only | IPv6 | Post

#14927

|

Senior Member

2,992 posts Joined: Feb 2015 |

|

|

|

Jul 16 2021, 05:14 PM Jul 16 2021, 05:14 PM

|

Junior Member

427 posts Joined: Oct 2010 |

is AmIncomePlus fund considered as good as or even better than fd ?

would it be better to buy AmIncome fund through fund houses rather than SAMY ? |

|

|

Jul 16 2021, 05:27 PM Jul 16 2021, 05:27 PM

Show posts by this member only | IPv6 | Post

#14929

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(no6 @ Jul 16 2021, 05:14 PM) is AmIncomePlus fund considered as good as or even better than fd ? https://www.fsmone.com.my/funds/tools/facts...t?fund=MYAMICPSwould it be better to buy AmIncome fund through fund houses rather than SAMY ? [FSM is not able to buy thou] IMO there is gives and takes, merely a preference compare with the yearly performance, FD rate might outperform at some years but FD has lock in period, amincome plus dont have SA amincome plus allow you to invest in small amount, slower settlement period buying through fund house require you to fulfill min and subsequent investment amount. |

|

|

Jul 16 2021, 05:55 PM Jul 16 2021, 05:55 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(no6 @ Jul 16 2021, 05:14 PM) is AmIncomePlus fund considered as good as or even better than fd ? Buying through fund houses be prepared to pay for management fees would it be better to buy AmIncome fund through fund houses rather than SAMY ? Don’t compared to FD because Simple interest while MMF is compounded by daily interests hence MMF will still outperform FD anytime |

|

|

Jul 16 2021, 06:02 PM Jul 16 2021, 06:02 PM

|

Junior Member

427 posts Joined: Oct 2010 |

QUOTE(tadashi987 @ Jul 16 2021, 05:27 PM) https://www.fsmone.com.my/funds/tools/facts...t?fund=MYAMICPS [FSM is not able to buy thou] IMO there is gives and takes, merely a preference compare with the yearly performance, FD rate might outperform at some years but FD has lock in period, amincome plus dont have SA amincome plus allow you to invest in small amount, slower settlement period buying through fund house require you to fulfill min and subsequent investment amount. QUOTE(xander83 @ Jul 16 2021, 05:55 PM) Buying through fund houses be prepared to pay for management fees Just tried on fsm, seems no problem can buy AmIncome, no ? Don’t compared to FD because Simple interest while MMF is compounded by daily interests hence MMF will still outperform FD anytime Isnt management fees are paid as well even though buying through SAMY ? |

|

|

Jul 16 2021, 06:06 PM Jul 16 2021, 06:06 PM

Show posts by this member only | IPv6 | Post

#14932

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(no6 @ Jul 16 2021, 06:02 PM) Just tried on fsm, seems no problem can buy AmIncome, no ? that's Amincome not Amincome plus, they are both different funds.Isnt management fees are paid as well even though buying through SAMY ? management fee by fund manager on the fund itself is charged anyhow u bought from SA or FSM or any other channels. but there are others fee e.g. sale charge, platform fee or not, it is depending on the distribution channels. FSM dont distribute this fund, SA dont charge any fee. |

|

|

Jul 16 2021, 06:17 PM Jul 16 2021, 06:17 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(no6 @ Jul 16 2021, 06:02 PM) Just tried on fsm, seems no problem can buy AmIncome, no ? Through SA no fees plus guaranteed 2.4% plus rebates from SA Isnt management fees are paid as well even though buying through SAMY ? If you buy direct 0.7% management fee hence you earning 0.2% lesser Learn to check and read properly on the sales charges beforehand simply buying a fund |

|

|

|

|

|

Jul 16 2021, 06:21 PM Jul 16 2021, 06:21 PM

|

Junior Member

427 posts Joined: Oct 2010 |

QUOTE(tadashi987 @ Jul 16 2021, 06:06 PM) that's Amincome not Amincome plus, they are both different funds. sorry my badmanagement fee by fund manager on the fund itself is charged anyhow u bought from SA or FSM or any other channels. but there are others fee e.g. sale charge, platform fee or not, it is depending on the distribution channels. FSM dont distribute this fund, SA dont charge any fee. Amincome Plus seems to be having better calendar year annual return, wondering are they having different kind of risk profile Would you consider Amincome Plus ? This post has been edited by no6: Jul 16 2021, 06:37 PM |

|

|

Jul 16 2021, 06:36 PM Jul 16 2021, 06:36 PM

|

Junior Member

427 posts Joined: Oct 2010 |

QUOTE(tadashi987 @ Jul 16 2021, 06:06 PM) management fee by fund manager on the fund itself is charged anyhow u bought from SA or FSM or any other channels. QUOTE(xander83 @ Jul 16 2021, 06:17 PM) Through SA no fees plus guaranteed 2.4% plus rebates from SA buying direct incur management fee whereas through SA without ?If you buy direct 0.7% management fee hence you earning 0.2% lesser Learn to check and read properly on the sales charges beforehand simply buying a fund |

|

|

Jul 16 2021, 06:42 PM Jul 16 2021, 06:42 PM

Show posts by this member only | IPv6 | Post

#14936

|

Senior Member

2,106 posts Joined: Jul 2018 |

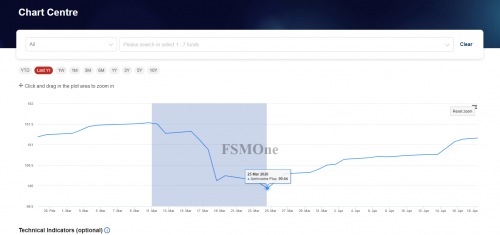

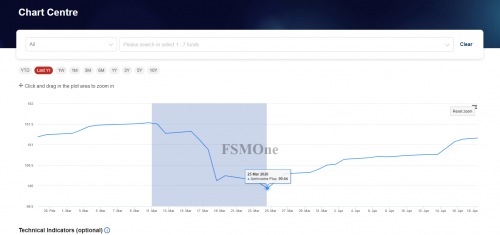

QUOTE(no6 @ Jul 16 2021, 06:21 PM) sorry my bad, SAMY is Amincome while FSM is Amincome Plus for me it is no brainer, riskier, higher return. usually, it is how it works.Amincome Plus seems to be having better calendar year annual return as compared to Amincome, wondering are they having different kind of risk profile Would you consider Amincome Plus ? for your question would I consider Amincome Plus? yes, why not in fact I even park my money in a higher risk income fund I am not persuading you to do so thou, everyone has different risk appetites. let me somehow teach u a way of gauging your risk appetite, by the downfall rate taking the example of 2020 March crash, amIncome plus fall from 101.53 to 99.94 which is approximately -1.57%  are you ok with this risk/downfall? if yes, then why not, you are happy to go with the 'riskier' fund with better performance. This post has been edited by tadashi987: Jul 16 2021, 06:43 PM no6 liked this post

|

|

|

Jul 16 2021, 07:01 PM Jul 16 2021, 07:01 PM

Show posts by this member only | IPv6 | Post

#14937

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(no6 @ Jul 16 2021, 06:21 PM) sorry my bad I think plus more to short term bond. Amincome Plus seems to be having better calendar year annual return, wondering are they having different kind of risk profile Would you consider Amincome Plus ? Amincome more toward mmf. Can check both fund fact sheet This post has been edited by ironman16: Jul 16 2021, 07:02 PM no6 liked this post

|

|

|

Jul 16 2021, 07:40 PM Jul 16 2021, 07:40 PM

Show posts by this member only | IPv6 | Post

#14938

|

Junior Member

507 posts Joined: Jun 2015 |

QUOTE(xander83 @ Jul 16 2021, 05:55 PM) Buying through fund houses be prepared to pay for management fees It is not true at all. FD rates can be higher than MMF interest even though it is not compounded. It depends on the actual difference between the rates offered.Don’t compared to FD because Simple interest while MMF is compounded by daily interests hence MMF will still outperform FD anytime QUOTE(xander83 @ Jul 16 2021, 06:17 PM) Through SA no fees plus guaranteed 2.4% plus rebates from SA There is fee also when buying from SA, they just give rebate back to the customer. The 2.4% is indicative and not guaranteed and it includes the rebate. You should know better. If you buy direct 0.7% management fee hence you earning 0.2% lesser Learn to check and read properly on the sales charges beforehand simply buying a fund |

|

|

Jul 16 2021, 09:37 PM Jul 16 2021, 09:37 PM

|

Junior Member

427 posts Joined: Oct 2010 |

QUOTE(tadashi987 @ Jul 16 2021, 06:42 PM) for me it is no brainer, riskier, higher return. usually, it is how it works. mind to share what are other income fund worth considering ?for your question would I consider Amincome Plus? yes, why not in fact I even park my money in a higher risk income fund I am not persuading you to do so thou, everyone has different risk appetites. let me somehow teach u a way of gauging your risk appetite, by the downfall rate taking the example of 2020 March crash, amIncome plus fall from 101.53 to 99.94 which is approximately -1.57%  are you ok with this risk/downfall? if yes, then why not, you are happy to go with the 'riskier' fund with better performance. |

|

|

Jul 16 2021, 11:52 PM Jul 16 2021, 11:52 PM

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(no6 @ Jul 16 2021, 09:37 PM) i am looking at china bond fund this years, local bond fund are not performing well this year due to MYR.but china bond fund might be a bit high risk to you, so do ur due diligence. no6 liked this post

|

| Change to: |  0.0337sec 0.0337sec

0.55 0.55

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 04:56 PM |