QUOTE(DragonReine @ Jun 25 2021, 10:10 AM)

That probably explains why those who bought before the gold surge in 19/20 is still in the green. Heavier weightage holding up the portfolios.

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Jun 25 2021, 10:15 AM Jun 25 2021, 10:15 AM

Show posts by this member only | IPv6 | Post

#14621

|

All Stars

12,267 posts Joined: Oct 2010 |

QUOTE(DragonReine @ Jun 25 2021, 10:10 AM) That probably explains why those who bought before the gold surge in 19/20 is still in the green. Heavier weightage holding up the portfolios. DragonReine liked this post

|

|

|

|

|

|

Jun 25 2021, 10:20 AM Jun 25 2021, 10:20 AM

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(prophetjul @ Jun 25 2021, 10:15 AM) That probably explains why those who bought before the gold surge in 19/20 is still in the green. The ones who buy higher SRI near KWEB surge (in late 2020 to earl 2021) also ended up red by now 😂 my SRI 16% still holding quite steady even though i bought after the gold reallocation, mostly propped up by the good performance of IJR and XLV under US Equities sector.Heavier weightage holding up the portfolios.  This post has been edited by DragonReine: Jun 25 2021, 10:22 AM |

|

|

Jun 25 2021, 10:48 AM Jun 25 2021, 10:48 AM

Show posts by this member only | IPv6 | Post

#14623

|

All Stars

12,267 posts Joined: Oct 2010 |

QUOTE(DragonReine @ Jun 25 2021, 10:20 AM) The ones who buy higher SRI near KWEB surge (in late 2020 to earl 2021) also ended up red by now 😂 my SRI 16% still holding quite steady even though i bought after the gold reallocation, mostly propped up by the good performance of IJR and XLV under US Equities sector. i bought in end Feb into 22% portfolio this year. DCA every 2 weeks. It is pretty flat. Still greeen. Just about.  This post has been edited by prophetjul: Jun 25 2021, 10:48 AM |

|

|

Jun 25 2021, 11:14 AM Jun 25 2021, 11:14 AM

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(prophetjul @ Jun 25 2021, 10:48 AM) i bought in end Feb into 22% portfolio this year. DCA every 2 weeks. It is pretty flat. Still greeen. Just about. same with my 36% 😂 the MYR-USD exchange rate post March 2020 really worked against USD-based investments deposited during that time even while stock markets rocket up hahaha |

|

|

Jun 25 2021, 12:55 PM Jun 25 2021, 12:55 PM

Show posts by this member only | IPv6 | Post

#14625

|

All Stars

14,852 posts Joined: Mar 2015 |

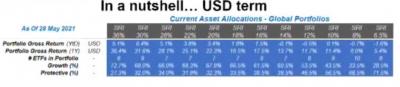

QUOTE(backspace66 @ Jun 25 2021, 09:20 AM) SA teams has a lot to explain if this underperformance of the new portfolio is going to extend beyond this year. in page 730, there is this chart,Remember SA teams react after the fact as what was seen back in May 2020 when the portfolio was reoptimized while keeping the portfolio as is probably provided better result. it shows SA's YTD performance and also Performance from May 2020 till May 2021 (1 yr) Attached thumbnail(s)

|

|

|

Jun 25 2021, 01:07 PM Jun 25 2021, 01:07 PM

Show posts by this member only | IPv6 | Post

#14626

|

Senior Member

2,139 posts Joined: Nov 2007 |

QUOTE(MUM @ Jun 25 2021, 12:55 PM) in page 730, there is this chart, Owh yeah i know that, it underperform the old portfolio for 36% SR.it shows SA's YTD performance and also Performance from May 2020 till May 2021 (1 yr) They should have remain as is rather than to try to react to the market. Added gold to 36% risk after market already crash and so on. Slightly different date and i started this particular portfolio in june 2020. The reason why i can use old portfolio is because i did not switched on auto optimization. Btw, this is old portfolio allocation. If you are not using this platform before may 2020, you probably dont know what i am talking about.  This post has been edited by backspace66: Jun 25 2021, 01:11 PM |

|

|

|

|

|

Jun 25 2021, 01:10 PM Jun 25 2021, 01:10 PM

Show posts by this member only | IPv6 | Post

#14627

|

All Stars

14,852 posts Joined: Mar 2015 |

QUOTE(backspace66 @ Jun 25 2021, 01:07 PM) Owh yeah i know that, it underperform the old portfolio for 36% SR most probably SA wanted to cater for a heavy population group of people that wanted a more diversified portfolio,....should have remain as is. Slightly different date and i started this particular portfolio in june 2020. The reason why i can use old portfolio is because i did not switched on auto optimizatiom .......... for they know that if those that wanted to be heavy in S&P500, they can just go over to Akrunow or buy their own US Etfs |

|

|

Jun 25 2021, 01:15 PM Jun 25 2021, 01:15 PM

Show posts by this member only | IPv6 | Post

#14628

|

Senior Member

2,139 posts Joined: Nov 2007 |

QUOTE(MUM @ Jun 25 2021, 01:10 PM) most probably SA wanted to cater for a heavy population group of people that wanted a more diversified portfolio,.... Akru is horrible for the time being, not in term of performance but in term of support. for they know that if those that wanted to be heavy in S&P500, they can just go over to Akrunow or buy their own US Etfs If one want to optimize the fee, it is better to pool onto one trustable platform to reach the higher tier and reduce effective fees. If i ask myself which one going to be around in the next 5 years, i believe it is SA. Not sure for 10 years from now. Your logic also based on SA purposely want to lose customer to akru, please do you even read what you type? This post has been edited by backspace66: Jun 25 2021, 01:44 PM |

|

|

Jun 25 2021, 01:21 PM Jun 25 2021, 01:21 PM

Show posts by this member only | IPv6 | Post

#14629

|

All Stars

14,852 posts Joined: Mar 2015 |

QUOTE(backspace66 @ Jun 25 2021, 01:15 PM) Akru is horrible for the time being, not in term of performance but in term of support. for me, If one want to optimize the fee, it is better to pool onto one trustable platform to reach the higher tier and reduce effective fees. If i ask myself which one going to be around in the next 5 years, i believe it is SA. Not sure for 10 years from now. if the performance is above expectation,...then the variance in fees does not matter much.... if it does not last 5 yrs,...i can still moves else where. if it can last forever, but if it does not performance within expectation, i would also move else where tehoice liked this post

|

|

|

Jun 25 2021, 01:37 PM Jun 25 2021, 01:37 PM

Show posts by this member only | IPv6 | Post

#14630

|

Senior Member

2,139 posts Joined: Nov 2007 |

QUOTE(MUM @ Jun 25 2021, 01:21 PM) for me, Sure, but i dont think you get my point anyway. The old portfolio is not just s&p 500. There are a lot of s&p 500 component but weightage is different overall which gives it a different performance compared to plain s&p 500. if the performance is above expectation,...then the variance in fees does not matter much.... if it does not last 5 yrs,...i can still moves else where. if it can last forever, but if it does not performance within expectation, i would also move else where Other than that there is also europe and US small cap. Check out the graph before someone says the old portfolio is just s&p 500. LOL Btw, those are all the etf from US part of the portfolio.  This post has been edited by backspace66: Jun 25 2021, 01:39 PM |

|

|

Jun 25 2021, 01:52 PM Jun 25 2021, 01:52 PM

Show posts by this member only | IPv6 | Post

#14631

|

All Stars

14,852 posts Joined: Mar 2015 |

QUOTE(backspace66 @ Jun 25 2021, 01:37 PM) Sure, but i dont think you get my point anyway. The old portfolio is not just s&p 500. There are a lot of s&p 500 component but weightage is different overall which gives it a different performance compared to plain s&p 500. buying into this "we are not the driver" things,....just like unit trusts funds,....Other than that there is also europe and US small cap. Check out the graph before someone says the old portfolio is just s&p 500. LOL Btw, those are all the etf from US part of the portfolio. ..... it is the prerogative of the company to set the directions and allocations to suit their evaluated and forecasted performance expectations. we as a passenger, can just alight and board another bus if we don't like the way the driver drives or the atmosphere on the bus or the route it takes we cannot go tell the company to use back the old driver or the old bus, or use back the old route.....the company should have all data to support that their decision whether to continue, change back or try another new driver, bus or route. smokymcpot liked this post

|

|

|

Jun 25 2021, 02:02 PM Jun 25 2021, 02:02 PM

Show posts by this member only | IPv6 | Post

#14632

|

Senior Member

2,139 posts Joined: Nov 2007 |

QUOTE(MUM @ Jun 25 2021, 01:52 PM) buying into this "we are not the driver" things,....just like unit trusts funds,.... Sure, if you say so. Good things is some people can think by themselves here and SA actually provide option to stay with the old bus or change to the new bus. We call that turning off auto optimization which is fully allowed by SA.it is the prerogative of the company to set the directions and allocations to suit their evaluated and forecasted performance expectations. we as a passenger, can just alight and board another bus if we don't like the way the driver drives or the atmosphere on the bus or the route it takes we cannot go tell the company to use back the old driver or the old bus, or use back the old route.....the company should have all data to support that their decision whether to continue, change back or try another new driver, bus or route. I think you are not even user of this platform, so i am quite sure you are still scratching your head trying to understand. Only user of SA platform will understand and those who have been here since before may 2020. I am not trying to confuse you even further, if you turn off auto optimizatiom, you can even have old and new portfolio. Sure, but someone who are not part of it will not understand what i am talking about. So please stick to what one knows best |

|

|

Jun 25 2021, 02:06 PM Jun 25 2021, 02:06 PM

Show posts by this member only | IPv6 | Post

#14633

|

All Stars

14,852 posts Joined: Mar 2015 |

QUOTE(backspace66 @ Jun 25 2021, 02:02 PM) Sure, if you say so. Good things is some people can think by themselves here and SA actually provide option to stay with the old bus or change to the new bus. We call that turning off auto optimization which is fully allowed by SA. if you knew that earlier, then the below does not apply to SA,...they gave you the option to chooseI think you are not even user of this platform, so i am quite sure you are still scratching your head trying to understand. Only user of SA platform will understand and those who have been here since before may 2020. I am not trying to confuse you even further, if you turn off auto optimizatiom, you can even have old and new portfolio. Sure, but someone who are not part of it will not understand what i am talking about. So please stick to what one knows best QUOTE(backspace66 @ Jun 25 2021, 09:20 AM) SA teams has a lot to explain if this underperformance of the new portfolio is going to extend beyond this year. This post has been edited by MUM: Jun 25 2021, 02:08 PMRemember SA teams react after the fact as what was seen back in May 2020 when the portfolio was reoptimized while keeping the portfolio as is probably provided better result. |

|

|

|

|

|

Jun 25 2021, 02:08 PM Jun 25 2021, 02:08 PM

Show posts by this member only | IPv6 | Post

#14634

|

Senior Member

2,139 posts Joined: Nov 2007 |

QUOTE(MUM @ Jun 25 2021, 02:06 PM) It applies to people who came in after may 2020 or who blindly turn on the auto optimization, from observation this is the case from what i have read in the forum and to top it off someone here keep recommending to turn on auto optimization blindly. |

|

|

Jun 25 2021, 02:13 PM Jun 25 2021, 02:13 PM

Show posts by this member only | IPv6 | Post

#14635

|

All Stars

14,852 posts Joined: Mar 2015 |

QUOTE(backspace66 @ Jun 25 2021, 02:08 PM) It applies to people who came in after may 2020 or who blindly turn on the auto optimization, from observation this is the case from what i have read in the forum and to top it off someone here keep recommending to turn on auto optimization blindly. so those opened a/c after May will get only 1 option?with just 1 year of data,...i cannot judge if that decision to turn on or off is a "blind" decision. the decision of those that choose to reoptimise could also due to wanted to have a more diversified to include "GOLD" and maybe go heavier into KWEB? This post has been edited by MUM: Jun 25 2021, 02:20 PM |

|

|

Jun 25 2021, 02:20 PM Jun 25 2021, 02:20 PM

|

All Stars

15,856 posts Joined: Nov 2007 From: Zion |

back to +18.65% TWR.. the dip recovered really quickly sigh

|

|

|

Jun 25 2021, 02:22 PM Jun 25 2021, 02:22 PM

|

Senior Member

3,182 posts Joined: Nov 2008 From: KL |

|

|

|

Jun 25 2021, 02:22 PM Jun 25 2021, 02:22 PM

Show posts by this member only | IPv6 | Post

#14638

|

Senior Member

2,139 posts Joined: Nov 2007 |

QUOTE(MUM @ Jun 25 2021, 02:13 PM) so those opened a/c after May will get only 1 option? I dont think i need to reply anymore, you clearly not a user of SA based on the question you asked.with just 1 year of data,...i cannot judge if that decision to turn on or off is a "blind" decision. the decision of those that choose to reoptimise could also due to wanted to have a more diversified to include "GOLD" and maybe go heavier into KWEB? |

|

|

Jun 25 2021, 02:25 PM Jun 25 2021, 02:25 PM

|

All Stars

15,856 posts Joined: Nov 2007 From: Zion |

|

|

|

Jun 25 2021, 02:26 PM Jun 25 2021, 02:26 PM

Show posts by this member only | IPv6 | Post

#14640

|

All Stars

14,852 posts Joined: Mar 2015 |

QUOTE(backspace66 @ Jun 25 2021, 02:22 PM) i could have joined after May last year being a user of SA is not the object of discussion here,...being able to post logical comment are just my think,...don't reply if you don't want to.... |

| Change to: |  0.0248sec 0.0248sec

1.12 1.12

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 25th November 2025 - 08:39 AM |