Hi all, newly registered with SA without clicking on any referral. is there any way that still can get the 6 months fee waiver? TQ

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Jun 4 2020, 02:27 AM Jun 4 2020, 02:27 AM

Return to original view | IPv6 | Post

#1

|

Junior Member

427 posts Joined: Oct 2010 |

Hi all, newly registered with SA without clicking on any referral. is there any way that still can get the 6 months fee waiver? TQ

|

|

|

|

|

|

Jun 4 2020, 02:47 AM Jun 4 2020, 02:47 AM

Return to original view | IPv6 | Post

#2

|

Junior Member

427 posts Joined: Oct 2010 |

|

|

|

Jun 11 2020, 03:53 PM Jun 11 2020, 03:53 PM

Return to original view | IPv6 | Post

#3

|

Junior Member

427 posts Joined: Oct 2010 |

|

|

|

Aug 11 2020, 05:50 PM Aug 11 2020, 05:50 PM

Return to original view | Post

#4

|

Junior Member

427 posts Joined: Oct 2010 |

QUOTE(Gabriel03 @ Aug 11 2020, 04:48 PM) Stashaway Simple projected 2.4% pa is subjected to OPR rate. With latest drop, the return is less than 2.4% pa. how much is philip money market projected rate as compared to samy 2.4% ?Another issue with Simple is the longer duration to process buy and sell order. Besides that, there other money market funds which give competitive rate against Simple but with less processing time like Philips Money Market Fund, etc. |

|

|

Aug 11 2020, 06:17 PM Aug 11 2020, 06:17 PM

Return to original view | Post

#5

|

Junior Member

427 posts Joined: Oct 2010 |

|

|

|

Aug 12 2020, 10:52 AM Aug 12 2020, 10:52 AM

Return to original view | Post

#6

|

Junior Member

427 posts Joined: Oct 2010 |

|

|

|

|

|

|

Feb 18 2021, 01:58 PM Feb 18 2021, 01:58 PM

Return to original view | Post

#7

|

Junior Member

427 posts Joined: Oct 2010 |

may i know any reason why the total amount for currency conversion (usd) is not tally with the total amount for buy order (usd) ?

|

|

|

Feb 18 2021, 02:13 PM Feb 18 2021, 02:13 PM

Return to original view | Post

#8

|

Junior Member

427 posts Joined: Oct 2010 |

QUOTE(tsutsugami86 @ Feb 18 2021, 02:00 PM) QUOTE(GrumpyNooby @ Feb 18 2021, 02:00 PM) QUOTE(DragonReine @ Feb 18 2021, 02:02 PM) I think SA all portfolios have 1% cash asset weight allocation? I've noticed some of the converted USD remains as cash to meet that 1% target weight arh .... that's the reasons why. thank you so much. |

|

|

Mar 25 2021, 12:13 AM Mar 25 2021, 12:13 AM

Return to original view | Post

#9

|

Junior Member

427 posts Joined: Oct 2010 |

|

|

|

Jun 18 2021, 05:08 PM Jun 18 2021, 05:08 PM

Return to original view | Post

#10

|

Junior Member

427 posts Joined: Oct 2010 |

QUOTE(lee82gx @ Jun 18 2021, 01:19 PM) Tbh how many really bear markets can you find these days? does that means bond prices are usually up during the bear market ?A proper bear market is a mini recession followed by a true recession. You need to monitor bond market and bond prices to be really sure of that. I’ve encountered 2 in my 15 years of investing. What do you really want to do at those times can make or break if you do the wrong thing whereas in both cases just doing nothing also not that bad eventually. |

|

|

Jul 16 2021, 05:14 PM Jul 16 2021, 05:14 PM

Return to original view | Post

#11

|

Junior Member

427 posts Joined: Oct 2010 |

is AmIncomePlus fund considered as good as or even better than fd ?

would it be better to buy AmIncome fund through fund houses rather than SAMY ? |

|

|

Jul 16 2021, 06:02 PM Jul 16 2021, 06:02 PM

Return to original view | Post

#12

|

Junior Member

427 posts Joined: Oct 2010 |

QUOTE(tadashi987 @ Jul 16 2021, 05:27 PM) https://www.fsmone.com.my/funds/tools/facts...t?fund=MYAMICPS [FSM is not able to buy thou] IMO there is gives and takes, merely a preference compare with the yearly performance, FD rate might outperform at some years but FD has lock in period, amincome plus dont have SA amincome plus allow you to invest in small amount, slower settlement period buying through fund house require you to fulfill min and subsequent investment amount. QUOTE(xander83 @ Jul 16 2021, 05:55 PM) Buying through fund houses be prepared to pay for management fees Just tried on fsm, seems no problem can buy AmIncome, no ? Don’t compared to FD because Simple interest while MMF is compounded by daily interests hence MMF will still outperform FD anytime Isnt management fees are paid as well even though buying through SAMY ? |

|

|

Jul 16 2021, 06:21 PM Jul 16 2021, 06:21 PM

Return to original view | Post

#13

|

Junior Member

427 posts Joined: Oct 2010 |

QUOTE(tadashi987 @ Jul 16 2021, 06:06 PM) that's Amincome not Amincome plus, they are both different funds. sorry my badmanagement fee by fund manager on the fund itself is charged anyhow u bought from SA or FSM or any other channels. but there are others fee e.g. sale charge, platform fee or not, it is depending on the distribution channels. FSM dont distribute this fund, SA dont charge any fee. Amincome Plus seems to be having better calendar year annual return, wondering are they having different kind of risk profile Would you consider Amincome Plus ? This post has been edited by no6: Jul 16 2021, 06:37 PM |

|

|

Jul 16 2021, 06:36 PM Jul 16 2021, 06:36 PM

Return to original view | Post

#14

|

Junior Member

427 posts Joined: Oct 2010 |

QUOTE(tadashi987 @ Jul 16 2021, 06:06 PM) management fee by fund manager on the fund itself is charged anyhow u bought from SA or FSM or any other channels. QUOTE(xander83 @ Jul 16 2021, 06:17 PM) Through SA no fees plus guaranteed 2.4% plus rebates from SA buying direct incur management fee whereas through SA without ?If you buy direct 0.7% management fee hence you earning 0.2% lesser Learn to check and read properly on the sales charges beforehand simply buying a fund |

|

|

Jul 16 2021, 09:37 PM Jul 16 2021, 09:37 PM

Return to original view | Post

#15

|

Junior Member

427 posts Joined: Oct 2010 |

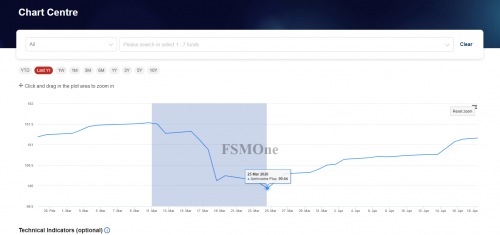

QUOTE(tadashi987 @ Jul 16 2021, 06:42 PM) for me it is no brainer, riskier, higher return. usually, it is how it works. mind to share what are other income fund worth considering ?for your question would I consider Amincome Plus? yes, why not in fact I even park my money in a higher risk income fund I am not persuading you to do so thou, everyone has different risk appetites. let me somehow teach u a way of gauging your risk appetite, by the downfall rate taking the example of 2020 March crash, amIncome plus fall from 101.53 to 99.94 which is approximately -1.57%  are you ok with this risk/downfall? if yes, then why not, you are happy to go with the 'riskier' fund with better performance. |

| Change to: |  0.0588sec 0.0588sec

0.36 0.36

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 25th November 2025 - 08:19 PM |