The question now is where gold is going to land if there is a repeat of 2011-2013 period.

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Nov 9 2020, 11:15 PM Nov 9 2020, 11:15 PM

Return to original view | IPv6 | Post

#121

|

Senior Member

2,139 posts Joined: Nov 2007 |

The question now is where gold is going to land if there is a repeat of 2011-2013 period.

|

|

|

|

|

|

Nov 10 2020, 06:19 PM Nov 10 2020, 06:19 PM

Return to original view | IPv6 | Post

#122

|

Senior Member

2,139 posts Joined: Nov 2007 |

QUOTE(ericlaiys @ Nov 10 2020, 05:42 PM) Update on my FPx using jompay. Thank you for the information sharing, i always transfer early morning after US market close. Good to know that even a transfer at 10 a.m would be invested on the same day.Jompay this morning - 10am. Stashaway received it - 5pm. That was quick bank in...tonight can start to buy & conversion This post has been edited by backspace66: Nov 10 2020, 06:19 PM |

|

|

Nov 17 2020, 06:43 PM Nov 17 2020, 06:43 PM

Return to original view | IPv6 | Post

#123

|

Senior Member

2,139 posts Joined: Nov 2007 |

You can reduce yourself if you turn off optimization. Put 75% on the old 36% and 25% on the new 36%. Then magic happen, 5 % lol

|

|

|

Nov 24 2020, 12:47 PM Nov 24 2020, 12:47 PM

Return to original view | IPv6 | Post

#124

|

Senior Member

2,139 posts Joined: Nov 2007 |

Finally, XLE nearing breakeven for me.

|

|

|

Nov 24 2020, 09:17 PM Nov 24 2020, 09:17 PM

Return to original view | IPv6 | Post

#125

|

Senior Member

2,139 posts Joined: Nov 2007 |

Something wrong with the maths there, how is past value or current value of any importance if

1) portfolio 1 has upside potential 15% from the current state 2) portfolio 2 has upside potential of 5 % from the current state Switching to one with higher upside potential of course increase the downside risk as well. Doesnt take a scientist to figure that out. This post has been edited by backspace66: Nov 24 2020, 09:35 PM |

|

|

Dec 10 2020, 07:25 AM Dec 10 2020, 07:25 AM

Return to original view | IPv6 | Post

#126

|

Senior Member

2,139 posts Joined: Nov 2007 |

If anyone is curious, whenever you close a portfolio and transfer to another portfolio, the net value of that closed portfolio will be inluced under net deposit. At least that is what i see in my account, but i keep a proper record of whatever i deposit in so it is not a concern for me and do not depend on the app to give me info on my net deposit.

|

|

|

|

|

|

Dec 10 2020, 05:05 PM Dec 10 2020, 05:05 PM

Return to original view | IPv6 | Post

#127

|

Senior Member

2,139 posts Joined: Nov 2007 |

|

|

|

Dec 17 2020, 07:02 PM Dec 17 2020, 07:02 PM

Return to original view | IPv6 | Post

#128

|

Senior Member

2,139 posts Joined: Nov 2007 |

Better check all the transaction in your portfolio especially the last few weeks, seems like some weird stuff is going on where they are selling the same ETF on one day only to buy it again the next day at HIGHER price.

|

|

|

Dec 17 2020, 07:16 PM Dec 17 2020, 07:16 PM

Return to original view | IPv6 | Post

#129

|

Senior Member

2,139 posts Joined: Nov 2007 |

|

|

|

Dec 18 2020, 07:31 AM Dec 18 2020, 07:31 AM

Return to original view | IPv6 | Post

#130

|

Senior Member

2,139 posts Joined: Nov 2007 |

QUOTE(Xenopher @ Dec 17 2020, 08:04 PM) Already ask SA support, but i disagree with the answer given. It seems my worry about manipulation since the change of terms and condition about to come true. At least that is what it looks like right now. Other thing is this is for the old portfolio not the new one with gold.Remember etf does not completely need to go through the exchange now as per updated terms and condition. It can exchange internally within SA. This post has been edited by backspace66: Dec 18 2020, 07:46 AM |

|

|

Jan 10 2021, 12:02 PM Jan 10 2021, 12:02 PM

Return to original view | IPv6 | Post

#131

|

Senior Member

2,139 posts Joined: Nov 2007 |

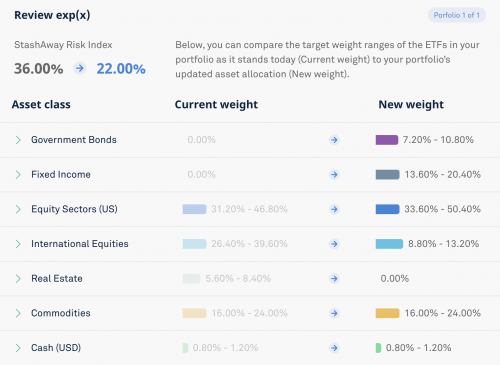

QUOTE(Higgsboson8888 @ Jan 9 2021, 08:43 PM) Hey guys, I've just updated my financial and tax information on StashAway and they sent me an email suggesting a change in my portfolio. While my goal is to maximize the returns, do you think I should accept their recommendation? If yes, can anyone share with us how did they come up with the recommendation (solely for learning purposes) Same thing with me, comitment and expenses only 50% of net, the system recommended me to lower the risk to 22%. Maybe investment as percentage of networth is high on my side but they should have categorized the investment part further into equity, fixed income, gold or even fixed priced fund from pnb. Not sure why it matters though for people who can plan by themselves. So i just ignore. This post has been edited by backspace66: Jan 10 2021, 12:06 PM Higgsboson8888 liked this post

|

|

|

Jan 11 2021, 08:53 AM Jan 11 2021, 08:53 AM

Return to original view | IPv6 | Post

#132

|

Senior Member

2,139 posts Joined: Nov 2007 |

QUOTE(idyllrain @ Jan 11 2021, 02:30 AM) No one can answer this for you; you just have to decide what you believe the trend will be in the coming days. If USD weakens 5% relative to MYR and the ETFs increases 5% due to positive investor sentiment, the effects cancel out. If you are not comfortable committing a large sum of money in one transaction, you can always DCA first until you make a decision. Yerp, i saw some forumer try to time based on conversion rate. If they want to do that at least convert the etf price to myr term first, rather than just looking at one side of the variable. |

|

|

Jan 11 2021, 04:13 PM Jan 11 2021, 04:13 PM

Return to original view | IPv6 | Post

#133

|

Senior Member

2,139 posts Joined: Nov 2007 |

QUOTE(xander83 @ Jan 11 2021, 01:42 PM) MWR 6 to 9% higher because I time the market to deposit when FX conversion is strong for RM just what happen last week I find it quite weird to see you time the market based on forex, did you check the underlying etf price before you consider that?It would be better to take all the underlying etf into consideration in term of myr. Based on your logic, one should not invest during march crash since USD/MYR is pretty high back then. You get "less" USD. |

|

|

|

|

|

Jan 11 2021, 08:14 PM Jan 11 2021, 08:14 PM

Return to original view | IPv6 | Post

#134

|

Senior Member

2,139 posts Joined: Nov 2007 |

QUOTE(xander83 @ Jan 11 2021, 08:11 PM) Of course I did on the FX conversion spot rate on to USD with prices to buy ETF in USD with comparison on levels which is when to buy ETF price which mine strategy is different due to weekly monitoring I admire your confidence level. I think it is waste of my time to explain. Nevermind. Simple does not even exist back then in the time period you mention and march is definitely the time to invest but no point since no one got a time machine. LolI will cash out my gains just my returns when the USD is stronger against the RM wand ETF prices is on range trading otherwise just adjust the risk 30 to 36 or vice versa March was not the time to invest but May was because FX conversion and it’s ETF was rock bottom then which I bought into it then when my money was on Simple since Jan to May If put lump sum at 36% just be patient because the gains will show within 3 to 6 months This post has been edited by backspace66: Jan 11 2021, 08:27 PM polarzbearz and TaiGoh liked this post

|

|

|

Jan 11 2021, 08:39 PM Jan 11 2021, 08:39 PM

Return to original view | IPv6 | Post

#135

|

Senior Member

2,139 posts Joined: Nov 2007 |

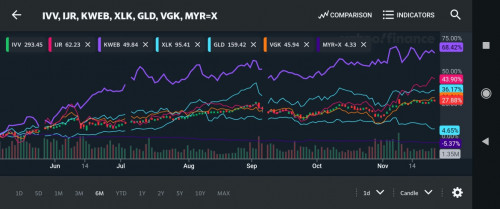

QUOTE(xander83 @ Jan 11 2021, 08:34 PM) I am just going to leave it here, let see if you understand Did you see that awesome double digit gain compared to your meagre forex changes This post has been edited by backspace66: Jan 11 2021, 08:41 PM polarzbearz liked this post

|

|

|

Jan 11 2021, 08:52 PM Jan 11 2021, 08:52 PM

Return to original view | IPv6 | Post

#136

|

Senior Member

2,139 posts Joined: Nov 2007 |

QUOTE(xander83 @ Jan 11 2021, 08:47 PM) Those double digits are nothing compared to invest on FX spot rates at that time This is the last time i am going to try to explain this.The forex changes are for those who is willing to lump sum into deposit and buying into momentum and you should provide the chart from May to December which is on double uptrend to what is shown here  Usd to myr drop by around 5% and that is nothing compared to the gain in etf This post has been edited by backspace66: Jan 11 2021, 10:02 PM polarzbearz, TaiGoh, and 3 others liked this post

|

|

|

Jan 13 2021, 11:28 AM Jan 13 2021, 11:28 AM

Return to original view | IPv6 | Post

#137

|

Senior Member

2,139 posts Joined: Nov 2007 |

|

|

|

Jan 15 2021, 02:21 PM Jan 15 2021, 02:21 PM

Return to original view | IPv6 | Post

#138

|

Senior Member

2,139 posts Joined: Nov 2007 |

The day SA mix BTC and equity for the higher risk is the day i take out my investment. Unless it is just 1 to 5 % maybe i dont really mind. This post has been edited by backspace66: Jan 15 2021, 02:22 PM DragonReine liked this post

|

|

|

Jan 21 2021, 02:09 PM Jan 21 2021, 02:09 PM

Return to original view | IPv6 | Post

#139

|

Senior Member

2,139 posts Joined: Nov 2007 |

Forex thingy this guy is doing, is pretty entertaining. LMAO. Such a meagre gain for something you dont have much control on since there is lag time to buy and sell and inconsistency in term of speed. For a fast in and out, just directly invest in the stock market or to a certain degree unit trust( i have been doing this using epf and taking advantage of 0% SC) wKkaY liked this post

|

|

|

Jan 23 2021, 11:32 AM Jan 23 2021, 11:32 AM

Return to original view | IPv6 | Post

#140

|

Senior Member

2,139 posts Joined: Nov 2007 |

QUOTE(skyvisionz @ Jan 23 2021, 12:51 AM) The reply above pretty much sums it up.I am turning off but do not ignore the newer optimized portfolio. You can have best of both world by having multiple portfolio , new and old at the same time and allocate accordingly. I have both the US centric portfolio (36%) and the current one with less US exposure and gold with the same (36%) risk. Turning off optimization doesnt mean you dont have access to the new so called optimized portfolio, it just that it is not automatic and you choose how much percentage you want to expose the newer portfolio. |

| Change to: |  0.4525sec 0.4525sec

0.57 0.57

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 17th December 2025 - 10:54 PM |